If the future is anything even remotely similar to the past 48 years of market data, then gold could rally by 24% (or more) over the next 2 years. It’s time to buy gold. Words: 640

data, then gold could rally by 24% (or more) over the next 2 years. It’s time to buy gold. Words: 640

An article by QuandaryFX which has been edited ([ ]) and abridged (…) by the editorial team at munKNEE.com – Your Key to Making Money! – to provide a fast and easy read.

In this article …I show a clear relationship between changes in inflation and the future price change of gold…

Inflation

When you engage any gold bug in a conversation as to where the price of gold is headed, you are bound to hear “inflation” and “to the moon” within a few minutes. The belief that inflation drives the price of gold is very pervasive and, to the honest, I didn’t belief in the relationship until I actually dug into the data for myself. You see, there actually is a fairly predictive relationship between past changes in inflation and the future change in the price of gold… but why should this be?

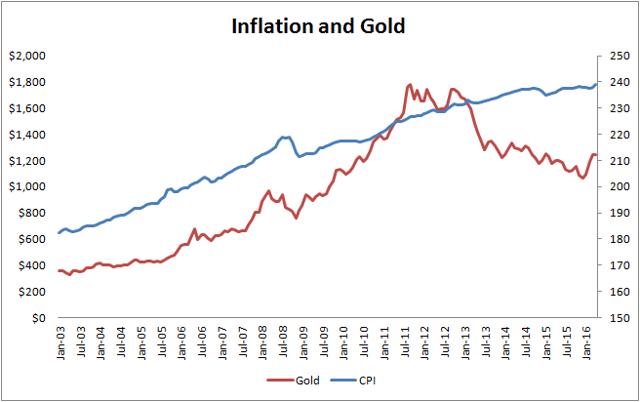

Inflation (as measured by the CPI), in and of itself, has absolutely nothing to do with gold as a commodity. The CPI measures the price changes experienced in a typical basket of goods which the average consumer purchases. The idea behind the CPI is to try to concisely summarize the effective inflation rate experienced by the average consumer. Gold, on the other hand, is a commodity with prices set by the confluence of supply and demand across a variety of exchanges. As you can see in the chart below, there is very little relationship between these two.

When you generate an investment thesis, you need to look beyond the numbers. It is not enough to say “x causes y” or “x and y are unrelated” – we need to test the data to see if there actually is an underlying, exploitable relationship.

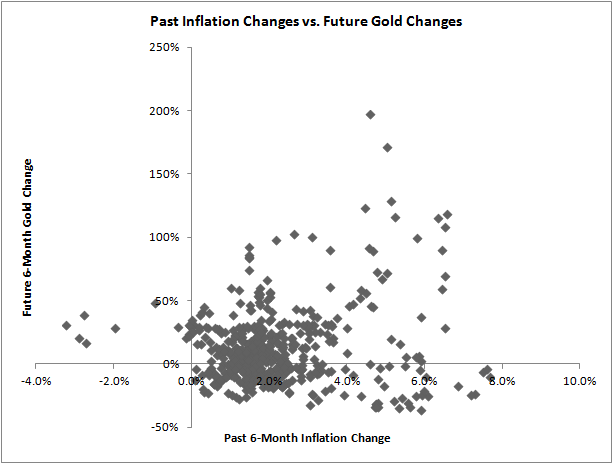

Even though there is no direct, fundamental relationship between inflation and the price of gold, billions of dollars transact on commodity exchanges based on readings and expectations of inflation. As investors expect inflation to rise, they tend to park capital into gold as a perceived “hedge” against inflation. Now here’s the interesting part. The very act of “hedgers” piling money into gold becomes a self-fulfilling prophecy, propelling gold prices higher as inflation increases. Don’t believe me? Here’s the data.

As you can see, there’s a moderately strong relationship between inflation and gold. When inflation rises in a given 6-month period, there’s a greater than…[50%] chance that gold will rally over the next 6 months. When inflation rose in a given 6-month period, gold averaged a 10% return over the next 6 months. If you were to lengthen your holding period, you would find that when inflation increases over [more than] a 6-month period, gold rallies by an average of 24% over the next year. This can be exploited for profit.

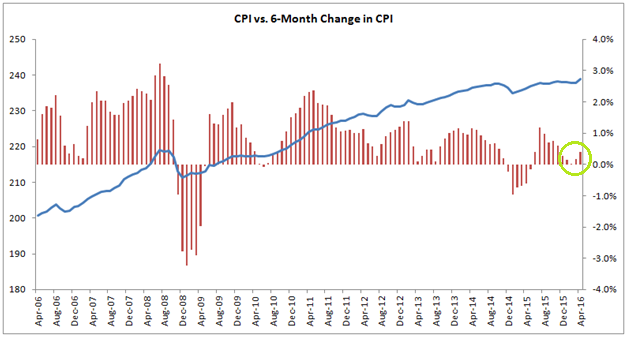

…[Below is] a chart of the current CPI and the 6-month change in CPI. This shows the inflation rate over the last 6 months. Do you see the significance of the chart above? I’ve circled it. This chart tells us something very impactful – it tells us inflation is on the rebound. Or in economic talk, this tangibly means that the economic recovery has now entered into another upwards swing and the demand for goods and services has risen such that the average price of goods is on the mend. This is good for the economy and good for gold.

Over the previous year, we have seen the rate of change in inflation flip negative for several months, culminating in the final sell-off of the collapse in gold. Right now, inflation is strengthening – this is very good news for gold.

Summary

As previously demonstrated – when inflation rises, gold rises in the future due to “hedgers” acting on the expectation. If the future is anything even remotely similar to the past 48 years of market data, then gold could rally by 24% (or more) over the next 2 years. It’s time to buy gold.

Disclosure: The above article was edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money