The Fed continues to assert that its Quantitative Easing bond purchases will boost economic growth by lowering borrowing costs for businesses and consumers but the evidence shows that QE bond purchases have actually coincided with increases in long-term interest rates.

economic growth by lowering borrowing costs for businesses and consumers but the evidence shows that QE bond purchases have actually coincided with increases in long-term interest rates.

The above are edited excerpts by Scott Grannis, the Calafia Beach Pundit, (scottgrannis.blogspot.ca) from his original article* entitled Quantitative Easing Myths.

The following is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here). The excerpts may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

The Fed is guilty of misleading the public; it should be arguing that its QE efforts have been successful because they have boosted long-term interest rates [as can be seen in the chart below]. Interest rates are up because the outlook for the economy has improved, and QE has likely contributed to that improvement by satisfying the world’s huge demand for safe assets.

Myth #1: Effect of QE on 10-year Treasury Yields

The chart below shows the yield on 10-yr Treasuries (blue), overlaid by shaded areas representing periods of Quantitative Easing (darker green) and the one period of Operation Twist (light green).

Note that:

-

yields rose on net during each period of Quantitative Easing,

-

yields only fell when the Fed was NOT purchasing bonds.

-

Operation Twist also failed to deliver on its promise, since 10-yr yields were roughly unchanged despite purchases of $400 billion longer term bonds and corresponding sales of shorter term bonds.

Myth #2: Effect of QE on Bond Prices/Yields

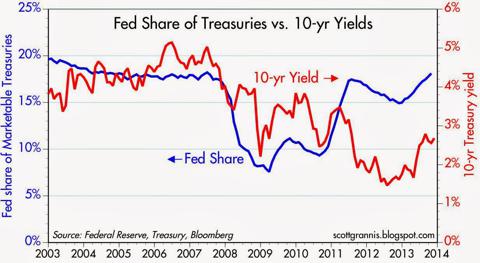

The chart below compares the yield on 10-yr Treasuries (red line) with the percent of marketable Treasuries held by the Fed as a result of its QE purchases (blue line).

Note that:

- the Fed today holds about 18% of marketable Treasuries, which is almost identical to what it held in the years leading up to QE, yet yields are substantially lower– there’s no discernible correlation between the amount of bonds the Fed owns and the level of yields.

- over the past four years the Fed has significantly boosted not only its purchases of Treasuries but also the portion of marketable Treasuries it holds, yet interest rates are largely unchanged on net.

- 10-yr Treasury yields have jumped over 100 bps since early May, even as the Fed has stepped up its purchases and its percentage ownership of marketable Treasuries.

There is no evidence in either of the two charts above to support the notion that QE bond purchases have inflated bond prices or depressed bond yields.

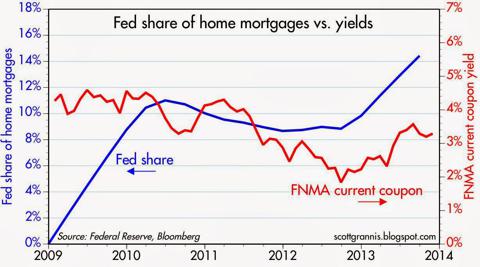

Myth #3: Effect of QE on Mortgage-backed Securities

The same arguments apply to the Fed’s purchases of mortgage-backed securities as the chart below shows. The Fed has dramatically increased its ownership of MBS over the past several years, yet there is no indication that increased purchases have had a depressing effect on mortgage yields. Over the past year, during which the Fed has purchased $40 billion of MBS per month, mortgage yields have actually increased by about 100 bps.

One explanation for why the Fed’s QE efforts have not produced their promised results is relatively simple.

- The Fed has purchased only a relatively small portion of the outstanding supply of Treasuries and MBS, and that is not enough to materially change the yield on all outstanding bonds.

The outstanding supply of marketable Treasuries and MBS is almost $21 trillion, while the Fed owns only about $3.6 trillion. More important is the fact that there are tens of trillions of corporate and non-U.S. bonds that are effectively priced off of Treasuries. To artificially depress the yield on Treasuries the Fed would have to not only buy a huge portion of outstanding Treasuries but also a significant portion of corporate and non-U.S. bonds.

Myth #4: QE Means Fed Is Printing Money with Abandon

It’s also a myth that the Fed has been “printing money” with abandon as a result of its QE bond purchases. This myth persists, despite strong evidence to the contrary (i.e., the fact that inflation remains very low despite four years of massive QE purchases), because the majority of observers fail to understand the mechanics of Quantitative Easing.

- QE bond purchases do not create money; they create bank reserves, which are very different from money.

- Bank reserves can’t be spent anywhere, because they exist only on the Fed’s balance sheet.

- Banks don’t lend bank reserves, they use them to collateralize their deposits, which in turn are a function of total lending activity.

- The huge expansion of bank reserves could potentially result in a huge expansion of the money supply (banks need extra reserves to support increased lending), but it has not, because

- banks have been reluctant to expand their lending activities, and

- the public has been reluctant to borrow more. Not only banks, but the entire world remains relatively risk-averse, preferring to hold significantly more cash and cash equivalents, of which bank reserves are an important part.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://scottgrannis.blogspot.ca/2013/11/quantitative-easing-myths.html

Related Articles:

1. Noonan: The Fed Will Never Ever Taper & What That Means For Gold

The Ponzi bubble is bigger than most can imagine. Western central planners… [continue to try to] suppress gold and silver in order to keep their sorry lives alive. In the process, the destruction of people’s financial well- being is unabated… Read More »

2. What Will Happen If (and probably when) the U.S. Debt Bubble Bursts?

The madmen who are responsible for the coming economic disaster continue to behave as if they can manage to avoid it. Violating Einstein’s definition of insanity, they continue to apply the same poison that caused the problem. These fools believe they can manage complexities they do not understand. The end is certain, only its timing is unknown, and, once interest rates begin to rise, and they will, it’s game over so it begs the questions “How much longer this can possibly go on?” and “What will happen to the U.S. and the world when it does?” Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money