This article analyzes what the consequences would be for the global economy were the Federal Reserve to increase interest rates significantly.

global economy were the Federal Reserve to increase interest rates significantly.

By Katchum (Correlation Economics)

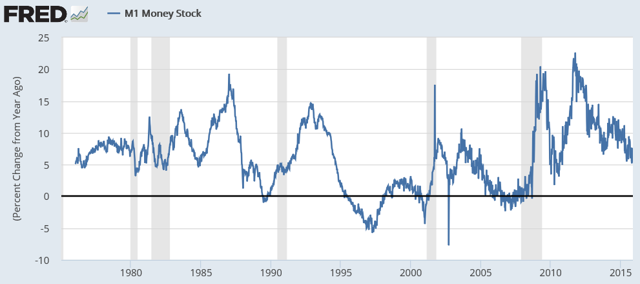

M1 Money Supply

A rate hike would cause the M1 money supply:

- to contract as lending would decrease (see chart below from FRED) and

- the value of the money multiplier would decrease, reducing GDP growth.

Please note that M1 is already declining year over year at this moment, so the Federal Reserve would be exacerbating the decline in M1 growth with any rate increase.

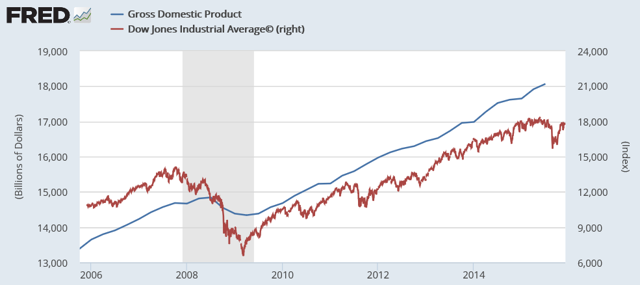

The Stock Market

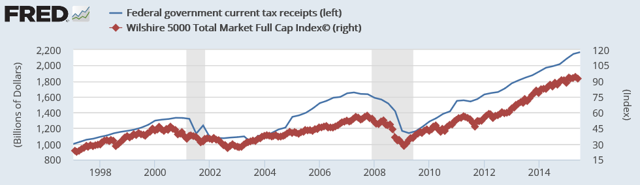

A reduction in GDP growth would take the stock market down with it. As you can see below, the stock market is correlated to GDP (see chart below from FRED).

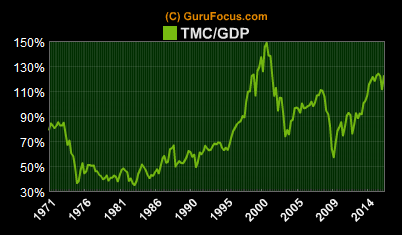

TMC to GDP Ratio

Here too, we need to bear in mind that the stock market capitalization is already in an overvalued state compared to GDP (see chart below from Gurufocus) so we would be further exacerbating the coming decline in stocks by raising rates.

U.S. Dollar Strength

A rate hike would strengthen the U.S. dollar against all other currencies (see chart below from Zerohedge) and this would have a negative effect on corporations that hold U.S. debt and have non-U.S. denominated earnings.

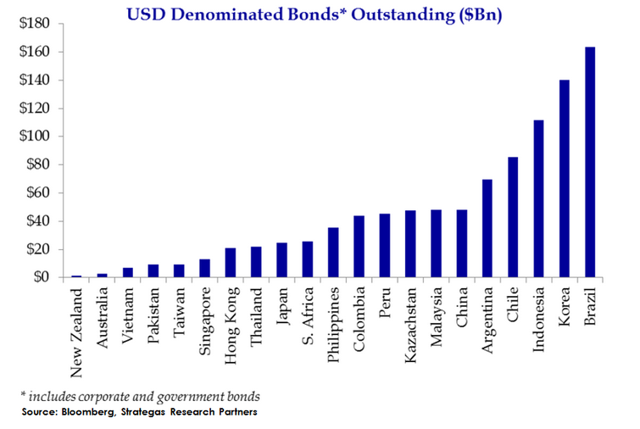

U.S. Dollar Denominated Debt

In addition, were the Federal Reserve to increase interest rates, U.S. dollar denominated debt would go up. Countries with a lot of U.S. denominated debt on their balance sheets would be adversely affected (see chart below from wolfstreet.com).

