Almost every financial crisis is presented in the mainstream media as one that “nobody saw coming” yet, as the 4 charts show below, the next one is foreseeable – “the writing is already on the wall”.

The original article by Charles Hugh Smith (oftwominds.com) is presented below by the editorial team of munKNEE.com (Your Key to Making Money!)

in a slightly edited ([ ]) and abridged (…) format for the sake of clarity and brevity to ensure a fast and easy read.

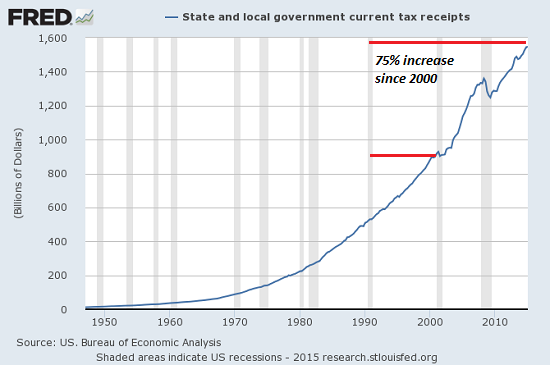

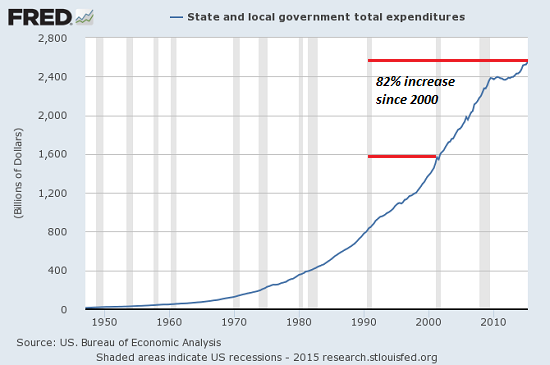

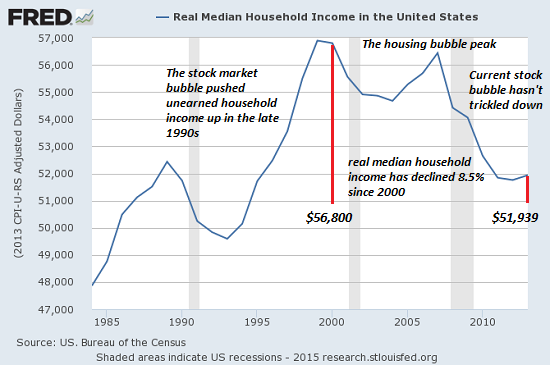

If state and local taxes keep soaring while wages stagnate and household income declines, households will have less cash to spend on consumption and declining consumer spending = recession.

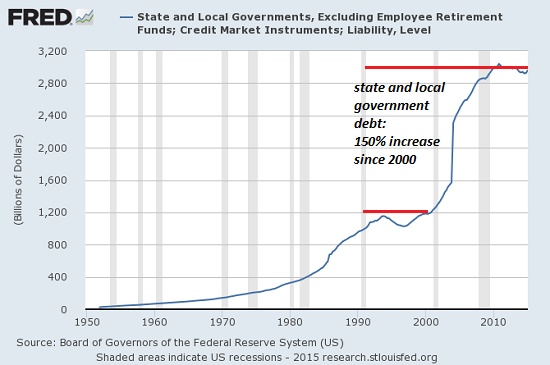

1. State and Local Government Tax Receipts, Expenditures & Debt

a) Tax Receipts

b) Expenditures

c) Debt

2. Stagnating Individual Wages = Declining Household Income

[To exacerbate the problem is the fact that] wages and salaries have barely kept pace with inflation (38% since 2000) so state and local taxes have risen at a rate twice that of wages/salaries.

We Are In An Unvirtuous (Vicious) Cycle

In recessions, sales and income taxes decline as households spending drops. This will crimp state and local tax revenues which sets up an unvirtuous cycle:

- State and local governments will have to raise taxes to maintain their trend of higher spending.

- Higher taxes reduce household spending,

- which reduces income and sales tax revenues.

- In response, state and local governments raise taxes again.

- This further suppresses disposable income and consumption…

At some point,

- local government revenues will decline despite tax increases, and

- the bond market will raise the premium on local government debt in response to the rising risks.

- When borrowing becomes prohibitive (or impossible) and raising taxes no longer generates more revenues, state and local governments will have to cut expenditures.

- Given their many contractual obligations, these cuts will slice very quickly into sinews and bone.

Conclusion

If this doesn’t strike you as a crisis in the making, please check back in a few years. Unfortunately, it will be a crisis that “nobody saw coming” in spite of the clear signs that it will soon be upon us.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Related Articles from the munKNEE Vault:

1. A Deflationary Financial Collapse Is Right Around the Corner – Here’s Why

4 patterns are developing that also happened just prior to the great financial crisis of 2008 and, as such, provide strong evidence that a deflationary financial collapse is right around the corner.

2. Deepest Downturn Since the Great Depression Is Coming

This isn’t the time to listen to those leading politicians, economists and pundits who say we’re not in a bubble and we’re finally seeing a sustainable recovery. We’re not. Central banks can’t keep this bubble going forever… [Instead,] you need to prepare for another across-the-board bubble burst and the deepest downturn since the Great Depression, with deflation, not inflation, and this time, in spite of what others such as Jeff Clark might tell you, Gold will not be your defense, it will be your downfall.

3. The Next Major U.S. Economic Downturn Is Dead Ahead – Here Are 16 Reasons Why

There are many out there (including myself) that believe that the next major economic downturn is dead ahead. As you will see in this article, a whole bunch of things are happening right now that we would expect to see if a recession was beginning.

4. Bursting of Bond Bubble Will Make 2008 Stock Market Crisis Look Like A Picnic!

Many investors think that we could never have a crash like the melt-down in 2008 but they are wrong. The 2008 Crisis was a stock and investment bank crisis – but it was not THE Crisis. That will happen when the biggest bubble in financial history – the epic Bond bubble – bursts. Let me explain.

5. The IMF & BIS Have Issued 16 Warnings Of An Impending Financial & Social Crash – Are you listening?

For several years, and in particular the last 12 months, the IMF (International Monetary Fund) and the BIS (Bank for International Settlements) have been issuing warning after warning – as outlined below – that the biggest financial and social crash in history is coming. Are you listening? The warnings are all well thought out with cogent logic and are not to be ignored!

6. Is An Economic Crash Coming Soon? These Analysts Think So – Here’s Why

Dozens of “analysts are convinced that the U.S. economy is going to hell in a hand basket – and soon. How sound are their analyses of the current economic situation? Will they be proven to be very insightful or nothing less than fear mongers looking for attention? Their views are all here. You be the judge.

Links to More Sites With Great Financial Commentary, Analyses & Entertainment:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

This Financial Crisis Looms is a good article and says exactly what I have been preaching for a long time.

While he didn’t say it directly, the single biggest problem for municipalities and states are the unfunded pension obligations and low rates of return on pension fund investments.

Unions, local politicians in the bag to their employee unions, and the senior bureaucrats who are also pending pension recipients, are also aligned with their unionized colleagues to sand bag court challenges.

Regardless, this is an immovable debt wall which can’t be avoided.

All hell will break loose at varying times and places depending on how bad the situation is. The worst will be First.