“Whether you are a businessman or an ordinary citizen concerned about what’s going on in the world, the yield curve is something you should care about…[as it] is probably the single best indicator of an upcoming recession and where the markets are headed.”

Prepared by Lorimer Wilson, editor of munKNEE.com – Your KEY To Making Money! [Editor’s Note: This version* of the original article by Les Nemethy has been edited ([ ]), restructured and abridged (…) by 43% for a FASTER – and easier – read.]

“(a) Background and the theory of yield curves

…The bond yield curve below is the typical shape. The longer the term of the bond, the higher the yield, because, under normal circumstances, money is worth more today than tomorrow, as bond holders will typically look for a premium to postpone their spending that dollar today.

When investors perceive that a recession is approaching, there is a flight to quality: they typically flock to Government bonds, particularly U.S. Government bonds (the reserve currency of the world monetary system). In such times, investors are concerned about preserving the value of their holdings in the medium to long-term. Hence there is a so-called “compression” of the yield curve: the premium of long-term yields or interest rates over short term interest rates diminishes (as will be illustrated and discussed in more detail in Figure 5 below.

In extreme cases, the yield curve may even become inverted (e.g. investors are prepared to accept a lower yield on long-term than on shorter-term bonds). In such a risk-averse environment, investors are prepared to accept a discount in order to preserve capital.

(b) How good a predictor of recession have yield curves been in the past?

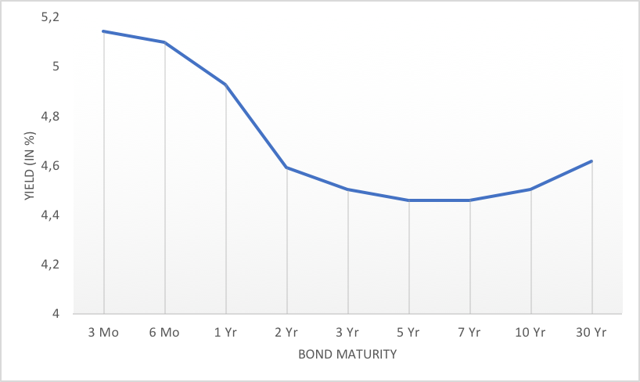

Historically, the inverted bond yield curve has been a signal of an impending recession as it has accurately predicted every recession since mid 1960s, with only one false positive, in 1966. The 2007 inversion (figure 2), followed by the 2008 crisis is a perfect example of the strength of the yield curve as a predictor.

Figure 2: U.S. bond yield curve on 27 February 2007

…The above yield curve was a harbinger of the 2008 crisis…

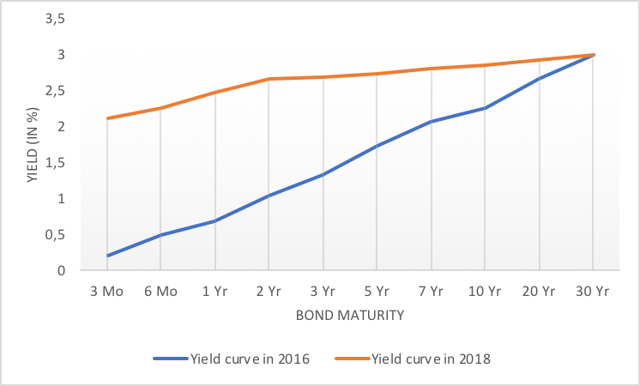

(c) What are yield curves saying today?

In a nutshell, over the past two years, there has been a so-called “flattening” of the yield curve. The chart below compares the yield curves as of January 1, 2016 to the curve as of August 27, 2018.

Figure 5: U.S. bond yield curves in 2016 and 2018

On December 7, 2018, the five year yield temporarily dipped below the three year yield. This created some market panic, with the DJIA tumbling 799 points that day. Some investors feared that this would also be a harbinger of a future recession. It should be noted that this was just a very brief inversion of the yield curve, over a very short period and that the curve has since normalized. Nevertheless, the flattening of the curve and this skittish inversion should warrant caution. The bull market will not last forever…

Conclusion

One can never know with certainty when the next recession will hit but the yield curve can provide some extremely valuable insights.”

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here).

Scroll to very bottom of page & add your comments on this article. We want to share what you have to say!

If you enjoyed reading the above article please hit the “Like” button, and if you’d like to be notified of future articles, hit that “Follow” link.

Want your very own financial site? munKNEE.com is being GIVEN away – Check it out!

A note from Lorimer Wilson, owner/editor of munKNEE.com – Your KEY to Making Money!:

“Illness necessitates that I spend less time on this unique & successful site so:

- if you’re interested in exploring the opportunity of taking the site to the next level as associate editor/webmaster

- and being rewarded with full ownership – at absolutely no cost to you – at the end of the second year of involvement

- please indicate your interest in the Comment section below

- and I will get in touch with you.”

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money