- Credit would deteriorate and

- defaults would start to emerge.

Most of this debt is located in Latin America, Korea, Indonesia and China. We do see emerging weakness in the stock markets of these countries.

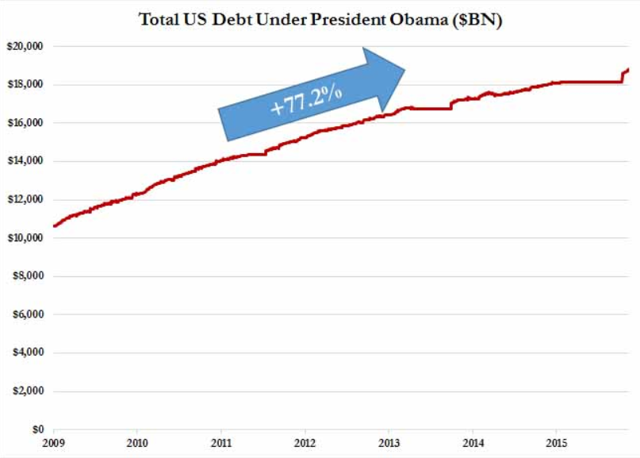

The affects of a rate hike…would also be felt in the U.S. itself. People forget that the U.S. is also a “corporation” and has $18.8 trillion in public debt that will also increase in value (private debt and unfunded liabilities not included) (see chart below from Zerohedge). Interest payments will go up due to the rate hike.

Revenue

On the revenue side, things will deteriorate. I need to remind you that U.S. government revenue is highly correlated to the U.S. stock market (see chart below from FRED). Were the Federal Reserve to increase interest rates, stocks would fall and government revenue would go down. The effect would be a rise in deficits and debt causing the country to, ultimately, fall into a death spiral which would, ultimately, result in a currency crisis.

Bond Market

…A change in short term rates does not guarantee the same change in the longer term rates of government bonds. Of course the Federal Reserve would hope that the longer term maturities increase in the same amount as the short term rate hike (pointing to growth in the economy), but a decrease in yields on the longer term maturities is equally probable. What the latter means is that the economy is in such big trouble that people are buying into safe haven assets like long term bonds. As the yield curve flattens again, a new recession is about to start.

On the corporate side of the bond market we would see losses as corporate bond yields go up together with the rise in the fed funds rate and, because the corporate bond market is huge in size, the losses here could be very high.

Conclusion

..A significant rate hike would…adversely affect the country’s GDP, stock markets, bonds, government revenue, U.S. denominated debt and the U.S. dollar itself. Because of that, I don’t think we will see a significant rate hike.

Want more such articles? Just “follow the munKNEE” on Twitter; visit our Facebook page and “like” an article; or subscribe to our free newsletter – see sample here.

[The original article* is by Katchum (katchum.blogspot.be) and is presented above by the editorial team of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here) in a slightly edited ([ ]) and abridged (…) format to provide a fast and easy read.]*http://katchum.blogspot.be/2015/12/the-consequences-of-fed-rate-hike.html

Related Articles from the munKNEE Vault:

Fed Unlikely To Raise Rates Anytime Soon – Here’s 5 Reasons Why

The US Federal Reserve has been increasingly hinting that it would raise its policy rate at its next meeting, scheduled for December 15th but their communications have been sloppy, erratic and contradictory. To get a sense of where the Fed might go a closer look at some of the key underlying economic forces, however, it is clear that there are 5 key reasons that the Fed is unlikely to raise rates anytime soon.

2. The Fed’s Next Move – More Easing Or A Rate Increase?

I see no way the Fed can raise interest rates this year, I think the earliest rate increase is probably the end of 2016. I expect the Fed’s next step will be easing, not tightening – which of course is very bullish for gold!

3. Inside Scoop: Fed Rate To Increase By Infinitesimal Amount In December

Believe it or not, what follows is supposedly the transcript of a recent speech by the outspoken Gustavo Laframboise-Pierre, Global Director of Statistical Creation at the European Central Bank, to the Federal Reserve Bank of Kansas City’s “Economic Symposium”. It provides considerable inside insight into what is going to unfold regarding interest rates.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money