Automatically receive the internet’s most informative articles bi-weekly via our free bi-weekly Market Intelligence Report newsletter (sample here). Register in the top right hand corner of this page.

…Investing in this metal is pure speculation with very little fundamental support… If the economy collapses silver prices will crash along with every other commodity…

…There is no reason for investors to believe precious metals like silver are any different, or somehow immune from the factors currently crushing the prices of oil and the other commodities. Right now we have crested the boom cycle and commodity prices are entering a long term bear market. On top of this, the economy of China is slowing and U.S GDP growth figures are constantly being revised downward. This does not bode well for silver, because demand for commodities depends on economic growth and if growth falters silver will fail. There is no glamour here, only cold hard facts.

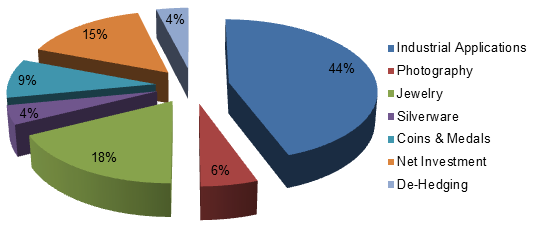

Most of the talk about silver centers on its usage as an investment vehicle, but investment is only a small portion of what drives the price of the metal. Silver is primarily an industrial and consumer discretionary ingredient, in fact over 70% of the metals usage is for economic output. This means only a tiny fraction of silver production goes toward investment, and most of this is metal is held by the silver ETFs and brazenly manipulated…@A Financial Site For Sore Eyes & Inquisitive Minds

Silver is primarily used in industrial applications, especially electronics… because it has the highest electric conductivity, thermal conductivity and contact resistance of any metal. To date no other substance can replicate the properties of silver cost efficiently and there is little risk of obsolescence at current prices. However, while silver’s role in industry is unassailable it does not have this same strength in its other usages…

Editor’s Note: Enjoying the article so far? If so, please DONATE a small amount so I can continue to bring you such informative articles.

Silver’s usage: A tiny fraction used for investment

Solar energy is a bullish factor

There are bullish factors for silver. The growing importance of solar energy (photovoltaic technology) provides an opportunity for growth in the metals industrial use. Silver demand in the energy industry has made up for much of the economic value it lost during decline of the traditional photograph technology it was once used in.

Photovoltaic technology has been growing steadily in the U.S, especially after the government committed to over-investing in the late 2000’s in the sector after the 2007 financial crisis…[which,] coincidentally, mark the height of the silver price bubble we saw around that same time. While this seems like a clear case of supply and demand determining prices, looking deeper into the situation reveals problems with this conclusion.

A tale of two bubbles

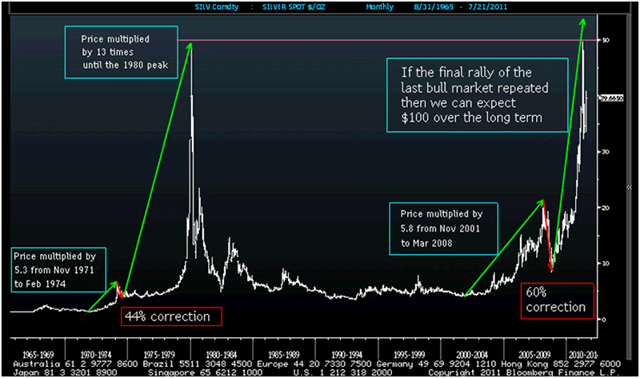

Silver has had two major rallies in modern history both of…[which] were speculative bubbles with little (usually coincidental) correlation to the metals actual economic demand.

Anatomy of irrational exuberance: Investors expected $100 silver

- The first modern silver bubble occurred in the early 80’s as the Hunt brothers, two Texas billionaires, attempted to corner the silver market. They did this by buying massive amounts of the metal on the commodity markets with leverage. At the height of this attempt, these two men were able to control the 1/3rd of the entries worlds supply of silver, driving the price up the metal up 712% in a week.

- The second silver bubble occurred in 2011 and was commonly assumed to be caused by supply shortages and increasing photovoltaic demand. This wasn’t the case. Photovoltaic requires an ultra pure silver (.9999) which is not used as bullion and doesn’t factor into the supply/demand situation for the common .999 and sterling physical. Backwardation and an unprepared bullion industry compounded the myth of a supply shortage…

Just as stocks tend to move with each other in the equity markets. (think NASDAQ vs S&P 500) commodity prices do the same. However, while stocks can trade for a long periods of time based on speculation and future earnings the price of commodities is determined by one thing above all else; economic demand.

When economic demand does not justify price a commodity will slowly sink back down to its cost of production. This is what recently happened to oil, and this is what will continue happening to silver. For this reason, any premium significantly above silver’s cost of production (that cannot be justified economic demand) should be seen as a bubble because it will not last.

Stop clicking around! #Follow the munKNEE instead

Economic outlook and investor expectations

The current and future economic outlook for commodities is not good…despite the supposedly strong U.S economy. If, and [indeed] when the U.S economy goes into recession commodity prices will fall to levels we would have previously found unimaginable. This could be $20/bbl oil and $7/ozt silver…

The original article, by Kelsey Williams has been edited ([ ]) and abridged (…) above for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

Editor’s Note:

Please donate what you can towards the costs involved in providing this article and those to come. Contribute by Paypal or credit card.

Thank you Dom for your recent $50 donation!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Hi,

I don’t understand your logic, why would silver go down due to a market crash when sliver hasn’t increased with all the shortages and with 95% not being able to be recycled.

Why wouldn’t this be considered money as the world fiat currencies are decreasing in purchasing power?

