The United States has been keeping a close eye on its trade relationships over the years. In 2023, trade deficits with many key partners were a major focus. These deficits are influenced by everything from policy changes to shifts in the global economy. While the numbers may change, the fundamental challenges frequently remain the same: striking a balance between free …

Read More »US Banks Stocks Decline on Executive Comments – Is this a Good Time to Enter the Sector

U.S. banking stocks are underperforming, with a 6% drop in September 2024, compared to the S&P 500 remaining flat. Bank executives have issued warnings about lower-than-expected recoveries from investment banking and the effects of looming interest rate cuts. With U.S. banks trading at lower P/E ratios (11.7x for 2024 and 10.4x for 2025), analysts view the sector as potentially undervalued. Meanwhile, capital requirements have been scaled back, but pessimism has intensified after Berkshire Hathaway reduced its investment in Bank of America. This may offer an entry point into the sector for value investors.

Read More »Gold Rises in August Amid Rate Cut Speculation and Election Concerns

The World Gold Council published its monthly Gold Market Commentary for August this week. Gold surged by 3.6% in August, reaching $2,513 per ounce, driven by a weaker U.S. dollar and lower Treasury yields. Investors are positioning for potential rate cuts by the U.S. Federal Reserve and the uncertainties surrounding the U.S. election. Demand also saw a boost from a reduction in gold import duties in India, contributing to strong buying interest. Meanwhile, gold-backed ETFs extended their four-month inflow streak. As traders brace for a volatile second half of 2024, gold remains a key hedge against risk, with global economic uncertainties and U.S. political developments fueling the demand.

Read More »Five-Year Performance Review of Gold and Gold-Related ETFs Amid Market Volatility

Over the past five years, gold and gold-related ETFs have experienced significant fluctuations due to economic events, changing interest rates, and shifting market sentiment. This article reviews the performance of gold, the SPDR Gold Trust (GLD), VanEck Gold Miners ETF (GDX), and VanEck Junior Gold Miners ETF (GDXJ). Gold rose by over 60%, while GLD closely mirrored this increase. In contrast, GDX and GDXJ significantly underperformed, with GDX up only 30% and GDXJ up just 12%. This analysis highlights the varying risks and returns associated with different gold-related investments.

Read More »Can Silver Get You Through a Stock Market Crisis

On Monday, major U.S. stock indexes experienced their most significant decline since 2022. The S&P 500 fell by approximately 3%, while the NASDAQ dropped over 6%. As investors navigate through the current financial turbulence, attention is increasingly turning towards assets that can provide stability amidst uncertainty. Silver, historically known as a safe haven during economic downturns, is garnering interest due to its potential to hedge against market volatility.

Read More »Baltic Dry Index: Leading Indicator of Short-term Global Economic Activity & Commodity Price Movements (+2K Views)

BDI is a “leading economic indicator” in that it measures the transportation cost of raw materials used for production of finished goods. Therefore, it is an important input in predicting short-term economic activity.

Read More »Gold’s Prospects In A Soft-Landing Scenario Are Mixed – Here’s Why

According to the World Gold Council, soft landing environments have typically resulted in flat to slightly negative average returns for gold. However, every cycle is unique, and 2024 may bring surprises.

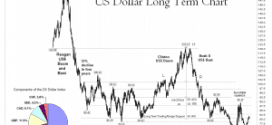

Read More »Long Term Trends On Gold, Crypto, Stock Market & Much More

The Gold/Silver Ratio has been rising along with the strength of the US dollar.

Read More »Unlike the U.S., A Canadian Recession Is A Matter Of When, Not If – Here’s Why.

A reasonable debate can be had regarding the extent to which the U.S. economy may slow in the near-term but Canada's sensitivity to interest rates suggests that a Canadian recession is a matter of when, not if.

Read More »The Economy Is In Decline: Here’s Proof

It is one thing to complain that the economy is not growing, or, that economic activity is slowing; but the 4 charts below indicate something more serious. Economic activity is in decline and the decline might be accelerating.

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money