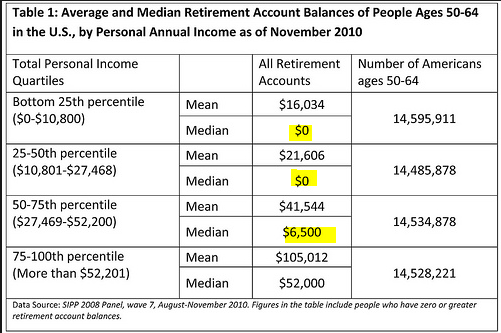

Why aren’t YOU planning for retirement in any adequate fashion? [I say YOU because I am assuming that YOU are in the top 75 to 100th percentile of those 50 to 64 years of age who have an average annual income of +$52,201 per year. The latest statistics reveal that such people as YOU have a totally insufficient amount set aside in various retirement savings accounts – mean savings of $105,012; median savings of $52,000!] All it takes is a tiny bit of rain and the financial house of cards YOU live in can come crumbling down.

I am assuming that YOU are in the top 75 to 100th percentile of those 50 to 64 years of age who have an average annual income of +$52,201 per year. The latest statistics reveal that such people as YOU have a totally insufficient amount set aside in various retirement savings accounts – mean savings of $105,012; median savings of $52,000!] All it takes is a tiny bit of rain and the financial house of cards YOU live in can come crumbling down.

By mybudget360.com. Originally* entitled Only 4 out of 10 Americans has enough in their savings to pay for an unexpected expense: Half of the country is living paycheck to paycheck with no retirement plans.

Why Are YOU Saving So Little?

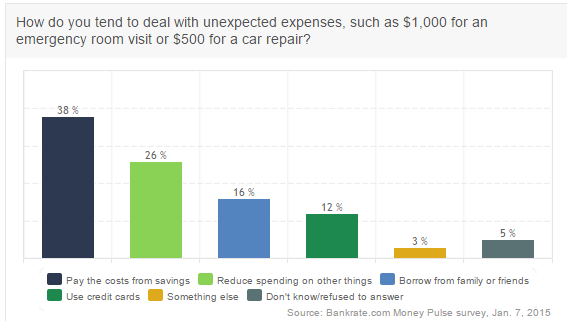

Contrary to what the media portrays, most Americans [does that include YOU?] are horrible savers. In fact, only 40% of Americans have enough in their savings accounts to pay for an unexpected expense [does that include YOU?] so it should also come as no surprise that half this country is not adequately preparing for retirement [does that include YOU?] and will be depend on Social Security as their main, and for many only, source of income in old age [does that include YOU?]. Why do YOU save so little?

Most people [does that include YOU?] realize that putting away a few months of expenses is good financial hygiene so the question then centers on the lack of people saving money. There are two main reasons:

- living beyond your means [does that include YOU?] and

- simply having more expenses than income [does that include YOU?].

Given the contraction of the middle class and inflation, many Americans [does that include YOU?] are simply feeling the pinch of inflation combined with low wages.

A recent survey found that most Americans [does that include YOU?] are not prepared for an unexpected expense:

Are YOU Making Adequate Plans For Retirement?

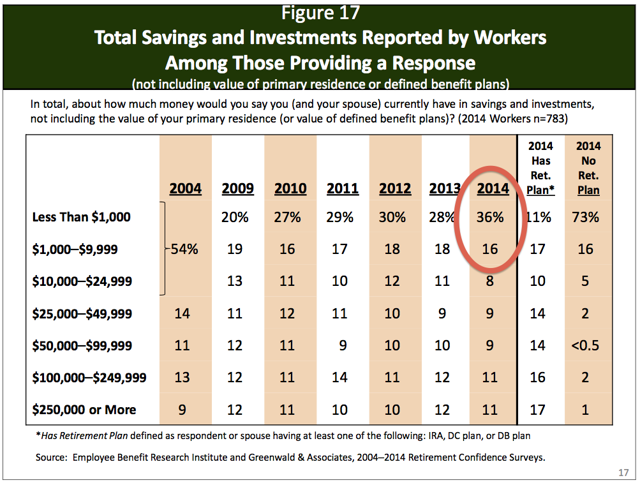

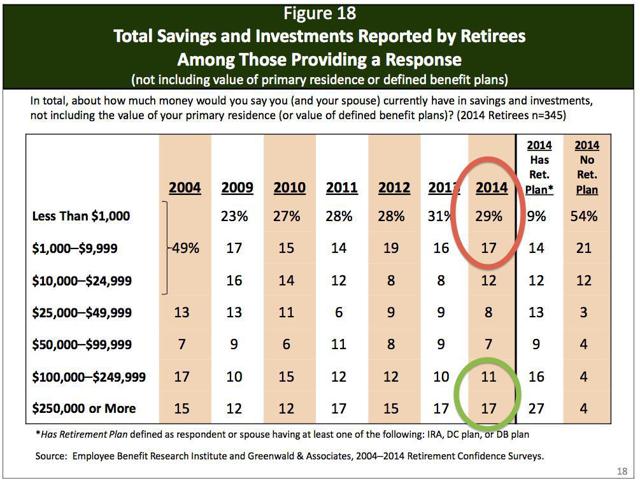

It shouldn’t come as a surprise then that many Americans [does that include YOU?] are also not planning for retirement in any adequate fashion.

Take a look at this data:

[As noted the above] data is for those 50 to 64 years of age and deep into the retirement planning period of life.- You’ll notice that half of this group has a median retirement account of $0. That is correct. No money whatsoever. This is why roughly half of older Americans would be out on the street if they didn’t have Social Security.

- Even those with higher incomes are not doing so well. The 50 to 75th percentile has a median retirement account of $6,500 and the top 75 to 100th percentile has $52,000.

Conclusion

The vast majority of Americans [does that include YOU?] are under saving for immediate emergencies and retirement. All it takes is a tiny bit of rain and the financial house of cards can come crumbling down.

[The above article is presented by Lorimer Wilson, editor of www.munKNEE.com and www.FinancialArticleSummariesToday.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. This paragraph must be included in any article re-posting to avoid copyright infringement.]

*Original Article: http://www.mybudget360.com/american-savings-rate-retirement-account-median-saved/ (If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!)

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. Looking At Retirement & Planning To “Wing It”? Here’s A Better Way

In reality most Americans are winging it when it comes to their retirement plans. The plan for most will be the default with Social Security which was never intended to be the primary source of incomes for millions of Americans. The new retirement is no retirement and working well into old age. If that’s you here is how to avoid such a future. Read More »

2. How to Make a Rich Retirement Your Reality

Since WWII, we have enjoyed one of the most productive economies the world has ever seen, yet many seniors are broke. When you reach retirement age, you don’t have to be one of them. Below is some straight talk on how to make a rich retirement your reality. Read More »

3. 3 Ways To Manage Your Eventual Retirement

…The Employee Benefit Research Institute surveys workers each year concerning their retirement confidence. Despite an uptrend, the latest report shows that 82% of workers feel less than “very confident” about having enough money to retire comfortably. With that statistic in mind, this article looks at three different 40-year retirement scenarios. Read More »

4. Here’s How To Set Up A Risk Averse Retirement Plan

One of the most difficult challenges of transitioning to retirement from the working world is a complete change in mindset with regards to an investment portfolio. You go from being a saver to a spender. There’s no future income or nearly as much time to soften the blow from bear markets. Growth is still necessary but you have to be cognizant of the fact that you’ll need to protect some of your assets for spending purposes. Here’s an interesting case study in how to approach this change in mindset. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money