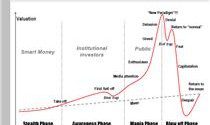

In their infinite wisdom the Fed thinks they have rescued the economy by inflating asset prices and creating a so called "wealth affect". In reality they have created the conditions for the next Great Depression and now it's just a matter of time...[until] the forces of regression collapse this parabolic structure. When they do it will drag the global economy into the next depression. Let me explain further.

Read More »Call the “Smart Money’s” Bluff & Stay Invested – Here’s Why

Brace yourself! The stock market is ripe for a nasty selloff according to a number of politicians and even more market pundits - but not so fast. Two very reliable long-term recession indicators strongly suggest that a correction – or worse, the end of the bull market - is highly unlikely given the current state of the economy. Let me explain.

Read More »No Recession Until These 6 Indicators Are Triggered (+2K Views)

Despite a long list of major risks to the global economy, the trend for the stock market is still UP until proven otherwise. At this stage it is absolutely critical to be cautious and watch for signs of a market correction or peak, but it is our view that a recession won't take hold until the following 6 key indicators are triggered.

Read More »All Is NOT Hunky Dory In the Stock Market – Here’s Why (+2K Views)

We look at this market and we see "too much." Too much divergence, too much complacency, too much embedded downside risk…the list goes on and covers many things. Let's make the rounds and see what we find [and what it means for the immediate well-being of the various stock markets.]

Read More »Mixed Signals About Direction of Stock Market Abound – Here Are 10 (+2K Views)

[No wonder you are confused!] Several technical and fundamental indicators have flashed caution to no avail and this has given way to an uncomfortable tension beneath the surface as investors try to find answers while keeping pace with performance. Below are 10 mixed signals about the near-term direction and theme of the markets.

Read More »What Are the 2 Catalysts That Cause Major Market Corrections Telling Us Today? (+2K Views)

There are a number of potential pitfalls out there for the market but, right now, the behavior of the main catalysts for a major correction suggest that there continues to be more right than wrong with the market. Let me explain.

Read More »Dow About to Correct 14-18%, Then Increase 111-122% Into 2017

The stock market has topped. It got stretched too high, for too long, and needs to pull back and wash out some diehard bulls and refresh itself before heading any higher. We are now in a bear market that could last anywhere from 3-10 months and the significance of it all is crucial to not only understanding what is going on, but also to protecting and growing your wealth. This article does just that!

Read More »Part 1: Economic Ice Age Is Coming – Dow Dropping to 1,000 (+2K Views)

Are the general stock markets and precious metals and precious metals equities about to experience a reversal in fortunes? Based upon current evidence, I think so. Here's why.

Read More »A Stock Market Correction/Crash May Not Occur For Quite A While – Here’s Why (+2K Views)

Some investors are sure we’re heading for a crash because we’ve had such an uninterrupted rise in stocks but these things can last much longer than most people realize. While a crash is never out of the realm of possibilities, just because stocks are up doesn’t mean they have to immediately crash. Eventually they will be right. It’s the timing that gets you on these type of calls.

Read More »Market Significantly Overvalued. It is Not A Question Of “IF” but “When” It Will Happen! (+2K Views)

This is not going to end well, I tell you. The stock market is significantly overvalued at 123%. The question is: "When will it happen?" I think it happens soon.

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money