Fortunately for gold investors, the spike in real yields may be coming to an end. The Fed is slowing down its rate hikes and CPI has fallen significantly. When real yields stagnate or revert, it will be like lifting a 100-pound sack from the back of the gold price.

Read More »Silver Is One of the Most Important Metals in the World! Own Any?

Silver always has been – and always will be – one of the most important metals in the world. As silver demand increases for technology and industrial applications, its value will follow.

Read More »US DOE Includes Copper in its Recent Critical Minerals Assessment Report

In a pivotal move towards bolstering the supply chain security for clean energy technologies, the U.S. Department of Energy has released its much-anticipated 2023 Critical Materials Assessment. Among the materials deemed critical are aluminum, cobalt, copper, dysprosium, and various types of steel and metals like gallium, iridium, lithium, and magnesium.

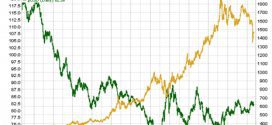

Read More »Silver Is EXTREMELY Undervalued vs. the Stock Market

If you ask the average investor, you might think that buying stocks is the best way to grow your wealth - the S&P 500 has an average return of around 10% per year - but it may surprise you that silver has consistently outperformed stocks — with an average return of 14.35% over the last 20 years.

Read More »Gold & Silver: 5 Reasons Why A Bullish Outlook Remains Intact

There’s a 99% chance of a recession within the next 12 months and this places gold, which is as heralded the best safeguard against economic turmoil, in the spotlight for at least this year and in 2024. In addition, this article highlights four further reasons why a bullish outlook for precious metals remains intact over a longer horizon.

Read More »Major Revaluation Of Gold & Silver Is Coming Soon

The time has now come for the 99.5% of financial assets which are not invested in gold, silver or precious metals mining stocks to grab both the investment and wealth preservation opportunity of a life time. Making that decision before it is too late is likely to determine your financial and also general wellbeing for the rest of your life!

Read More »Don’t Expect Much From Gold

This article provides my answers to various questions about gold, inflation, and the Federal Reserve.

Read More »Putting A Price On Gold Doesn’t Tell Us Anything About Gold – Here’s Why

No matter how high the price of gold goes in U.S. dollars, the value of an ounce of gold remains the same. Gold is literally priceless.

Read More »Get Positioned! Gold Has Entered Into A New Phase Of This Bull Market

Current and future weakness in the dollar — the result of much better inflation readings and the subsequent expectation of the Fed putting an end to its interest rate-hiking cycle, potentially even lowering rates — bodes well for...gold and other commodities that tend to gain value on a lower dollar.

Read More »Silver Will Soon Move Suddenly & Shockingly Higher – Here’s Why (+62K Views)

I am convinced that silver will soon explode in price in a manner of unprecedented proportions, both in terms of previous silver rallies and relative to all other commodities. By unprecedented, I mean that the price of silver will move suddenly and shockingly higher in a manner never witnessed previously, including the great price run ups in 1980 and 2011. The highest prior price level of $50 will quickly be exceeded.

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money