With the Buffett Indicator pointing to a “lost decade” of negative returns, and Nouriel Roubini...predicting in an interview with Bloomberg this past September that the S&P 500 could experience a severe (-40%), long and ugly recession the obvious question is how to batten down the hatches and survive the coming storm.

Read More »Don’t ‘Always Stay Invested’: You Could Miss A Major Opportunity

Most investors have bought into Wall Street’s mantra of always staying invested. While this strategy may work for institutions during a bull market as we have had for the last 20 years, today it is not the best strategy for individual investors. [Here’s why.] By* Lorimer Wilson, Managing Editor of munKNEE.com – Your KEY to Making Money. Here’s why. While …

Read More »AMMO Inc. (POWW) Split Aims To Take Business To the Next Level

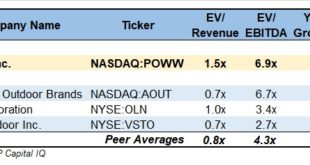

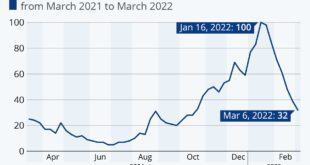

AMMO, Inc. is taking the bold step of splitting up its successful business of manufacturing, marketing and selling an array of small caliber bullets and online marketing of ammunition to increase sales, improve margins and expand its business platform and, in doing so, “significantly enhance shareholder value.” This article takes a looks at the ammunition industry, AMMO’s current place in the marketplace and its plans to take its business to the next level.

Read More »What You Need To Know About NFTs in the World of Web 3.0

This graphic showcases the evolving utility of NFTs, and how they are already building communities, enabling unique and tradeable game assets, and laying the foundations for ownership and identity in the metaverse.

Read More »Gold Royalties Offer Inflation-Resistant Gold Exposure – Here’s How

Without exposure to rising wages, fuel, and energy costs, gold royalty companies are able to maintain strong profit margins that are often more than double those of gold mining companies.

Read More »Commodities Are Practically Bulletproof Investments Going Forward

The markets have heard Powell’s message of higher interest rates, and the damage they could cause the greater economy, loud and clear. The S&P 500 has slid 8.4% over the past month (as of the close of trading Wednesday), and the 2-year Treasury yield recently hit its highest level since 2007...How bad could it get? Ho can an investor survive the coming storm? [Read on!]

Read More »These Sites Are the BEST Places to Buy Gold & Silver Online – Here’s Why (+37K Views)

Our review of the best places to buy gold online are dependent on what your goal with the gold is — amassing physical bullion for financial security or to speculate on gold prices. Below are strategies and recommended dealers for each approach.

Read More »Extent of Management ‘Skin in the Game’ & ‘Smart Money’ Involvement In Junior Miners Is CRUCIAL! Here’s Why (+4K Views)

How much capital has the management team taken out of their pockets and put directly into the company? What amount of shares of a company are owned by funds or big financial institutions. The extent of such 'skin in the game' and 'smart money' involvement is crucial in deciding whether or not to invest in a particular company. Here's why.

Read More »Buy Silver Instead of Gold! Here’s Why (+13K Views)

We are at the beginning of a major shift out of paper assets into real assets and the more I studied the merits of owning gold and silver the more I realized that silver was the smart decision. Let me explain.

Read More »Check It Out: Gold Stock Manias in 79/80, 82/83 & 95/96 Saw 2,000 – 4,000% Returns – and It Could Happen Again (+5K Views)

The timing of this article may seem incongruous given the current weak performance of gold and gold stocks but that was the identical situation in each of the past manias - both the metal and the equities didn't excel until the frenzy kicked in. The following documentation (exact returns from specific companies during this era are identified) is actually a fresh reminder of why we think you should hold on to your positions – or start accumulating them, if you haven't already. (Words: 1987; Tables: 7)

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money