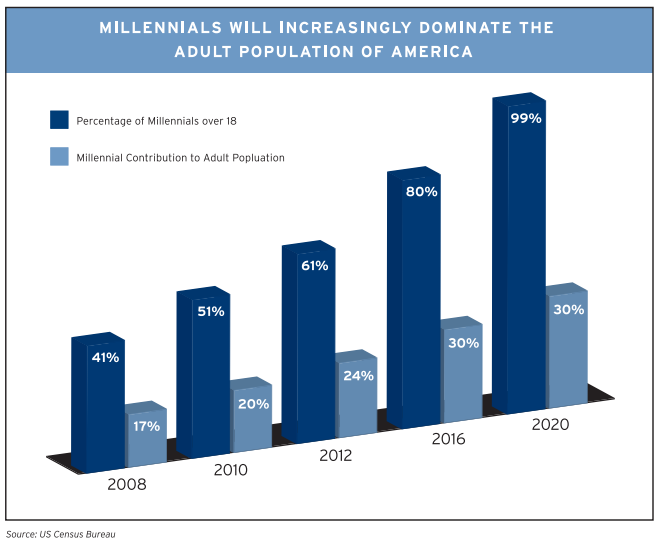

for approx. 75% of the adult work force in the next 10 years. The stakes are high for both sides. Here’s why.

for approx. 75% of the adult work force in the next 10 years. The stakes are high for both sides. Here’s why.

The following article is presented courtesy of Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

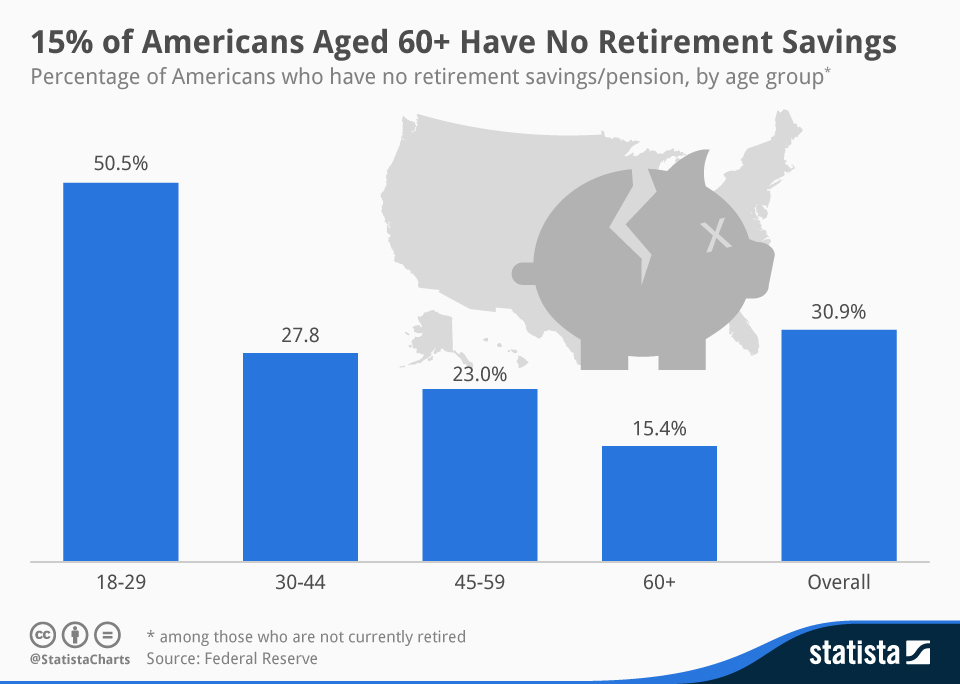

Many Millennials are at risk of falling behind on their financial goals because they haven’t even started investing yet. For example, 50% of Americans between the ages of 18 and 29 [see chart below] have zero retirement savings, according to a Federal Reserve survey. Millennials, also known as Generation Y, are generally defined as those in their 20s or early 30s, and they are justifiably wary of the financial industry and the market.

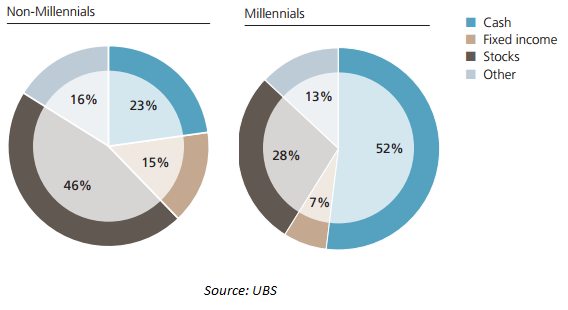

- They are extremely conservative as investors: Millennials are the most fiscally conservative generation since the Great Depression, according to a UBS survey.

- They’ve seen their parents get hit with two major bear markets the past 15 years.