Depressed Silver Price = Low Price Risk = Low risk entry point to use as a Store of Value

against the Fed’s M1-M2 pump-up.

Gold can fall a very long way per ounce, very quickly.

Silver can fall only the price you bought it for ($26 spot today).

Silver you hold cannot go down to zero, because you’d still own the metal.

Fiat (e.g., the fiat-dollar), throughout history, has always gone to zero. ALWAYS.

So I’ve been told. 🙂

Peace to All

Okay you all 😉

This silver “thing” you ALL have been discussing for the time I have been stacking (1995-2021). Needs to be addressed! The author of this article in question is not a liar and is not “wrong”. As has been addressed by some on this board. His numbers are accurate! I have been waiting for 26 years for silver to hit 100 an oz! I have read books, watched videos, took part in forum’s, been apart of social media, and watched silver only to find us at 26 dollars during a PANDEMIC! Are you all following? We are in a pandemic! Look that word up. Do you see it’s meaning? Silver is not that “thing” to have when things go bad! Like I have been instructed, taught and guided to believe. A thing called Bitcoin and a “joke” Dogecoin have taken over and made many rich! Where is silver? In my basement in a safe. People face it the author has a valid point and our silver ship is in need of a new “sail”. I sure have enjoyed my time with silver and have enjoyed the smile it brings when I give the bullion as a gift. However, Amazon, Tesla, the Dallas Mavericks and my local gas station owners are still not allowing me to buy products with my junk silver at spot price! You cannot argue that or call me a liar like you did to the author that hit the “nail on the head”.

Where is your silver? Protecting you from the dollar crash? Let me know how this is working out for you as you invest in a new safe, security system, polish, time and people to trade with that recognize it’s value!

I sure do enjoy stacking but I have been apart of this “silver thing” half my life and wish I had diversified more! My wife invested in a Joke Dogecoin @ .003 thinking it was a silver coin with a picture of a dog on it. She was so happy to tell me about her 85 dollar investment. I didn’t have the heart to tell her about the Bad Investment she made. So, I just hugged her and told her how much I loved her and some day I would help her with investing.

This week my wife gave me a hug and told me how much she loved me and asked “Honey how is your silver? Do you need help with your investment? If it is made of the same silver my Dogecoin is we might be rich!” I asked what do you mean? “She replied that her 85 dollars is now worth $9,400 dollars!” Happy stacking my fellow stackers and treat your wife kind! They along with this author my have things to teach us.

Keep on stacking the day will come. I still believe.

I have decided that 1600 sliver eagles and 100 ounces of Constitutional silver are my limit. I am now concentrating on gold. My stack was never bought as an investment but rather insurance. I am a firm believer in that especially on this date of October 26, 2021 with the current administration damaging the economy with runaway inflation, Southern border chaos, gas prices going way up, food prices way up, empty shelves etc. I sleep well at night KNOWING that I have something TANGIBLE to rely on in bad economic times.

https://www.roadtoroota.com/public/998.cfm

You will Have the last laugh!!!

Microsoft has been going up 30% a year while some penny stock may go up 1000% in one year. Does that make investing in the penny stock a wiser investment. Silver has been going up in value for 100 years so yes it does qualify as a good investment,.

I could have written that! Little did I know back in the late 90’s that forces such as banks and collusion were far stronger than market forces. Are there still market forces?

Guess you haven’t seen the historical price of silver. It has kept up with inflation. With Dogecoin you are referring to a speculative bubble. There was a bubble in beanie babies too! But silver is still hoarded for its value, and the bubble will come for it too.

For literally thousands of years, the actual value of silver and gold never has changed. ALL currency is somewhere down the line based on the value of gold and silver. Most of the time, silver is 1/6th the value of gold. It has changed the last 100 years due to its use in the electronic industry, but this will last as long as the boom for other metals in which silver is the byproduct of the refinement process, “silver mines no longer really exist”, silver will not reach that value, however, in a crash, those processes will get halted and guess what metal will become rare in the market? Gold is more of the standard when it comes to the dollar. When you see the value of gold rising, that is not gold becoming worth more, that is your dollar becoming worth less. The only way for the value of gold and silver to permanently fall is if we have an economic boom and inflation reverses. If you bought a cow 2000 years ago with gold, it would require approxmently the same weight of gold today to buy the same cow.

Saying that, this country/world can collapse so bad that you won’t be able to find anyone to buy silver or gold, this can also happen if corruption, aka a dictator, restricts peasants from owning silver or gold “think Africa and diamonds”. If that happens, everyone is screwed and it does not matter if you have silver/gold or not, there will be nothing available you can purchase with it.

Pretty poor take by the author. Silver has been and will be an inflation hedge against the coming stagflation or hyper-inflation. Let’s say a gallon of gas cost .25 cents in 1950 and a gallon of gas today costs 2.00. I can take my 1950 90% silver quarter to the LCS and get (current spot 27.39) $4.95. So I can go buy that same gallon of gas in 2020 with that 1950 90% silver quarter and “profit” $2.95.

There is so much more to silver’s use cases than what the author cherry picked for their silver bear article. This is either a case of being malinformed or just straight up dishonesty.

Agree 100%. The author is wrong

Absolutely Ridiculous! To think that Silver will drop as the US Dollar is printed like Monopoly money is Ludicrous! Demand for Silver as an investment will grow Exponentially as the faith in a dying currency is realized.

The only issue is that the fed has to provide QE to the moon to keep this possible scheme going. If they stop this will turn into deflation.

The more I read posts from you retards the less I believe in silver. There are a million alternatives people can turn to (and it’ll probably be BTC) besides silver