I would prefer a scenario in which rates rise slowly, and the dollar -- as well as the economy -- stabilize gently; while the alternative makes me wealthy, unfortunately, its actualization necessarily means I will be forced to watch everyone around me suffer - and that’s a troubling thought. Words: 1480

Read More »Oil Prices Are Going Higher! Here's Why

Global crude oil production has plateaued at 74 million barrels per day. However, now that economies are recovering, consumption levels are back on the rise [and] the result will be an inevitable rise in oil prices. Words: 717

Read More »Don’t Worry About A Gold Correction (+2K Views)

Gold is overbought...but I will not be selling into overbought conditions, but looking to add on weakness. For the duration of this bull market, overbought conditions have led to a retest of the 200-day moving average. The 200-day currently sits at $1189, so a correction to $1250 or so is reasonable. In no way would a correction to these levels indicate the end of this bull market. Words: 725

Read More »The Gold Bubble Is About to Burst! Here's Why

The gold bubble is preparing to burst. Investors have endured panic for three years, and gold has rightfully gone up. Unfortunately for current gold investors, [however,] fear/panic is diminishing by the day and without that essential element, the big money will exit the trade...Those left carrying gold in their portfolios will be trying to come up with reasons to justify their holdings... [and there is considerable] confusion of rationale to [support] the precious metal's continued rise. Words: 606

Read More »U.S. Dollar In A Race To The Bottom With Other Currencies And The Winner Will Be Gold (+2K Views)

[What we are experiencing these days] is a race to the bottom among global currencies. Whenever any nation wants to gain a little bit more of an edge in global trade they push the value of their currency down just a little bit more so that the products and services produced by that nation will be less expensive for other nations [and, as such,] other nations will buy more of those products and services. When exports go up, employment goes up and more wealth flows into the country. Who is the winner in all of this? Well, that is easy. Gold, silver and other precious metals will continue to be the winners as fiat currencies all over the globe continue to decline in value. Words: 1430

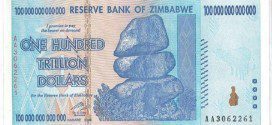

Read More »Coming Hyperinflation Will Make You A Billionaire By 2020! (+4K Views)

The National Inflation Association (NIA) believes that if the Federal Reserve doesn't reverse course immediately, we are on a direct path to all Americans becoming billionaires by the year 2020, if not much sooner. Being a billionaire in dollars won't mean anything. The wealth of Americans later this decade will be calculated based on how much gold and silver they own. We are at the beginning stages of a massive worldwide rush out of the U.S. dollar and into gold and silver. Words: 1021

Read More »News Flash! The Fed Has Declared That It MUST Create Inflation! Got Gold?

In... September's Federal Open Market Committee minutes, the Fed officially announced that ... "Unless ... underlying inflation moved back toward a level consistent with the Committee's mandate, they would consider it appropriate to take action soon" and take "... possible steps to affect inflation expectations." That's Fed-speak for a MANDATE TO CREATE INFLATION! Words: 694

Read More »Check Out These 5 Hard Asset Investment Alternatives to Gold

While the 2010 gold rush is making a lot of headlines, it’s important to not overlook other hard assets [such as silver, copper, platinum, palladium and rare earth metals] that are good investment alternatives to gold and have all rallied to fresh highs recently as well. While each of these offers its own strengths and weaknesses they are ways to diversify your holdings away from gold if you are worried about a crash. Words: 1561

Read More »These Long-Term Trends Are Destroying U.S. Economy – and America’s Way of Life! (+2K Views)

The U.S. economy is being slowly but surely destroyed and many Americans have no idea that it is happening. There are 11 long-term trends that reveal... that there are certain underlying foundational problems that are destroying the U.S. economy a little bit more every single day. They are undeniable and they are constantly getting worse. If they are not corrected (and there is no indication that they will be) they will destroy not only our economy but also our entire way of life! Words: 2520

Read More »The Long and Short of What’s Happening With Silver These Days

Something has drastically changed in the silver market. The banks that once controlled the price of silver are now closing positions at a loss. The commercial shorts have begun to bleed money – and when blood spills sharks will circle. Hedge funds and traders that never even thought of silver before will begin to squeeze the shorts. If the big banks don't quickly regain control of the silver market they may lose it forever. Words: 733

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money