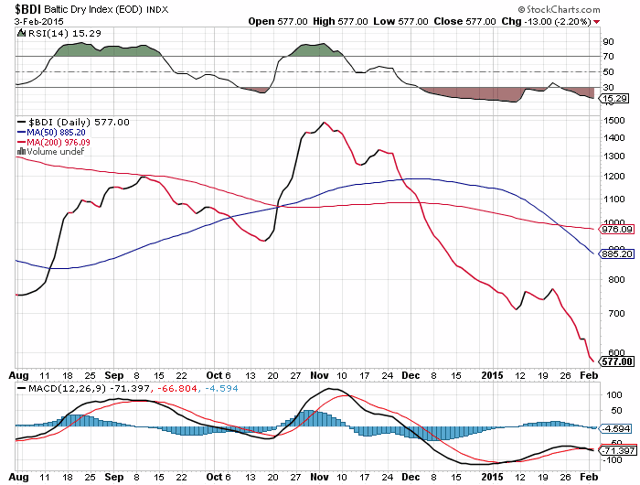

The current Baltic Dry Index (BDI) is warning that a global slowdown in importing/exporting is upon us that signals that the global economy could once again be slowing and that caution is warranted on U.S. equity markets. Let us explain.

us that signals that the global economy could once again be slowing and that caution is warranted on U.S. equity markets. Let us explain.

By Parke Shall of Orange Peel Investments as posted* on SeekingAlpha.com under the title Baltic Dry Index Crushed, Avoid Dry Shipping.

The BDI is one of the key indicators as to the world’s economic view on shipping via the oceans. Why? Because

- when there’s more demand for cross-ocean shipping of goods, rates go up. Therefore, when the price rises, productivity globally is thought to be increasing and,

- when rates drop, it usually signals too many carriers without enough goods to ship…[and, as such,] that the global economy could once again be slowing.

In the past, the Baltic Dry Index has been looked at because its relatively simple and tough to misconstrue. Supply comes down to:

- the supply of ships available for shipping and

- demand is commodity buyers who need finished goods and raw goods.

It’s a tough indicator to mess up, because it takes years for new ships to be built. Unless the demand is skewed, the BDI is pretty much clear as a bell.

It’s also been used to help predict global stock returns and macro-economic activity. It’s been featured in scholarly works** that…show the BDI has “predictive ability for a range of stock markets.” Why is this important, aside from obvious reasons? As the abstract to this paper points out:

- The documented stock return predictability is also of economic significance, as seen by examining the certainty equivalent returns and Sharpe ratios of portfolio strategies that exploit the BDI growth rate.

- In addition, the BDI growth rate predicts the returns of commodity indexes, and we find some evidence for joint predictability of stock and commodity returns in a system of predictive regressions.

- Finally, the BDI growth rate predicts the growth in global economic activity, establishing further BDI’s role in revealing a link between the real and financial sectors…

Conclusion

[As such,] we believe that the current BDI is a warning sign signaling a global slowdown in importing/exporting, which falls in line with our view that equities could be due for a rest this year…Our outlook on the sector is dim, and our caution on U.S. equity markets remains.

[The above article is presented by Lorimer Wilson, editor of www.munKNEE.com and www.FinancialArticleSummariesToday.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Sources: *http://seekingalpha.com/article/2886226-baltic-dry-index-crushed-avoid-dry-shipping?ifp=0 (© 2015 Seeking Alpha); **http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1747345

If you liked this article then “Follow the munKNEE” & get each new post via

Our Newsletter (sample here)

On Facebook

By Twitter (#munknee)

Related Articles:

1. The Baltic Dry Index: Why You Should Use It and How to Do So

The Baltic Dry Index is, in my opinion, the best leading economic indicator to follow when the media is telling us the economy is looking great one week and then predicting a double dip recession the next. Let me explain. Words: 933 Read More »

2. What Does the Baltic Dry Index Indicate For the Global Economy?

The Baltic Dry Index is often looked at as a leading indicator of the global economy as higher shipping rates indicate stronger demand for shipping and healthier global trade. Year to date, the index is up 234% and is now at its highest level in more than three years (November 2010). This would indicate that the global economy is picking up steam. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money