[Russia’s invasion of Ukraine is] an effort by a relatively small country trying to use military action and threats, backed up by a nuclear arsenal, that can in no way compare in terms of resources to those it is threatening [and, as such] the combined impacts of the imposed sanctions on its small economy will likely be significant and widely felt.

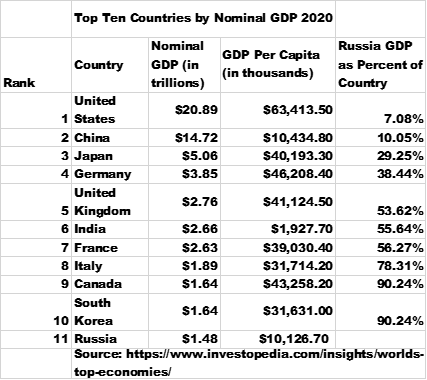

Compared to most of the economies of Europe and the U.S., the Russian economy is extremely small. The following table compares Russian GDP with that of major European countries and the U.S..

Editor’s Note: Enjoying the article so far? If so, please DONATE a little something so I can continue to bring you such informative articles.

We can see that the Russian economy is minuscule when compared to other major economies…[and its] productive capabilities on a per capita basis are low relative to other developed economies…[Indeed,] the Russian economy [at $1.48 trillion]…is smaller in terms of GDP than California ($2.45 trillion), Texas ($1.8 trillion), and New York ($1.68 trillion) and none of these three states spend money on maintaining a military, a nuclear arsenal, or sustaining an attack on a neighboring state…

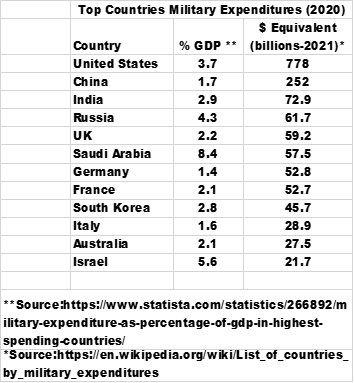

The following table shows that at present, the U.S. spends about $778 billion on military expenditures, or about 3.7% of GDP. This compares with just $61 billion by Russia, or only about 8% of what the U.S. spends each year so, while Russia may have amassed an army and nuclear arsenal, it can’t match the investment the U.S. has made in its military.

