Building a portfolio to withstand the storms of life means understanding even a portfolio of the most reliable and sturdy securities will take hits along the way and diversification allows your portfolio to keep moving forward.

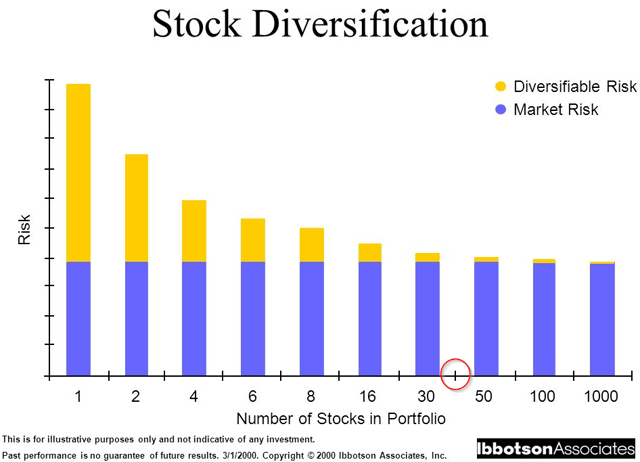

…As you continue to add securities to your portfolio, you can spread out and reduce your risk. We landed on 40 due to it being very near, if not the sweet spot between benefiting from diversification, and the loss of noticeable benefit beyond that amount.

Having good diversification is more than just the number of investments, and it does not mean owning hundreds of stocks. Diversification mutes the impact of any negative events by offsetting them with positive ones. As you can see from the chart above, as you add more securities to your portfolio, the benefit of it drops.

- Once you reach about 50 securities, it would take a doubling of your portfolio to 100 securities before a measurable additional benefit occurs.

- Clearly, a portfolio of 40 to 80 stocks and bonds would be ideal.

…Occasionally an investor will choose to overweight a specific security they have extreme convictions in or see as extremely undervalued. By aiming to keep each security between 2% and 3% of your portfolio, you have room for a few overweight holdings when you keep at least 40 holdings in your portfolio. This means going to 5% on a single one will not cause Titanic-level damage if it goes south.

In Summary

…Diversification means:

- owning approx. 40 securities…

- [investing in more than]…one sector…

- keeping multiple types of securities in your portfolio – common equity, preferred securities, and bonds – because they perform differently in various market conditions… and

- aiming to keep each security between 2% and 3% of your portfolio…

The goal should be to have a healthy and proper level of diversification. This should be achieved through careful research, meticulous planning, and strong convictions. Throwing any old security into your portfolio in the name of diversification will lead to weakening your portfolio. Keep your portfolio afloat in the sea of life and be prepared for anything…

Editor’s Note: The original article by Rida Morwa has been edited ([ ]) and abridged (…) above for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

A Few Last Words:

- Click the “Like” button at the top of the page if you found this article a worthwhile read as this will help us build a bigger audience.

- Comment below if you want to share your opinion or perspective with other readers and possibly exchange views with them.

- Register to receive our free Market Intelligence Report newsletter (sample here) in the top right hand corner of this page.

- Join us on Facebook to be automatically advised of the latest articles posted and to comment on any of them.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money