Financial markets are influenced by relatively predictable cycles…[and should] play a big role in one’s decision-making process just as they do in our day-to-day lives. [This article takes a look at several and discusses their relevance to one’s investment management process.]

a big role in one’s decision-making process just as they do in our day-to-day lives. [This article takes a look at several and discusses their relevance to one’s investment management process.]

The above introductory comments are edited excerpts from Part 1* of a series of articles by Frank Holmes (usfunds.com) entitled Managing Expectations. Go here for Part 2 and here for Part 3.

The following article is presented courtesy of Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Holmes goes on to say in further edited excerpts:

Gold Seasonal Trends – One Year Cycle

Gold is a classic example of a commodity that rotates through seasonal cycles year after year…in response to international festivals and holidays such as the Chinese New Year and Ramadan. You can look back five, 15 and 30 years to spot the patterns the precious metal dependably follows, reaching annual highs late in the year during Diwali and Christmas when gold jewelry demand spikes.

Presidential Election Cycles – Four to Eight Years

At U.S. Global we like to say that government policy is a precursor to change, and no person in the nation has more control over policy than the President. The decisions he makes and actions he takes have far-reaching consequences in markets both domestic and international, more so than perhaps even he can anticipate.

The current occupant of the White House, Barack Obama, began his presidency by injecting $700 billion into the economy…and we’ve also seen several rounds of quantitative easing (QE) to loosen money and facilitate loan-taking. Largely as a result of these policies, the S&P 500 Index during both of Obama’s terms has performed above the average four-year presidential cycle. Early last month, furthermore, the Dow Jones Industrial Average hit a record high of 17,000.

Just over the horizon are midterm elections, a time when the market historically becomes bullish. According to the most recent Stock Trader’s Almanac:

“An impressive 2.7% has been the average gain during the eight trading days surrounding midterm election days since 1934. This is equivalent to roughly 52 Dow points per day at present levels. There was only one losing period in 1994 when the Republicans took control of both the House and the Senate for the first time in 40 years.”

Lifecycle of a Mine – Multiple Years

Not only is it important for us to understand the seasonality of the commodity itself, it’s equally important to be aware of the stages a mine must proceed through before it becomes operational. As I write in The Goldwatcher: Demystifying Gold Investing:

“We strongly believe in using cycles to better manage risks and expectations, and we see this as a way for others to manage their emotions when it comes to investing. Knowing where a company is on the mine lifecycle can be a tremendous asset to an investor in gold equities who seeks to minimize risk and optimize performance. It’s one more tool the investor can use to try to manage volatility and his own market expectations.”

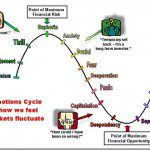

Take a look at the graphic below. Years can, and do, divide the time when a mine is discovered and when production begins. It’s imperative to know which stage of its lifecycle it’s in to make a better-informed decision on whether to invest, withdraw or wait.

When a mine is first discovered, excitement raises the price of the stock. This is when investment is most speculative since only one in 2,000 companies finds at least a 1 million-ounce deposit. Once reality sets in and miners are faced with the notion that the metal or mineral—assuming there is any—probably won’t be exhumed for some time, prices tumble. Years later, after production finally begins, stocks see another uptick. This is when the equity is at its lowest risk factor. To manage risk and expectations, it’s critical for us to know where we are in the cycle of the mine.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.usfunds.com/investor-library/frank-talk/the-importance-of-cycles-in-the-investment-management-process/#.U_D1JFV0zIU

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. Part 2: What Role Do Oscillators, Standard Deviation & Mean Reversion Play In YOUR Investment Management Process?

In the investment management process…[it is important to] actively monitor both short- and long-term cycles…in order to manage expectations based on historical patterns…[as well as] oscillators – diagnostic tools that help us measure a security’s upward and downward price volatility. To understand how oscillators work, though, you first need to become familiar with standard deviation and mean reversion. In this article we do just that.

2. Part 3: The Best Times to Buy & Sell (or not) Your Stocks to Maximize Returns

Statistically speaking there is an optimal time to buy or sell a security and knowing such, or at least knowing when not to do so, would be quite beneficial to your financial health. This article provides the answers as to what are the best months, and work its way down to half-hours of the trading day, to engage in trading.

