How can you not be scared sh*tless about the future of the financial world given the fact that most S&P 500 companies are spending almost all of their profits on buybacks and payouts and, given the power finance has gathered over the real world, how can you not be scared about your own future? I’m open to suggestions, but I don’t see it. Why? Because I think that what we’re looking at here is the imminent demise of the corporate world, and therefore the financial world, and the entire U.S. economy as we know it. Let me explain.

fact that most S&P 500 companies are spending almost all of their profits on buybacks and payouts and, given the power finance has gathered over the real world, how can you not be scared about your own future? I’m open to suggestions, but I don’t see it. Why? Because I think that what we’re looking at here is the imminent demise of the corporate world, and therefore the financial world, and the entire U.S. economy as we know it. Let me explain.

The above introductory comments are edited excerpts from an article* by Raúl Ilargi Meijer (theautomaticearth.com) entitled The Imminent Demise Of The American Economy.

Meijer goes on to say in further edited excerpts:

Companies need to invest their earnings into projects that will generate profits, into the development of products and services that they can sell to the world out there. If they instead use their earnings to buy back their own shares, they’re on a fast track to oblivion, because they can’t keep on buying their own shares over and over again. At one point, they’ll own them all.

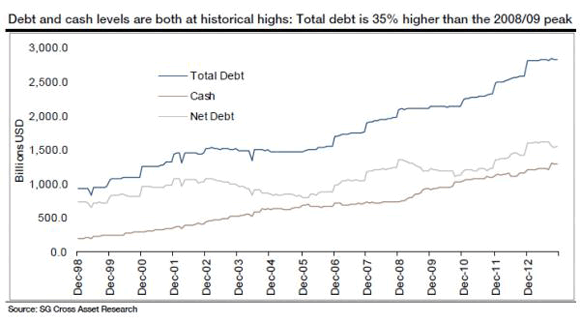

It’s not as if they take every dollar that comes in and buy back shares with it. They don’t, it’s not that simple. The problem is that they do buybacks with far too many of their dollars and much of what they buy back shares with is borrowed money. Ultra low rates, what can go wrong, right? Well, here’s what can: these allegedly rich firms are loading up on debt while their productive qualities, for lack of a better term, get thrown out with the bathwater.

Here’s how, and how much, U.S. companies are loading up on debt, graphs courtesy of Tyler Durden:

…It’s not just the companies themselves that buy their own stock…The major central banks, the Fed, Bank of Japan, and People’s Bank of China, also have substantial U.S. stock portfolios – and 50% of U.S. public pension funds are now holding the same U.S. stocks.

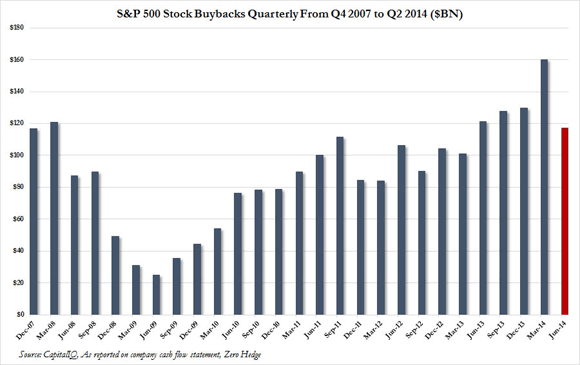

Everyone puts lipstick on the U.S. corporate pig. At some point, someone’s bound to see a bubble in there somewhere. The S&P companies gained $3.59 trillion in ‘value’ since 2009, and are set to spend $9.14 billion in buybacks and dividends in 2014. Bloomberg says that “the stocks with the most repurchases gained more than 300% since March 2009″. Looks great, until it doesn’t:

It’s like there’s a house up for sale, and you’re interested, but the owner asks $20 million, based on the fact that he himself just made an offer of $20 million. The pipes are leaking, and so is the roof, but the realtor says, I tell you man, there’s a $20 million offer on the table. Just to say, in today’s market nobody has a clue what anything is truly worth and today’s stock buyers (investors?) are in essence offering $21 million for a house that may not be worth a tenth of the asking price, but they wouldn’t have any way of knowing. All that’s left is blind wagers.

