The Pew Research Center’s recent report The American Middle Class Is  Losing Ground …says that 49% of adults are members of the Great American Middle Class. My more qualitative analysis suggests that…no more than 33% of U.S. households qualify as middle class. Claiming that 49% of the nation’s households are still middle class is a gross exaggeration. [I substantiate my contention in this most interesting and revealing article.]

Losing Ground …says that 49% of adults are members of the Great American Middle Class. My more qualitative analysis suggests that…no more than 33% of U.S. households qualify as middle class. Claiming that 49% of the nation’s households are still middle class is a gross exaggeration. [I substantiate my contention in this most interesting and revealing article.]

By Charles Hugh Smith (davidstockmanscontracorner.com)

- investing in their children’s future,

- investing in their own retirement (so they won’t be a burden to their adult kids) and

- building wealth that won’t vanish when the current asset bubble bursts.

- around $100,000 for state/corporate employed adults (i.e. jobs that provide healthcare and retirement/401K benefits) and

- $130,000+ for self-employed people (who have to pay their own healthcare and retirement costs)

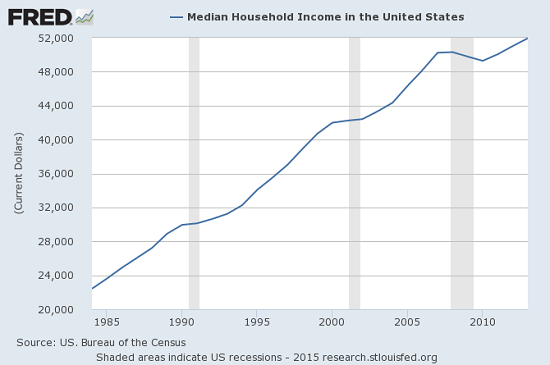

is more or less the minimum required to fund the qualities described above. It’s remarkably easy to earn this income and have very little to show for it by year-end, so this is (at least in many areas) bare-bones but, as you can in the chart below of nominal (not adjusted for inflation) median household income, this is roughly double the median household income of $52,000 annually.

“Follow the munKNEE” via Twitter and/or Facebook and have your say. Shock us, surprise us, inform us, entertain us. Here’s your opportunity to start a dialogue. Also one of the most comprehensive resources of the very best-of-the-best financial, economic, investment and gold/silver related Twitter & Facebook pages out there. Mark them as your favorites and get access to every article as posted.

The original article was written byCharles Hugh Smith (davidstockmanscontracorner.com) and is presented here by the editorial team of munKNEE.com (Your Key to Making Money!)and the FREE Market Intelligence Report newsletter (see sample here – sign up in top right corner) in a slightly edited ([ ]) and abridged (…) format to provide a fast and easy read.]

Related Articles from the munKNEE Vault:

Which Country Has the World’s Most Affluent Middle Class (and it is not the U.S.)?

The American middle class, long the most affluent in the world, has lost that distinction – to Canada, no less!

Believe it or not but according to research undertaken by Credit Suisse, a major global private banking, investment banking and asset management company, the top 10 countries with the highest average wealth per adult in 2011 DO NOT include the U.S. or Canada but DO include Belgium, whose credit rating has just been downgraded by Standard & Poors, and Italy, which is on the verge of being bankrupt. Below is a list of the 10 countries whose citizens are the richest. Words: 1095

3. Americans! Where’s the Outrage Regarding Your Financial Situation?

Most Americans don’t understand what is happening because neither the mainstream media nor our politicians are telling them the truth. We are being told that we just need to accept our lower standard of living and most Americans seem willing to accept that reality because they keep sending most of the exact same bozos back to Washington D.C….Why are the majority of Americans not screaming to their political “representatives” that they are as mad as hell and not willing to take it any more? Words: 1270

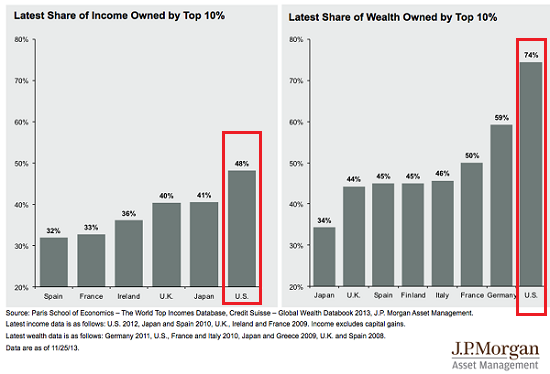

4. New Report Confirms that “Occupy Wall Street” Has a Point Regarding Income Inequality in America

Of all the many banners being waved around the world by disgruntled protesters from Chile to Australia the one that reads, “We Are the 99%” is the catchiest. It is purposefully vague, but it is also underpinned by some solid economics. A report from the Congressional Budget Office (CBO)… confirms the contentions of the 99% that a system that works well for the very richest has delivered returns on labour that are disappointing for everyone else and that the people at the top have made out like bandits over the past few decades, and that now everyone else must pick up the bill. [Take a look at the graph which shows just how unequal income distribution is in the USA.] Words: 776

5. How the Wealth of Canadians, Americans, Brits and Aussies Compare

Countries differ greatly in the levels and pattern of wealth holdings…In this article…we highlight those of Canada, the United States, the United Kingdom and Australia. [Take a look at the results of our extensive research.] Words: 1314

6. Canadian Senior Citizens Are Among the Most Affluent People In the World.

In Canada “seniors” (what an awful word!) are the new elite. Politicians pander to them. They get tax breaks up the yin-yang. They suck up most of the health care. Their employers can’t even kick them out the door – not that most need to work. They’re rich.

7. What Happened to America’s “Middle” Class? Here’s What!

Most American households are making less money than they would have 14 years ago with adjusted dollars. It begs the question, what is happening with America’s middle class? Why is there a decline?

8. How the Poor, Middle Class and Rich Spend Their Money

How do Americans spend their money and how do budgets change across the income spectrum? The graph below answers these questions. Words: 240

9. Never Have SO Few Owned SO Much – Where Do You Place in the Wealth Hierarchy?

Visit wsj.com – HERE – to find their calculator which shows where your household income stands compared to others in the U.S.. $506,000 puts you in the top 1%; the much talked about $250,00 in the top 6%; $200,000 in the top 10% while an annual salary of $43,000 puts you in the top/bottom 50%. Where do you stand?

11. How Much Do Americans Earn?

How much does the typical American family make? This question is probably one of the most central in figuring out how we can go about fixing our current economic malaise. In this article we break down the U.S. household income numbers. Words: 464

12. The 1%: Net Worth of $8,232,000; Average Annual Income of $1,530,733 – and More Interesting Facts

You’d be in the top 1 percent of U.S. households if your income in 2010 was at least $516,633; your net worth in 2007 was $8,232,000 or more, and your average income this year is $1,530,773. Where did the top 1 percent make its money? [Take a look at the following charts for the answers.] Words: 1048

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money