3. Cycle Analysis Suggests S&P 500 Has Topped & Will Decline To Major Low In 2016

While the majority is looking at the Megaphone Pattern correction since the 2000 high and is expecting the market to go back to the lower trend line of this pattern and to make new lows, I think that it will not happen. The opinion of the majority can be used as a contrarian indicator. I think that a healthy correction in this new Secular Bull Market could push the Dow Jones to 12500-13500 (end of 2015 – half 2016) followed by a second leg up of this new Secular Bull Market. Read More »

4. Fed Funds Cycle Suggests Positive Outlook for Gold – Here’s Why

Below is some interesting research by Doug Peta of BCA Research regarding the Fed Funds Rate Cycle, and what that research – as well as our own in-house research – could mean for gold to help you understand the positivity we see for the precious metal looking towards 2015. Read More »

5. Many Economic Cycle Theorists Believe 2014 to 2020 Is Going To Be Pure Hell For the U.S.!

Many mainstream economists want nothing to do with economic cycle theorists, but it should be noted that economic cycle theories have enabled some analysts to correctly predict the timing of recessions, stock market peaks and stock market crashes over the past couple of decades – and there are many economists who believe that the period from 2014 to 2020 is going to turn out to be pure hell for the United States. Read More »

6. Where Are We In the Current Economic/Market Cycle? These Charts Will Help You Decide

There is a debate on Wall Street between those who believe we have entered into the next “secular bull market” and those who believe that the current market advance is predicated on artificial stimulus and, as such, the “secular bear market” remains intact. Take a look below at a series of charts designed to allow you to draw your own conclusions and convey your view in the comments section at the very bottom of the page. Words: 719; Charts: 12 Read More »

7. These 20 Cycle Theories Suggest Stock Markets, Gold & Bonds To Severely Correct

Unsustainable trends can survive much longer than most people anticipate, but they do end when their “time is up” – at the culmination of their time cycles…In an effort to bring clarity in how and when these trends could change direction we analyzed more than 20 different cycles. They almost unanimously point to tectonic shifts in the months and years ahead … starting now. We have been warned. At this point, we have enough confirmation to accept that the gold and silver crash – starting in April of 2013 – was the first shot across the board of what is to come. Read on! Read More »

8. Gold & Silver in Super Cycles: When Will They Go “Boom” & Then “Bust”?

Commodity prices including those of…[gold and silver] tend to go through super-cycles…[which] last for many years. [Below is a review of the history of such cycles and the length of each. Where are we now in each? When will they go “boom”? When will they go “bust”? Let’s take a look.] Words: 165; Charts: 1; Tables: 3 Read More »

9. The Doomsday Cycle: There are More, and Worse, Crises to Come! Here’s Why

Industrialised countries today face serious risks – for their financial sectors, for their public finances, and for their growth prospects. This column explains how, through our financial systems, we have created enormous, complex financial structures that can inflict tragic consequences with failure and yet are inherently difficult to regulate and control. It explains how this has happened and why there are more and worse crises to come. Words: 2434 Read More »

10. John Mauldin: The Debt Supercycle Will End in the Next 2-3 Years – and It’s Deflationary

We’re coming to the end of government’s ability to borrow money to fund current spending that’s beyond the growth of their economy….and I actually find that massively bullish because that government funding misallocates capital. It’s going to end in the next 2 or 3 years, Europe first, then Japan, then the US…. Read More »

11. Gold/Silver & Mining Stocks Going From Their Cycle Bottoms to Parabolic Peaks by 2015

Once every year gold and stocks form a major yearly cycle low while other commodities form a major cycle bottom every 2 1/2 to 3 years. Occasionally all three of these major cycles hit at the same time….That’s what’s happening right now and it should lead to a powerful rally over the next 2 years, culminating in 2014 when the dollar forms its next 3 year cycle low. Words: 622 Read More »

12. Financialization: Its Definition, Its Lifecycle and Its Impending Collapse

Financialization is like the bubonic plague–it constantly needs new victims as it kills off its existing hosts. Housing? Dead, killed by financialization, aided, abetted and powered by the Federal Reserve. Now the Fed wants to “save” what it already killed via financialization–housing–by buying $1 trillion in plague-infested mortgages and brute-force efforts to keep interest rates below inflation, i.e. negative rates.[Let me take this disease analogy further.] Words: 514 Read More »

13. Time the Market With These Market Strength & Volatility Indicators

There are many indicators available that provide information on stock and index movement to help you time the market and make money. Market strength and volatility are two such categories of indicators and a description of six of them are described in this “cut and save” article. Read on! Words: 974 Read More »

14. Yes, You Can Time the Market – Use These Trend Indicators

Remember, the trend is your friend and now you have an arsenal of such indicators to make an extensive and in-depth assessment of whether you should be buying or selling. If ever there was a “cut and save” investment advisory this article is it. Words: 1579 Read More »

15. Make Money! Time the Market Using Market Strength Indicators- Here’s How

There are many indicators available that provide information on stock and index movement to help you time the market and make money. Market strength and volatility are two such categories of indicators and a description of six of them are described in this “cut and save” article. Read on! Words: 974 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money