The following take away from this article should be obvious, or so I think:

• While the S&P is at record highs, the U.S. companies it is supposed to reflect have become dramatically less productive. Not just a little bit. They’ve also accumulated a pirate’s fortune in additional debt.

• Through buybacks, S&P companies have, aided by central banks, and Wall Street, created a hugely perverted idea of what their shares are worth. ‘Someone’s buying, so there must be value there’. Well, not if the seller poses as the buyer too.

• The lack of capital invested in productive undertakings spells even more erosion of the U.S. manufacturing base and that tells you all you need to know about the future of U.S. industry. If companies don’t invest earnings in their own productive futures, who’s going to do it, and why should they?

Company shares have become a purely financial play, not something linked to a company doing well, performing, innovating, exceeding itself. That link is broken. It’s no longer about what you do, but what you can make people believe you do.

How much closer can you get to not having a functional economy? Beats me. There’s nothing there anymore, other than cheap credit and old habits. There’s no there, there.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.theautomaticearth.com/the-imminent-demise-of-the-american-economy/ (© 2008/14 The Automatic Earth All Rights Reserved)

Below is another take on the situation from Goldman Sachs’ David Kostin in an article** posted on BusinessInsider.com entitled GOLDMAN: We’re Blaming The Stock Market Sell-Off On A Pullback In Buybacks who] believes a temporary pullback may explain why the S&P 500 has tumbled from its all-time high of 2,019 on Sept. 19 saying:

Most companies are precluded from engaging in open-market stock repurchases during the five weeks before releasing earnings,” Kostin notes. “For many firms, the beginning of the blackout period coincided with the S&P 500 peak on September 18. So the sell-off occurred during a time when the single largest source of equity demand was absent. Buybacks dip during earnings reporting months, which have seen 1.2 points higher realized volatility than in other months during the past 25 years.

The bulk of Q3 earnings announcements will be out by the end of October, at which point Kostin believes buying will pick up again, saying:

We expect companies will actively repurchase shares in November and December. Since 2007, an average of 25% of annual buybacks has occurred during the last two months of the year.

Kostin believes the comeback in buybacks will drive the S&P to 2,050 by year-end.

**http://e.businessinsider.com/public/3219933

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. Present Bull Rally In Stocks Dangerously “Beyond the Pale” – Here’s Why

It is frighteningly clear to any objective analyst and/or intelligent investor that the present bull market rally in stocks (2006-2014) is “beyond the pale” (outside the bounds of acceptable behavior) i.e. the excess valuation is dangerously above the market excesses of the 1920s. Read More »

2. We’re All Cued Up For A Bear! Here’s Why

When taking a step back and viewing longer-term gauges, we see warning signs flashing. Many of these readings are in extreme territories, and historically bear markets have occurred from such overbought positioning. We are all cued up for a bear! Read More »

3. SELL! U.S. Stock Market Is An Investor’s Nightmare – Here’s Why

The stock market is presently a roulette wheel with dimes on black and dynamite on red. We continue to have extreme concerns about the extent of potential market losses over the completion of the present market cycle. Read More »

4. It’s Just A Matter Of Time Before the Stock Market Bubble Is Pricked! Here’s Why

Once again the stock market is in full bubble mode. The market was already overvalued earlier this year and the froth continues to build. Valuations are off the chart and euphoria is setting in while, at the same time, you have inflation eroding the purchasing power of regular Americans not participating in this casino. All the signs of a bubble top are there – massive speculation, unexplainable valuations, and blind optimism – even though the fundamentals don’t make any sense. This article substantiates that contention. Read More »

5. Financial Asset Values Hang In Mid-air Like Wile E. Coyote – Here’s Why

The financial markets are drastically over-capitalizing earnings and over-valuing all asset classes so, as the Fed and its central bank confederates around the world increasingly run out of excuses for extending the radical monetary experiments of the present era, even the gamblers will come to recognize who is really the Wile E Coyote in the piece. Then they will panic. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money