- They tend to avoid the stock market and hold a higher percentage of cash than older investors.

- They’ve also witnessed the effects of the housing boom and bust.

- They are very skeptical: The financial crisis has also made them understandably suspicious of Wall Street and potential conflicts of interest.

- Millennials require a high level of trust before they give their money to a bank or financial adviser.

- They verify using information on the Internet, social media and from personal connections.

- They defy stereotypes: They may be seen as coddled and spoiled, but it turns out they care a lot about their financial futures and don’t want to repeat their parents’ mistakes.

- They’re tech savvy and highly educated as a group.

- They want to have control over their finances, so they’re more likely to be self-directed investors.

- They want to be comfortable, but they don’t want their lives to be dominated by money, which is often secondary to pursuits such as traveling, family, staying healthy, friends and volunteer work.

- They have financial challenges: In many ways, it’s not easy to be a Millennial.

- College tuitions have skyrocketed in recent years, and many graduates are saddled with high levels of student debt. The Class of 2014 is the most indebted ever.

- Rents and home prices are creeping higher while wages have mostly stagnated.

- More Baby Boomers are staying in the workforce and delaying retirement after the financial crisis, making it harder for younger investors to find jobs.

- The above are all reasons why Millennials are hitting major milestones later in life such as getting married, buying a house and having children.

- They tune out marketing and advertising: Perhaps more than any other generation, Millennials understand how marketing and advertising work, and they’re adept at ignoring it or even finding ways to turn it off completely. They don’t click on banner ads or open mass emails.

- What works with Baby Boomers doesn’t work with Millennials: You can’t market to Millennials in the same way as retirees, but this goes beyond just the message and investments.

- With social media, the financial-services industry is still doing what it always has — just faster and louder.

- Millennials are keenly aware of when they’re being advertised or marketed to, and they resent it. Wall Street can’t talk down to Millennials.

- Wall Street has to turn its traditional marketing strategy on its head to reach Millennials.

- Social media engagement: Social media is where Millennials get a lot of their information and learn about brands. According to recent study, 77% of Millennials own a smartphone and they spend nearly 15 hours a week texting, talking and on social media.

- Companies need to engage followers on social media, not just talk AT them with links to their own blog posts and products. It needs to be a two-way street, with shares to other Facebook accounts and retweets to other Twitter handles.

- It’s important to educate followers, and be a part of the daily discussion with analysis of relevant, timely topics…and it helps to focus on a specific theme or niche, rather than trying to be all things to everyone…

- Wall Street’s approach to social media is probably backfiring for a lot of financial-services firms. Millennials just see these companies the same way they see Grandpa trying to “do Facebook.”

- Personalize it: Millennials are leading the backlash against conglomerates — the huge companies with big marketing budgets and aggressive sales tactics.

- Many Millennials are gravitating to companies that take more of a personalized, Mom-and-Pop approach. Many are willing to pay a little extra to “feel good” about the companies they buy from and deal with.

- Beyond marketing: Millennials as a group do more research than anyone else, BEFORE they even begin the decision process of buying a product or service. They’re very good at using the Internet and social media to find what they want. If a company has a bad product, customer experience or corporate culture — Millennials will see right through it – and then they’ll tell all their friends on social media. No amount of slick marketing can fix a broken corporate culture…

- Barry Ritholtz entitled Time, Not Timing, Is Key to Investment Success** and

- Ben Carlson entitled Millennials & The New Death of Equities***

that every financial advisor should incorporate into his/her marketing approach to Millennials:

Thinking long-term increases your probability for success in the stock market while the day-to-day noise gets drowned out by discipline and compound interest.”

2. “The biggest assets you have as a young person are your human capital for future savings and the ability to allow those savings to compound over many years.

I’m not sure what it’s going to take to get my fellow Millennials to understand that their aversion to stocks will only make it harder to achieve their financial goals in life.

The unfortunate reality is that it takes investors time and experience to learn about how the markets work.

The stock market doesn’t care if young people invest or not. It’s not going to wait around until you get more comfortable with taking risk.

Those that invest increase the probability of reaching their goals while those that don’t risk falling behind.

The fact is that the best way to build wealth for the majority of people is to slowly invest over the long-term and let compounding do most of the work for you.”

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

Follow the munKNEE!

