Housing makes up 42% of the Consumer Price Index (CPI) with the rest of it - food, energy, clothing, recreation, education, transportation, toys, cosmetics, etc. - making up the other 58%. [The current] softness of housing prices is artificially suppressing the growth of the CPI inflation rate [but with the coming increase in lumber costs that is about to change. Let me explain] Words: 772

Read More »Environment is Inflationary, NOT Deflationary – Here’s Why (3K Views)

While it is true that the average consumer isn’t (and won’t soon be) spending as much as he used to, it’s not because he’s waiting for bargains. No, it’s because he’s out of credit, he’s unemployed, his house, car, motorcycle, boat, and plasma television have all either been repossessed or foreclosed upon, and his wife just left him. He’s not exactly in the mood for shopping. He’s not waiting for bargains. He’s waiting for a miracle - and I don’t think they sell those at the mall. Words: 1582

Read More »The CPI, TIPS and Protecting Yourself From Inflation: What You Need to Know

Many investors are worried about inflation and, as a result, are considering buying inflation indexed bonds and other inflation protected investment vehicles. They may be setting themselves up for significant losses, however, because of the way the government is now calculating the CPI, and the further changes being proposed. In the opinion of this writer, the CPI calculation appears to be inaccurate and, as a result, such investments may not be appropriate inflation hedges. [Let me explain.] Words: 1533

Read More »Real-time Inflation Data is Now Available – Finally (+3K Views)

Inflation is a significant measurement for the economic health of countries around the world but rates are often reported weeks after data is collected. To address this problem, two professors at MIT Sloan School of Management have launched the Billion Prices Project which is the first website to publish daily price indexes and provide real-time inflation estimates around the world. Words: 825

Read More »These Indicators Say Inflation to Go to 4% Soon – and 6% by 2014 (+3K Views)

In response to the financial crisis of 2008, the Fed injected unprecedented levels of liquidity into the banking system. While inflation has been modest to date, an analysis of similar periods in history shows that it typically takes more than two years for the impact on consumer prices to be seen. Consequently, we are now at a pivotal point in the current cycle as Fed stimulus began more than two years ago. [Let me explain further.] Words: 2755

Read More »What Inflation? Take a Look At All the Deflation Around You! (+2K Views)

There is a tremendous fixation on the inflationary components of CPI of which the most obvious driver is gasoline without which even the rate of headline inflation would be dropping, and the largest risk would be falling inflation. [Deflation? Yes, that is the case when you look at] what consumer prices have declined over the past few years. Words: 460

Read More »Inflation Coming? Treasury Market Says Otherwise!

The Federal Reserve’s dual quantitative easing exercises...have been disappointing thus far and, according to what the multi-billion dollar Treasury market is telling us, the numerous forecasts of upcoming inflationary pressures just do NOT exist. [Let me explain.] Words: 571

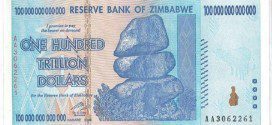

Read More »Why Hyperinflation is Not Likely – Let Alone Imminent (+2K Views)

The National Inflation Association (NIA) has just posted an article* which makes a number of interesting arguments for the advent of hyperinflation and, while I agree with the conclusion that we could potentially face such an event, I see it as just one of a few possible outcomes. Let me comment on the specific points in the NIA article. Words: 1666

Read More »A Hyperinflationary Great Depression Is Coming to America! Here’s Why (+7K Views)

As the advance squalls from this great financial tempest come ashore, the government could be expected to launch a variety of efforts at forestalling the hyperinflation’s landfall, but such efforts will buy little time and ultimately will fail in preventing the dollar’s collapse.

Read More »Hyperinflation to Occur in U.S. as Early as 2013! Here’s Why

In our estimation, the most likely time frame for a full-fledged outbreak of hyperinflation in America is between the years 2013 and 2015 [based on 12 warning signs that are on the horizon.] Americans who wait until 2013 to prepare, will most likely see the majority of their purchasing power wiped out. It is essential that all Americans begin preparing for hyperinflation immediately. Words: 2065

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money