Silver has now dropped to $19 and is down 3.1% for the year. Unfortunately, the pain is probably not over for  silver bulls due to the fact that June is historically the worst month of the year for silver.

silver bulls due to the fact that June is historically the worst month of the year for silver.

The above comments are edited excerpts from an article* by Prudent Finances as posted on SeekingAlpha.com under the title June Is Historically The Worst Month Of The Year For Silver (SLV).

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and the FREE Market Intelligence Report newsletter (sample here; register here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

The articles goes on to say in further edited excerpts:

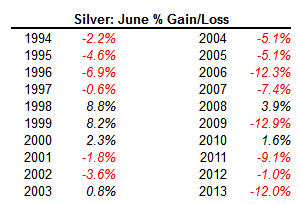

In the last 20 years, [as can be seen in the table below,] spot silver has dropped in 14 of those years in the month of June, and it has fallen by more than 10% three times…If it were to drop another 10% this year, it would take the price to a shade below $17. I’m not predicting that, but the $17 level could be seen as a worst-case scenario.

The Good News

…Is there any good news for silver bulls? In short, the answer is yes.

- silver is experiencing record demand…increasing by 13%…in 2013. Here is a link to a chart produced by The Silver Institute that details total supply and demand for the last ten years,

- silver is below the total production costs of primary silver miners. Primary silver mines supply about 30% of the world’s mine supply, while the remaining 70% of silver is produced as a by-product of other metals. With silver below its production cost, at least 30% of the world’s supply could be in jeopardy if primary silver mines get suspended due to non-profitability. Is $19 silver low enough to convince the management of primary silver mine operators…to suspend operations? Probably not, but a drop to the $17 worst-case scenario could be a different story.

Stay connected!

- Register for our Newsletter (sample here)

- Find us on Facebook

- Follow us on Twitter (#munknee)

- Subscribe via RSS

Physical Silver vs. Silver Miners

I continue to believe that if you have a long-term horizon and if you are unleveraged that you should not fear a drop to the $17 level because, in the long term, a silver price in the teens is not sustainable if you consider the global supply and demand situation. There is safety in silver in the long term.

[While there is safety in physical silver in the long term but] the same, however, cannot be said for the silver producers. While silver will always retain some sort of value…silver producers can drop all the way to zero…Conclusion

Time works against investors in silver miners, but it doesn’t for… investors in physical silver coins/bars investor. Yes, there are optional insurance fees for coin and bar holders, but those costs are small and won’t destroy your investment. However, if you are invested in silver producers, you could be right about the upward directional movement of silver, but still lose money if it takes too long to happen.

*http://seekingalpha.com/article/2248073-june-is-historically-the-worst-month-of-the-year-for-silver?ifp=0 (© 2014 Seeking Alpha )

Related Articles:

1. Blame Deflationary Pressures On Current Prices Of Gold & Silver

I believe that the inflation and price charts paint a clear picture, and that until inflation in the world picks up significantly, there will be no meaningful rallies in precious metals…[While] I am bullish on gold and silver long term, the short-term pressure is still evident and might take them lower in the next couple of months. Read More »

2. Is Gold Ready To Bounce? Not Likely! Here’s Why

Gold and silver have been all over the map in 2014. To figure out what’s next for the metals this article assesses their deep and long term status as speculative assets and the relationship between the two metals and determines what must happen to reverse their continuing decline. Read on! Read More »

3. Noonan: How Long Will These Low Prices In Gold & Silver Continue?

How long these low prices in gold and silver will continue is the ever pressing question on the minds of the gold and silver community and topic of so many articles written by the experts. While many have striven to provide an answer, and 2013 failed to match the “predictions” as to the “When?” issue, the best answer is: For as long as it takes. Here’s why. Read More »

4. Gold Dropping to $900 & Silver to $15 By End of June Before Going Parabolic!

Back in early May, 2013, I correctly forecast the lows in gold & silver which occurred 2 months later. Today, my new analyses of gold & silver indicates they both will show further weakness during the 2nd quarter of 2014 before both jumping dramatically in price before the end of 2014. Below are the specific details of my forecasts (with charts) to help you reap substantial financial rewards should you wish to avail yourself of my insightful analyses. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Holding physical Silver will continue to be a smart move, especially since Silver’s prices are currently much lower that even a few years ago.