Most financial consultants to institutions provide a wide range of services but what they’re all really selling is their due diligence capabilities for choosing money managers to invest on behalf of these large pools of capital. In that regard, according to a research paper from the latest issue of the Journal of Finance, there is “no evidence that their recommendations add value, suggesting that the search for winners, encouraged and guided by investment consultants, is fruitless”. This article identifies the reasons behind why that shocking revelation is the case.

selling is their due diligence capabilities for choosing money managers to invest on behalf of these large pools of capital. In that regard, according to a research paper from the latest issue of the Journal of Finance, there is “no evidence that their recommendations add value, suggesting that the search for winners, encouraged and guided by investment consultants, is fruitless”. This article identifies the reasons behind why that shocking revelation is the case.

The comments above and below are excerpts from an article by Ben Carlson (awealthofcommonsense.com) which may have been enhanced – edited ([ ]) and abridged (…) – by munKNEE.com (Your Key to Making Money!)

to provide you with a faster & easier read.

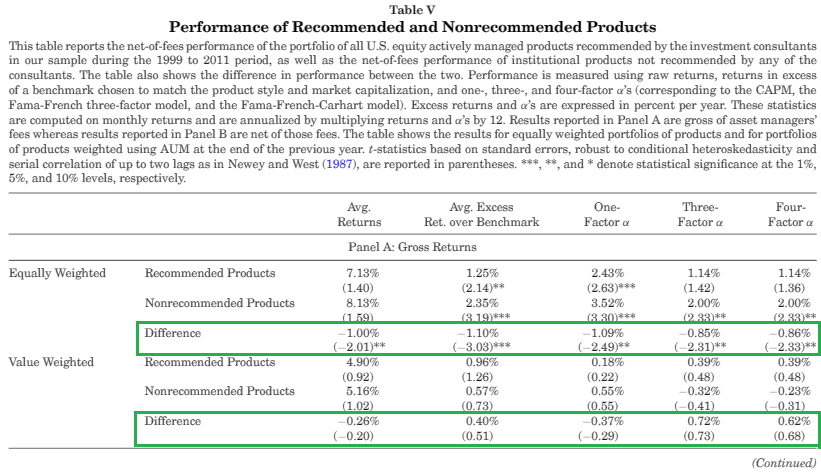

Financial consultants to institutions are probably one of the least scrutinized groups in the investment field, which has always been bizarre to me because they oversee tens of trillions of dollars for large pensions, endowment and foundations…Very few allocators…ever really spending much time judging the results of these manager-of-managers and, [as a result,] the data below (from the Journal of Finance research paper,) is not too pretty:

Why is the above the case?

1. Well, one of the problems is that these consulting firms are concentrated at the top with the top 10 firms controlling over 80% of all institutional assets.

- ([The following]…data is a little stale, but it shows just how large…the five largest investment consultants in 2011 were:

- Hewitt EnnisKnupp ($4.4 trillion under advisement),

- Mercer ($4.0 trillion),

- Cambridge Associates ($2.5 trillion),

- Russell Investments ($2.4 trillion), and

- Towers Watson ($2.1 trillion)…)

When you’re that large you almost have to invest in the largest money managers which ends up being a de-facto performance chase. It can also be difficult to offer personalized service at that size because you’re more worried about scale than anything.

2. The other problem is that those who are trying to pick consultants to pick money managers on their behalf don’t really have the expertise required to judge either the money managers or the consultants who are recommending the money managers so the blame gets passed around and everyone is none the wiser when the results end up being subpar.

Here are a few simple takeaways from this research:

- Picking money managers is hard.

- Picking other people to pick money managers for you is also hard.

- Many of the organizations overseeing these consultants probably aren’t even aware how poor their performance has been.

- Picking money managers should not be the main focus for 95% of all institutional clients.

- Consultants could add value to these relationships if they focused more of their time on client engagement, board education, asset allocation, investment policy and the unique goals of the nonprofits they are working with.

Follow the munKNEE – Your Key to Making Money! “Like” this article on Facebook; have your say on Twitter; register to receive our bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I guess I’m surprised by the realization that so much of this “high finance” is just opinion and guesswork.