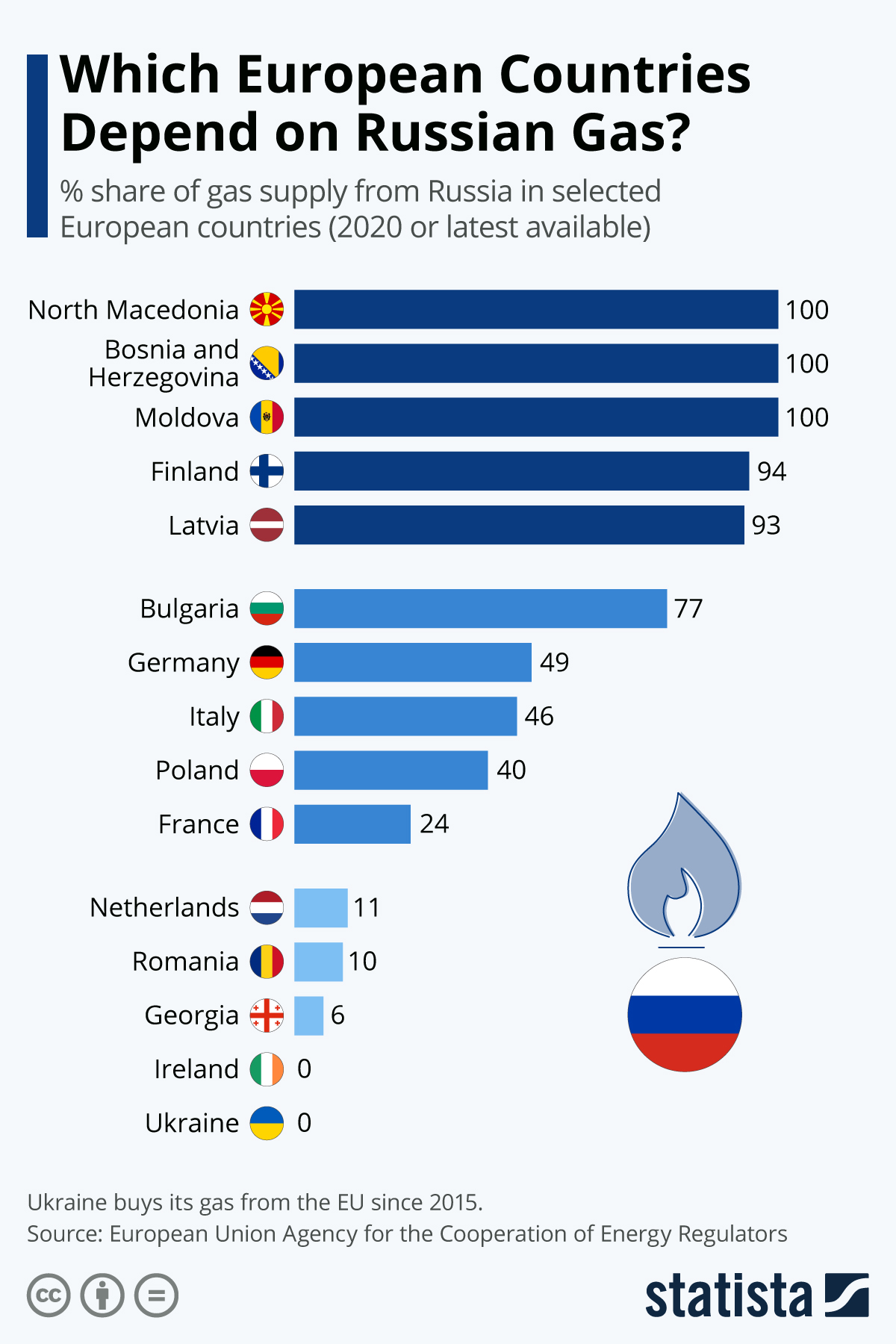

These comparisons bring us back to energy and the impact that sanctions will have on Russia……In 2020 Russia was the second-largest producer of natural gas (17% of world production) and the third-largest producer of oil (12% of world production) [which accounted for about 90% of its exports] and that production is down by 11% and 8.7% respectively…[of late. The continued] disruption to those supplies could have significant consequences for users of Russian energy (Russia supplies more than a third of Europe’s total imports, with Germany (49%), Italy (46%), France (24%), and Greece (39%)) but also across the world…[and to Russia itself.]

- the Russian stock market has declined drastically,

- sovereign bond rates have skyrocketed and

- its currency to plummet]…

Russia has stockpiled gold and foreign exchange reserves, but for those reserves to be useful, there has to be a way to change those assets into meaningful currencies and Russian banks are now cut off from access to dollar, euro, U.K. pound, and Japanese yen markets… The combined impacts of these sanctions on the small Russian economy will likely be significant and widely felt.

[Given the above statistics we can see that Russia’s invasion of Ukraine is] an effort by a relatively small country trying to use military action and threats, backed up by a nuclear arsenal that can in no way compare in terms of resources to those it is threatening…

The above version of the original article by Robert Eisenbeis (cumber.com) was edited [ ] and abridged (…) to provide you with a faster and easier read. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

This article points out the MAJOR role the country has in industrial metals, agriculture and industry in Europe and the world. It begs the question: “To what extent would an invasion of Ukraine disrupt the world’s supply and drive the stock prices of companies supplying these products dramatically higher?”

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

11 comments

Pingback: Russian Billionaire Wealth-to-GDP Ratio Highest Of All Countries - munKNEE.com

Pingback: World War 3: A Simulation Of How A Nuclear War Would Likely Unfold - munKNEE.com

Pingback: Russia-Ukraine War: Implications For Russia, the World & Your Investments - munKNEE.com

Pingback: Russian Gold Is Hit With De Facto Ban From Key London Market - munKNEE.com

Pingback: Russia's Main Imports Being Adversely Affected - munKNEE.com

Pingback: Ban On Russian Oil Imports Would Be A +$35 Billion Hit To Its Economy! - munKNEE.com

Pingback: If Russia Stops Exporting Natural Gas To EU Which Countries Could Fill the Void? - munKNEE.com

Pingback: Global Consequences Of A Nuclear War: A Terrifying Video Simulation - munKNEE.com

Pingback: Ukraine’s Largest Trading Partners & Goods Traded Will Be Irreversibly Impacted - munKNEE.com

Pingback: Which Trade Sanctions Would Hit the Russian Economy the Hardest? - munKNEE.com

Pingback: Ukraine: Its Geography, Population Make-up and Economy - munKNEE.com