Millions of investors have stormed into US Treasuries. Some have even settled for negative yields on Treasury Inflation Protected Securities (TIPS). They are making a terrible mistake, [however,] because right now a handful of gold mining stocks offer much more upside potential and immediate yield than T-bonds. [Let me explain.] Words: 1119

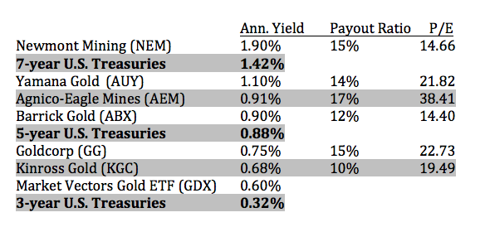

There’s an old saying that “Gold doesn’t pay interest” and, [while that’s] true,…right now [there are] six well-known gold miners are yielding just as much – or more – than government bonds [as outlined below].

Newmont Mining (NEM) yields a solid 1.9% – 48 basis points more than 7-year Treasuries (a basis point is equal to 0.01 so 48 basis points are 0.48) [and] according to government data from treasurydirect.gov this has never happened before going back to 1987, the first year Newmont paid a dividend.

Who in the world is currently reading this article along with you? Click here to find out.

[In addition,] Yamana (AUY), Agnico-Eagle (AEM) and Barrick (ABX) – for the first time ever – are yielding more than 5-year Treasuries. [Then there are] Goldcorp (GG), Kinross (KGC) and the Market Vectors Gold ETF (GDX) [who are currently yielding] nearly twice as much as 3-year Treasuries.Of course, mining stocks aren’t risk-free but, in a world where central banks led by the Federal Reserve are gutting the value of their currencies and, let’s be honest, entire governments’ ability to repay debt has come into question, Treasuries aren’t so “safe” either.

A Dirt Cheap Dividend Play – But Not For Long!

[In] the chart below we’ve [compared] the Market Vectors Gold Miners Trust ETF (GDX) with the popular SPDR Gold Trust (GLD). GDX offers a basket of mining company stocks [and] GLD closely tracks the price of gold bullion… GLD has rallied 30% this year [while] the gold miners (GDX) have only jumped 10%.click on image to enlarge

It’s hard to say what’s going on here for sure. Investors are piling into physical gold and the SPDR gold trusts and, so far, they’ve been richly rewarded but, while holding physical bullion is a better “end of the world” hedge, investors seeking short-term gains should instead focus on the miners.

Here’s why:

- How many businesses do you know with profit margins like this? The typical miner has production costs south of $600 an ounce, and is actively selling gold for $1,800+. Newmont (NEM), for example, reached a 27.68% profit margin in Q2, about on-par with red-hot Apple Computer (AAPL) at 25.58%.

- As central banks and sovereign wealth funds continue to accumulate the yellow metal they will have no choice but to buy mining companies…If they attempt to buy bullion alone, they will push the price up too high, too fast.

- Mining stocks are much more liquid than bullion coins and bars. You never have to search for a willing buyer or haul them off to a local bullion dealer. Just point, click and sell from your brokerage account.

What Could Possibly Go Wrong?

1. If somehow Bernanke’s magic pixy dust stimulates the economy into full recovery – mining stocks could take a hit but there is no evidence that a “recovery” is around the corner – and any recovery driven by printed money – by nature – must be inflationary.

2. If the banks and the stock market shut down for months, gold stocks (heck, every stock) will be worthless – so if you’re one of those Mayan doom and gloomers, ignore this article and get yourself a case of Johnny Walker Black and a good prayer book.

3. It’s possible panicked governments will attempt to grab hold of the last remaining gold supply by nationalizing the mines. This type of mass “theft” is more likely than a repeat of 1933, when Americans were commanded to turn over their gold coins but, still, it’s a long-shot considering no currency is backed by gold.

4. If commodities, especially oil, steel and rubber, go through the roof and gold doesn’t keep up, that would impact the mining companies’ profit margins.

Wait a Second! These Stocks Crashed in 2008-2009, Didn’t They?

Yes they did – and investors that stuck to their guns did very well. This time around, gold is trading over 2.5-times higher today than it was in 2008. So barring a crash, that should put a higher floor under well-run mining companies.

Bottom line

Gold is money. It can’t be printed or spread-sheeted into existence – but it can, and must, be pulled from the earth. Right now some of the world’s most well-run mining companies are trading at a clear discount to gold. On top of that, six of them pay higher yields than US Treasuries with the added bonus of potentially explosive dividend growth.

If you believe in the dollar and trust the government to guard its value – whatever little remains – stick with Treasuries. If you are willing to take some short-term risk, select mining stocks could help protect your wealth and pay you a growing stream of dividends in the months ahead.

*http://seekingalpha.com/article/292975-6-gold-miners-now-yield-more-than-u-s-treasuries?source=email_portfolio

Related Articles:

1. Negative Sentiment Suggests Buying Gold & Silver Stocks NOW

Relative to gold, gold stocks are now +30% cheaper than they were at the bottom of [the previous] 20 year long bear market [and that, in addition to the current negative sentiment for the PM sector, suggests that now might be an ideal time to get your fair share of PM stocks and/or their associated warrants. Let’s take a look at some charts that support my point of view]. Words: 905

2. Gold Mining Stocks Are CHEAP Compared to Price of Gold

So far in 2011 gold prices have increased [approx. 8] percent.. while the stocks of gold [mining] companies in the HUI have… declined 13%…[As such,] this year’s carnage has created a substantial opportunity to buy healthy gold mining companies at their second-cheapest level in nearly 30 years compared to gold bullion. [Let us explain.] Words: 1265

3. Sell Your Gold Now – and Buy Its Producers Instead – for Greater Returns

I believe that the masses are stumbling over themselves to buy gold when the far better value is to own the companies that control so much of the supply. I will probably be pilloried for this by the gold bugs, but I’m going to hold my ground: now is not the time to buy gold and it may be a great time to sell it. Words: 435

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money