Where will the dollar go from here? My answer: Though currency market volatility is likely to continue, I still see a stronger dollar over the longer term. Here’s why:

The above comments, and those below, have been edited for the sake of clarity and brevity to provide a fast and easy read and have been excerpted from an article* by Russ Koesterich, CFA (blackrockblog.com) originally entitled Why the Dollar’s Strength Can Continue and which can be read in its unabridged form HERE.

1. Diverging central bank policies

The Fed will likely begin raising rates later this year, and possibly as early as September…[while] most other central banks will likely remain in easing mode.

2. The U.S. energy renaissance

…Over the last 10 years, the U.S. current account deficit has been cut roughly in half, and a large part of that improvement has been a function of surging U.S. domestic oil production. Looking forward, rising U.S. production should continue to support a strong dollar.

2. U.S. dollar rally may just be getting started

Since the 1970s when the Bretton Woods fixed-currency regime ended and currencies began floating, a typical dollar rally has lasted roughly six to seven years and the increase in the dollar we’ve seen so far this year is muted compared with the strong dollar episodes of the early 1980s and late 1990s.

In addition, according to the BlackRock Investment Institute, dollar rallies tend to be self-reinforcing – a stronger dollar begets greater inflows into U.S. assets in expectation of further dollar appreciation. For instance, U.S. companies start hedging overseas earnings, increasing demand for dollars.

3. Anticipated Fed rate hike

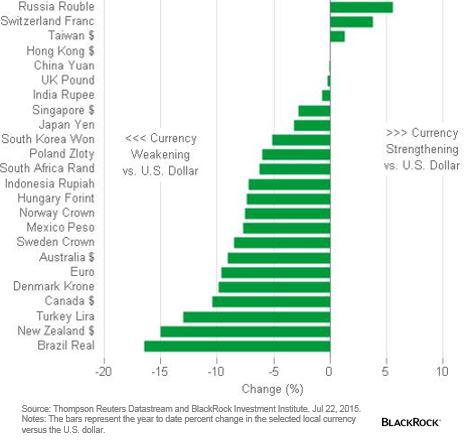

In past dollar rallies, the dollar’s rise is usually not uniform, with lots of dispersion across different currency pairs, and it’s characterized by sharp reversals.

According to BlackRock Investment Institute research, history suggests the dollar usually rises moderately before the first Fed rate hike, then stumbles for a year (as fixed income markets often take a hit), before resuming its rally. The same pattern could repeat itself this time around.

Implications of a stronger dollar for investors

Assuming the dollar continues to appreciate over the longer term, there are several implications for investors. A dollar that remains strong, albeit with some reversals, would:

- put downward pressure on inflation,

- put downward pressure on the earnings of U.S. exporters,

- cause commodities to struggle,

- be good for equity markets that traditionally outperform on their currency’s weakness, such as Japan and the eurozone, as a stronger dollar will make their exports more competitive and, finally, the long-term strength in the dollar would

- boost the case for considering strategies that can help insulate an international equity portfolio from the impact of weak foreign currencies, such as currency hedged exchanged traded funds (ETFs).

*http://www.blackrockblog.com/2015/07/31/dollars-strength-continue/

Related Articles from the munKNEE Vault:

1. Here’s Why the U.S. Dollar Is Going Through the Roof

When markets expect that U.S. interest rates will be hiked, it typically strengthens the dollar because people rush to change other currencies into dollars where they can make more money and this higher demand for the USD drives its value up.

2. Skyrocketing U.S. Dollar Is a VERY Bad Sign For Global Economy – Here’s Why

Yes, someday the U.S. dollar will essentially be toilet paper but that is not in our immediate future. What is in our immediate future is a “flight to safety” that will push the surging U.S. dollar even higher – and when the U.S. dollar soars the global economy tends to experience a contraction so the fact that the U.S. dollar has been skyrocketing lately is a very, very bad sign.

3. The U.S. Dollar Is Surging In Value – Why?

The U.S. dollar surged in value by 11% in 2014, appreciating against all main currencies in the world in 2014 including gold. The infographic below attempts to answer the obvious question, “What is behind this surge in value for the dollar?”

4. Why the USD Is So Strong & the Implications For the Economy & Stock Market

Given the recent upside breakout in the U.S. dollar I’ve been getting a lot of questions about the reasons behind the strength as well as implications for the stock market. Here are my views on the situation.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money