Register to “Follow the munKNEE“ and automatically receive all articles posted

With the Bank of Japan’s latest move to fight deflation and seemingly to start another round of global competitive currency devaluation, it…makes sense to hold some gold in a portfolio. However, I remain of the opinion that it makes no sense for gold bulls to hold gold stocks over bullion. [This article explains why that is the case.] Words: 281

start another round of global competitive currency devaluation, it…makes sense to hold some gold in a portfolio. However, I remain of the opinion that it makes no sense for gold bulls to hold gold stocks over bullion. [This article explains why that is the case.] Words: 281

So writes Cam Hui (http://humblestudentofthemarkets.blogspot.ca) in edited excerpts from his original article* entitled Where Is The Leverage To Gold?

This article is presented compliments of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Hui goes on to say, in further edited excerpts:

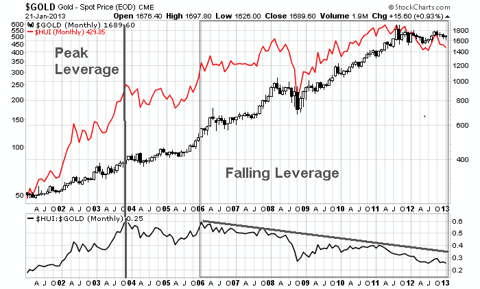

Consider this chart below of the price of gold compared to the Amex Gold Bugs Index (HUI).

The top panel shows the price of gold in black and HUI in red. The bottom panel shows the HUI/gold ratio. A rising ratio indicates positive leverage to gold and a falling ratio shows falling leverage. The HUI/gold ratio rose and peaked out in late 2003. It then flattened out and started to decline in 2005 and continues to fall today.

I wrote about this topic in 2011 and 2009 and it continues to be true: Gold bulls shouldn’t buy gold stocks! The reason why gold stocks have failed to keep pace with the price of bullion is gold mining companies can’t replace lost production at the same cost as the older cheaper ore bodies get mined out. They are mining lower and lower grade ore and therefore their profits and cash flows are lower because of higher production costs (see my analysis Valuing gold stocks on cash flow, not assets).

Bottom line: If you are a gold bull, buy physical gold, GLD, CEF, or any other vehicle directly related to the price of gold. Just avoid gold stocks.

Editor’s Note: The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://humblestudentofthemarkets.blogspot.ca/2013/01/where-is-leverage-to-gold.html

Register HERE for Your Daily Intelligence Report Newsletter

It’s FREE

The “best of the best” financial, economic and investment articles

An “edited excerpts” format to provide brevity & clarity for a fast & easy read

Don’t waste time searching for informative articles. We do it for you!

Register HERE and automatically receive every article posted

“Follow Us” on twitter & “Like Us” on Facebook

Related Articles:

1. Egon von Greyerz: The Real Move in Gold Hasn’t Started Yet, It Is Still to Come – Here’s Why

After having compounded at over 19% p.a. over 11 years, gold certainly should be allowed to just gain 7% in 2012 without some people calling an end to the bull market. Those who believe the bull market is over are mainly the investors who have missed gold going up almost 7 times in since 1999. Let me be very clear, the real move in gold hasn’t started yet, it is still to come. Here are my reasons why. Words: 1000

2. Gold Bugs: Here’s How to Make the Most of the Continuing Bull Market in Gold!

All you gold bugs out there (and budding gold bugs too!) should find this article of extreme interest. With gold about to make a major move upwards in price NOW is the time to position your gold-investment allocation to maximize your dollars deployed and returns generated. Those in the know will not be investing in physical or paper gold, or even the stocks of the miners, but in the long-term warrants of the very few mining companies that offer such an opportunity. This article provides a primer on the MAJOR advantage that long-term warrants have in a market upleg and identify the specific warrants that are available. Words: 1037

3. Interested in Buying Gold or Silver Mining Company Warrants? Here’s How

Buying and selling warrants associated with commodity-related companies (including those of gold and silver miners) can be very confusing if you are not aware of the unique information required to do so and understand just how to go about it. Below you will find all the information you need to know on the subject. Words: 2110

I am not a big fan of gold [and believe that the best we can expect for 2013 is that it will go sideways.] That said, [however,] I believe that there is still substantial money to be made from a such a sideways movement [and much, much more should it actually increase somewhat in price. This article explains exactly how.] Words: 691; Charts: 2

5. If You Think Silver Is Going To Increase In 2013 Here’s How to Best Maximize Your Return

I am not normally a big fan of precious metals but in 2013 I am an unabashed fan of silver. If SLV were to return 15% next year there is a 95% probability that a ProShares Ultrashort Silver ETF (ZSL) put option on SLV would return 80%+! [Let me explain how I have come to that conclusion.] Words: 985

6. New! Gold & Silver Bars Now Available in Divisible 1g “Coins”

CombiBars™ are precious metal bars which are constructed with predetermined breaking points so they can be separated easily without any loss of material. The idea of detachable bullion CombiBars™ came about in the summer of 2010 as a result of the European currency and global banking crises when more and more investors started to demand a higher number of small bars rather than few larger ones to increase their flexibility in the event of an economic crisis or to simplify future trading. Read more below about the complete CombiBar™ product offering and their CombiCoins which, incidentally, are legal tender investment coins of the Cook Islands.

7. Here’s An Easy Way to Identify Gold & Gold Miner Market Tops and Bottoms

It’s amazing! Every day I learn something new. I have just come across a very powerful tool that identifies market tops and bottoms in both the gold price and the gold mining industry valuation. Let me share it with you. Words: 352; Charts: 4

8. Gold Stocks Go Up Dramatically In Inauguration Years – Will Another +20% Increase Occur This Year?

President Obama will be sworn into office for a second term on January 21 and that’s good news if you own gold stocks. Why? Because gold stocks, [as represented by the XAU] have increased, on average, by 20% during inaugural years since 1985 (28% in 2005; 36% in 2003). While there’s no real rhyme or reason as to why gold stocks thrive in inauguration years – statistical anomaly or otherwise – it is yet another reason to buy gold stocks right now. Words: 312; Charts: 1

9. Alf Field: Once $1,800 Is Taken Out Gold Will See a Vigorous Climb to $4,500 Area

There is a high probability that the correction in the gold price that started in early October at $1797 has been completed. Once $1800 is taken out on the upside the gold chart will look tremendous. A beautiful “cup and handle” base would then provide strong support for a vigorous upward climb in the precious metal. At this stage there is no reason to abandon the rough target of $4500 for this coming upward wave. [Below is my analysis and some charts on the situation.] Words: 434; Charts: 2

The fact that nobody really knows with absolute certainty where gold will really go from today onward makes people try to make their own guesses about what can happen with the yellow metal. One of the methods to do that is to look back into past situations and try to estimate if what is happening now is somehow similar to those past events. The situation in the gold market today is different than the one in 1980 in a few important areas. Even if past patterns don’t give you any certainty, though, sometimes they can limit the uncertainty. Let us analyze that in more detail. Words: 1260; Charts: 2

10.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Good article!

I’d like to see a comparison between holding physical PM’s and those that buy and hold (long term) PM stocks (not mining stocks).

Thanks