- Register for our Newsletter (sample here)

- Find us on Facebook

- Follow us on Twitter (#munknee)

1. 12 Books that EVERY Financial Advisor – and Investor – Should Read

Bill Ackman, founder of Pershing Square Capital Management, believes the following books are essential financial reading. Enjoy the summer! Words: 235 Read More »

2. Should You Replace Your Financial Advisor With A “Robo” Advisor? Here Are the Pros & Cons

In the last few years a new “advisor” has entered the fray – the robo advisor, now being called “automated investment services”. Automated investment services are platforms that automate your investment portfolio and try to help you reduce fees, increase efficiencies and streamline your process through a simple computerized interface. Here’s a look at 4 primary benefits and 4 potential problems to help you decide if such a service is for you. Read More »

3. Self-manage Your Portfolio? Think Again! Here Are 10 Reasons You NEED a Financial Advisor

Irrespective of any active v. passive investing debate, good advisors are an absolute necessity. Here’s my top 10 list of reasons why Read More »

4. What You Need to Know About Financial Advisor/Planner Fees

Understanding how financial advisors get paid and what your advisor fees are will help you make smarter decisions about your money. Here are a few of the different ways financial advisors get paid and what you need to know about advisor fees. Words: 538 Read More »

5. Ways to Pay a Financial Advisor and Ways a Financial Advisor Gets Paid to “Manage” Your Portfolio

Just as it’s smart to question the doctor suggesting test after test for you at a facility he or she owns, it’s important to know how your financial advisor’s pay structure creates incentives that may harm or help your portfolio in the long run. [Let’s review the various ways there are for you to pay a financial advisor as well as the various ways a financial advisor can get compensated for how he/she “manages’ your portfolio.] Words: 1576 Read More »

6. Here are Some Telltale Signs It’s Time to Fire Your Financial Advisor

Investors…should start taking a long hard look at their broker [financial advisor/planner] and rethink [what they expect of them] while at the same time empowering themselves to take control of their own situations. This article identifies several warning signs that it may be time to cut ties with your current broker. Words: 721 Read More »

7. Is It Time To Fire Your Financial Advisor?

As more and more investor education and information is freely available online… investors now have an important choice to make. Should you go it alone, stick with your financial advisor, or fire him and find another, perhaps this time a fee-only planner? Words: 740 Read More »

8. Are the Millennials the Best Generation Ever?

The Millennials are the latest -and some would say, greatest – generation to emerge in America. Currently defined as those between the ages of 18 and 29, Millennials have many recognizable characteristics that researchers have deemed typical of the generation: optimism, tech-savvy, liberal leanings, and a solid educational background. [In fact,] a whopping 50% of those in college (40% of Millennials] say they plan on entering graduate programs afterwards. It could be a sign of the tough financial times, or just evidence of the remarkable smarts and ambition that define this generation – or perhaps it’s a little of both. Are the Millennials the best generation ever? Let’s take a look. Read More »

9. The Millennial Cohort: A Look at Their Present Predicament, Their Future Economic Prospects

Though considered the most educated generation in history, the Millennial generation – young adults between the age of 18 and 29 who make up 25% of America’s population – is also living through one of the worst economic crises. From a weak job market to the global economic downturn, are the Millennials cut out for this market? [A look at the infographic below tells the story.] Words: 345 Read More »

It’s up to the concerned and critical-thinking among us to look at the math, the hard data underlying the headlines, and construct what we can best calculate to be true [about our current personal financial level of (un)readiness for the future] and the truth is: the three adult generations in the U.S. are suffering, and their burdens are likely to increase with time. Each is experiencing a squeeze that is making it harder to create value, save capital, and pursue happiness than at any point since WWII….[Let’s]…walk through the numbers. Words: 2332 Read More »

It is not your civic and moral responsibility to pay off the debts of your government’s failures. Cast off the yoke of their control… and summon the courage to live a life by your own design. The path to your prosperity depends on this ability to reject the old system, declare your economic independence, and carve your own path. [This article outlines what is being laid out as your future unless you take independent action and, in conclusion, outlines suggestions on how to make a better life for yourself. Feel free to share this article with one and all – and the video at the end of the article.] Read More »

12. These Degrees Are the Ticket to the 10 Top Paying Careers

Staying in school has always been seen as the way to get ahead. Post-secondary education, especially a university degree, is often the ticket to the big pay cheque but not all degrees are created equally when it comes to earning potential. Which programs lead to the best paying jobs? Check out our list of the top earning degrees. Words: 775 Read More »

13. Unemployed? Under-employed? Bored? Check Out These 10 High-growth Jobs

Though unemployment has been wide-reaching across industries…[some] jobs, against all odds, are on the rise – a steep rise…So if you’re sick of your job and craving a new profession, now might be the time to head back to school and get that secondary degree in one of these 10 specializations. Read More »

14. Which U.S. Universities & Fields of Study Generate the Highest ROI?

Recent research by PayScale has revealed that the average ROI for U.S. university graduates (693 schools surveyed) is $387,501 over a 30-year period. 6 of the universities generated a return on investment for its graduates in excess of $1.6 million. Read More »

15. American Grads: Here’s a Great Guide to Personal Finance

Graduating from college can be an exciting and stressful time. Suddenly you need to find a job, replay loans and make solid financial decisions. Fortunately, you don’t need to be unprepared. Below are some budgeting basics to keep your spending under control, some suggestions on how to set financial goals and a list of the top 10 American cities for starting out. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money