economic success” but I say China’s model (and economy) will fail drastically, proving once and for all that government-planned economies do not work as well as free market capitalism balanced by democracy. This article identifies seven signs showing that the end is near.

economic success” but I say China’s model (and economy) will fail drastically, proving once and for all that government-planned economies do not work as well as free market capitalism balanced by democracy. This article identifies seven signs showing that the end is near.The above are edited excerpts from an article* by Harry Dent (survive-prosper.com) originally entitled 7 Signs China’s Economy Is Headed For Collapse.

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Dent goes on to say in further edited excerpts:

The greatest – and final – bubble to burst, in this century of bubbles, will be China. China has massively overbuilt everything – industrial capacity, housing, offices, malls, infrastructure, you name it – twice as much, and for twice as long, as any other government-driven emerging economy ever has. In fact, the last government-driven over-investment spree occurred in Southeast Asia, and it resulted in a financial crisis between late 1997 and late 2002. China’s has made that situation look puny by comparison.

Editor’s Note: An opposing point of view: The Boom in China Is Over BUT the “Bust Talk” Is Far Overdone. Here’s Why

There is no way this can end any way other than very, very badly. The question is: when will an economic collapse come? The answer is, sadly: sooner than you’d like. Now that cracks in the great red dragon’s economy are widening, it’s time to prepare for the worst.

Here are the seven signs the end is near:

Sign #1: Recently, a large Chinese property developer decided, for the first time, to discount condos by 40% when sales stalled…[which] is a shocking step to take in China – it’s just not done – but this discounting trend is likely to spread rapidly now as more developers are forced to discount prices just to raise cash and avoid bankruptcy…

Sign #2: Li Ka-shing – the richest man in China, with $31.9 billion – and his son, Richard, have sold $3 billion of prime commercial properties in the last nine months. That tells me the smart money is leaving before the bubble bursts!

Sign #3: A Bain & Company/Chinese Bank survey of affluent households showed that 60% of the rich are considering moving overseas because they don’t trust government, [fear a bursting of] the bubble, [find] pollution levels…intolerable, and they want to get their kids an English-speaking education.

Sign #4: A number of major highly leveraged developers have gone bankrupt… [and this is posing a] threat to the banking system, which has grown through shadow banking and unsustainable sub-prime lending in the last few years…

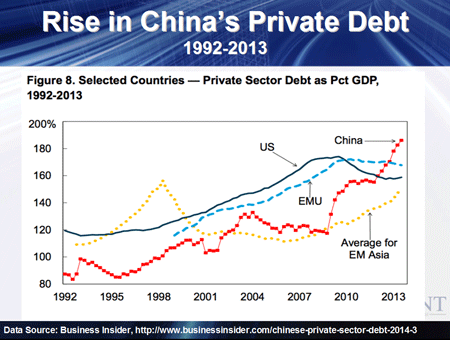

Sign #5: The country’s private debt is now higher than that of the U.S. or Europe, as you can see in the chart below. At 190% and rising, it’s higher than emerging countries in Asia in 1998 when private debt peaked at 160% before a five-year currency and financial crisis. Note that this chart doesn’t include financial sector or government debt and when you add those numbers into the pot, my estimates of the country’s total debt is around 277% of GDP. That’s much higher than other emerging countries like Brazil, which is at 152%, India at 130%, and Russia at 78%.

Emerging countries don’t have nearly the private debt of developed nations because their incomes are low and their citizens and businesses are less creditworthy so for China to have a total debt of around 277% is unprecedented for an emerging country. [Not surprisingly,] bad loans are now rising fast in China.

Sign #6: A major agricultural co-op closed its doors and investors couldn’t withdraw their deposits.

Sign #7: A major Chinese solar company defaulted on its bonds – the first to occur in China.

Thus far, the government has quietly bailed out or covered over the defaults and cracks but they’re now hinting that they’re going to let more defaults happen to “slowly let the air out of the balloon.”

Conclusion

The Chinese government simply doesn’t have a clue – actually, no government does. They always think they can deflate bubbles slowly to ensure a soft landing but soft landings never occur in major bubbles. Bubbles don’t correct. They burst. They get so extreme – and China’s bubble is the most extreme of all – that once they start to unwind, you get an avalanche of deleveraging and defaults that build on each other. Bubbles become black holes.

I expect major problems in China likely by the summer or fall and when China blows, there won’t be an effective stimulus policy from the U.S., Europe, or Japan, to counter such a shock. It will make the U.S. sub-prime crisis look like a Sunday afternoon picnic.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://survive-prosper.com/2014/05/15/7-signs-chinas-economy-is-headed-for-collapse/ (Copyright © 2014, Dent Research)

Related Articles:

1.The Boom in China Is Over BUT the “Bust Talk” Is Far Overdone. Here’s Why

China has decided to try and walk back from the edge of a Minsky moment and engineer a soft landing. They have made a decision to pop the bubble deliberately, allow defaults to instill market discipline and remove the moral hazard currently in place. They are moving into the modern world as fast as possible based on the enormous tasks they have embraced so we probably can expect no more booms but probably not a bust either. Let me explain. Read More »

2. China’s Debt Binge & Buying Spree Is About to Burst!

When it comes to reckless money creation, China is the king. Over the past five years Chinese bank assets have been fueled by the greatest private debt binge that the world has ever seen. Unfortunately for China (and for the rest of us), there are lots of signs that the gigantic debt bubble in China is about to burst, and when that does happen the entire world is going to feel the pain. Let me explain. Read More »

3. Richard Duncan: China Headed Into a Serious Crisis

China’s miracle is driven by one thing and one thing only: its trade surplus with the U.S., which went from zero in 1990 up to now more than $300 billion a year [but] since the darkest hours of the 2008 global economic meltdown, China has made little progress in shifting its reliance away from exports, and, as a result, the Chinese economy is dangerously exposed to a renewed downturn in global trade. Words: 500 Read More »

4. The China Syndrome – Fully Understanding China’s Economic Prospects: Michael Pettis

In order to argue that we will not see a sharp slowdown in Chinese growth, it is not enough to claim that:

- some expert or institution has predicted that Chinese growth will not slowdown,

- China has enough savings in its coffers to bail itself out of a crisis or that

- Beijing leaders cannot tolerate growth below 8%, so of course growth will not drop below 8%.

As greater evidence for the bear camp surfaces, China bulls need stronger justifications for their positions or risk losing credibility. [In fact, they need precise answers to 3 questions put forth in this lengthy but extremely insightful (dare I say, absolute best, article on the China syndrome to have ever been written!) article. Words: 4130 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

China will be far bette able to manage their debt since their people are much more used to being controlled by their Government than all Western Countries.