News events from the Crimean Peninsula have increased paranoia in the mainstream financial press and certain corners of the internet [that Russia, in response to any economic sanctions implemented by the West, might engage in some form of retaliatory financial warfare. It is suggested that Russia might sell all of its holdings of U.S. Treasury debt as a means of adversely affecting the financial “health” of the U.S. The fact is, however, that such a scenario is highly unlikely for the simple reason that it would have little, if any, impact. Here’s why.]

certain corners of the internet [that Russia, in response to any economic sanctions implemented by the West, might engage in some form of retaliatory financial warfare. It is suggested that Russia might sell all of its holdings of U.S. Treasury debt as a means of adversely affecting the financial “health” of the U.S. The fact is, however, that such a scenario is highly unlikely for the simple reason that it would have little, if any, impact. Here’s why.]

So say the guys at DQYDJ.net in edited (highly paraphrased) excerpts from their original article* as posted recently on SeekingAlpha.com under the title Can Russia Cause A Run On U.S. Debt?.

[The following is presented by Lorimer Wilson, editor of www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

The article goes on to say in further edited excerpts:

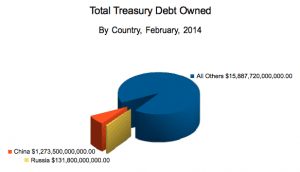

As the largest economy in the world, encompassing around 25% of combined world GDP…, the biggest economics guns still reside in the U.S….[but] who really owns their $17,293,020,000,000.00 in Treasury debt?…Is there any risk of a problem?

Not highly likely.

- $5 Trillion is held by other government agencies (the largest being Social Security and the Civil and Military retirement trust funds, ~$4.1 Trillion of that),

- $2.2 Trillion is held by the Federal Reserve and

- $4.2 Trillion is held by U.S. corporations and typical citizens while the last

- $5,832.7 Trillion is held by other countries (technically, the amount of debt sold in other countries) which amounts to “just” 33.729% of the total… if every other country banded together to commit financial shenanigans against the United States.

All others includes domestically held debt. (Sources above)

Below is the full foreign holdings chart, straight from the Treasury:

| Treasury Debt Held | Percentage of Total | |

| China, Mainland | $1,273,500,000,000.00 | 7.36% |

| Japan | $1,201,400,000,000.00 | 6.95% |

| Belgium | $310,300,000,000.00 | 1.79% |

| Caribbean Banking Centers (1) | $293,300,000,000.00 | 1.70% |

| Oil Exporters (2) | $246,400,000,000.00 | 1.42% |

| Brazil | $246,000,000,000.00 | 1.42% |

| Taiwan | $179,100,000,000.00 | 1.04% |

| Switzerland | $173,700,000,000.00 | 1.00% |

| United Kingdom | $162,900,000,000.00 | 0.94% |

| Hong Kong | $160,300,000,000.00 | 0.93% |

| Luxembourg | $135,300,000,000.00 | 0.78% |

| Russia | $131,800,000,000.00 | 0.76% |

| Ireland | $108,800,000,000.00 | 0.63% |

| Norway | $88,200,000,000.00 | 0.51% |

| Singapore | $85,900,000,000.00 | 0.50% |

| India | $68,100,000,000.00 | 0.39% |

| Mexico | $67,200,000,000.00 | 0.39% |

| Germany | $63,900,000,000.00 | 0.37% |

| France | $57,500,000,000.00 | 0.33% |

| Korea | $55,600,000,000.00 | 0.32% |

| Canada | $55,300,000,000.00 | 0.32% |

| Turkey | $48,900,000,000.00 | 0.28% |

| Thailand | $47,800,000,000.00 | 0.28% |

| Philippines | $38,700,000,000.00 | 0.22% |

| Sweden | $34,900,000,000.00 | 0.20% |

| Colombia | $32,900,000,000.00 | 0.19% |

| Netherlands | $32,300,000,000.00 | 0.19% |

| Poland | $31,200,000,000.00 | 0.18% |

| Australia | $31,000,000,000.00 | 0.18% |

| Italy | $30,400,000,000.00 | 0.18% |

| Kazakhstan | $29,800,000,000.00 | 0.17% |

| Chile | $27,100,000,000.00 | 0.16% |

| Israel | $24,200,000,000.00 | 0.14% |

| Spain | $23,200,000,000.00 | 0.13% |

| Denmark | $14,100,000,000.00 | 0.08% |

| Peru | $13,800,000,000.00 | 0.08% |

| South Africa | $11,500,000,000.00 | 0.07% |

| Malaysia | $10,800,000,000.00 | 0.06% |

| Vietnam | $10,600,000,000.00 | 0.06% |

| All Other | $174,900,000,000.00 | 1.01% |

Also straight from the Treasury, these footnotes:

1) Caribbean Banking Centers include Bahamas, Bermuda, Cayman Islands, former Netherlands Antilles and Panama. Beginning with new series for June 2006, also includes British Virgin Islands.

2) Oil exporters include Ecuador, Venezuela, Indonesia, Bahrain, Iran, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates, Algeria, Gabon, Libya, and Nigeria.

Conclusion

When it comes down to our debt, we’re the adult playing in the sandbox. Fannie and Freddie or other quasi-government agencies might be more exposed to manipulation than the U.S. in general, but we have the resources to put a quick halt to any manipulation.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

* http://seekingalpha.com/article/2097983-can-russia-cause-a-run-on-u-s-debt?

Related Articles:

1. Financial Warfare Could Result Between U.S. & Russia With Dire Worldwide Consequences

There is little the United States can do militarily to change the outcome in Ukraine…but this does not mean the United States is helpless. No sooner had the Russian invasion become clear than the White House announced the possibility of economic sanctions against Russia….By implementing such sanctions, the United States has moved in the direction of a new kind of warfare — not kinetic war involving ships, planes and missiles — but financial war involving cash, stocks, bonds and derivatives. The policy question, and an important question for investors, is how far can this type of financial warfare go and how effective can it be? What will the impact of financial war be on markets in general and investors in particular? Read More »

2. China’s Reining In of U.S. Treasury Purchases Will Precipitate U.S. Dollar Collapse

The People’s Bank of China is reported by Bloomberg to have said that it will rein in dollar purchases as the country no longer benefits from increases in its foreign-currency holdings…What implications will this have? I believe that we’ll see the start of a U.S. dollar collapse. Here’s why Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I agree that Russia alone could not bring down the US$, but that said any “attack” on currency would have some effects on the value of the US$…

This is yet another reason to have PM’s in your portfolio!

GOT PM’s ?