Is going about owning “physical” cryptocurrencies a little too technical for you but you would still like to be involved in the marketplace? Well, here’s the answer: buy an ETF that consists of companies involved in the sector but without the associated risk of self-custody within a digital wallet.

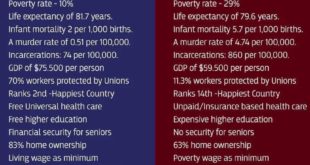

Read More »There Is NO Comparison Between Socialism & Capitalism (+8K Views)

Americans are ignorant about just what democratic socialism really is so here is a comparison of the economics of the avowed social democratic society of Norway and the unfettered capitalism of the U.S. Well, actually, there is NO comparison.

Read More »NEW Comparisons Of Gold, Silver, Platinum & Copper (+98K Views)

Here's an updated analysis of physical gold, silver, platinum and copper regarding their respective versatility of use, durability, fungibility, store of value, liquidity and aesthetics.

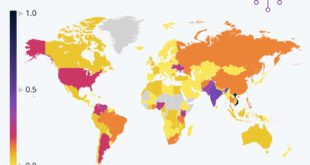

Read More »Dramatic Increase In Centi-millionaires Coming – Here’s Where (+27K Views)

This infographic looks at how many millionaires, centi-millionaires, and billionaires will be made in different regions of the world over the next decade. All of this is based on how many assets are accumulated by an individual. Take a look.

Read More »U.S. Health Care Most Expensive – Yet Worst – In World! Which is the Best? (+4K Views)

The cost of basic (and not so basic) health insurance in the U.S. is BY FAR the most expensive in the world, and certainly among its "wealthy-nation" peers, yet, while It would be logical to think that, as a result of this premium, the quality of the healthcare offered would be among the best, if not the best, in the world. Unfortunately, that would be wrong and, in fact, the reality is the complete opposite.

Read More »What Google Knows About You & Me – Yikes! (+2K Views)

Google tracks pretty much everything you do including where you've been, what you look like, your personal beliefs - and much, much more. Check out today`s infographic to see what Google knows about you.

Read More »BIG Differences In HUI, XAU, GDX & GDXJ Indices (+14K Views)

The number, market cap and currencies of the constituents of the HUI, XAU, GDX, XGD and CDNX indices differ considerably from each other and, as such, each index presents a different picture of what is really happening in the precious metals marketplace. This article analyzes the make-up of each index to reveal the biases of each to arrive at the answer to the question in the title. Words: 1026

Read More »Gold & Silver Junior Miners: Pile In Now For Future 10-Bagger Returns! (+4K Views)

If history repeats, so many will look back at this day and say, “Why, oh why, did I not listen to Goldrunner? Silver at $14.98 is about as good a time as it gets. IT’S LAST CALL AT THE BAR………..THE SILVER BAR.

Read More »New Research: A Diversified Portfolio Should Allocate 4-5% To Silver

A report by Oxford Economics has concluded that silver’s return characteristics are sufficiently different from gold to make it a valuable diversification tool that deserves its own portfolio commitment.

Read More »Prepare & Prosper – Gold Equities Could Experience +1000% Returns Once Again! (+4K Views)

We are in the eye of the storm and when the other side of the vortex engulfs us gold and silver will increase considerably, their associated stocks will go up substantially and their warrants, where available, will escalate dramatically. With what has happened in the world of late and what will be unfolding in the next 5 years or so those few investors who fully understand the impact the current economic situation is going to have on future inflation, the USD, interest rates, the stock market, physical gold and silver and gold and silver stocks and warrants in particular are going to be in the unique position of being the benefactors of currently unimaginable returns and wealth. All they need do, as I like to say, is “Just prepare and prosper!” Words: 918

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money