As the narrative goes, either we buy into the unlimited and more or less guaranteed creation of wealth for all who follow the agreed-upon wisdom, or we reject it, and prepare for the inevitable collapse of the financial system and the value of money. The problem, however, is that both the present and the recent past are completely different from either approach BUT there is a third potential future to consider which I believe to be the most compelling. [Let me explain.]

guaranteed creation of wealth for all who follow the agreed-upon wisdom, or we reject it, and prepare for the inevitable collapse of the financial system and the value of money. The problem, however, is that both the present and the recent past are completely different from either approach BUT there is a third potential future to consider which I believe to be the most compelling. [Let me explain.]

The comments above and below are excerpts from a lengthy article by Daniel Amerman (DanielAmerman.com) which has been edited ([ ]) and abridged (…) to provide a faster and easier read.

Most people in the investment community fall into one of two groups:…

- the comfortable Mainstream…[who] believe that…we can make informed choices today that will quite reliably build substantial wealth over the long-term future because we know what worked in the past – and the future will (implicitly) endlessly repeat the past…[and]

- the “Gloom & Doom” camp…[which] is typically presented as being comprised of marginalized, eternal pessimists who are always convinced an economic doomsday is nigh.

As the narrative goes, either we buy into the unlimited and more or less guaranteed creation of wealth for all who follow the agreed-upon wisdom, or we reject it, and prepare for the inevitable collapse of the financial system and the value of money.

The problem is that both the present and the recent past are completely different from either (1) or (2) above. Instead, since the crisis of 2008 investors have found themselves:

- in a world of very low interest rates and yields,

- investing in low and no growth economies in nations with aging populations, and

- with global markets that are dominated by the pervasive interventions of heavily indebted governments.

An environment of low yields and government-dominated markets is not [at] all how the textbooks say that markets and investments are supposed to work. It directly contradicts what we were told in the 1970s, 1980s and 1990s would be the future – a place where the effectively solved science of financial planning would reliably deliver the expected stock and bond returns for many millions of retirement investors. However, this is our collective reality. It is very different from our recent past.

Since the present – and the last seven years – are not consistent with either school of thought, then either approach requires dismissing our current reality as a temporary aberration, a passing phase before we return to either a world of reliable and substantial wealth creation – or we experience complete financial collapse…

An alternative is to accept reality as it is and, if we are to find meaningful and practical methods for dealing with these difficult challenges, our first step must be to reject the false dichotomy of “Mainstream” versus “Gloom & Doom” and instead examine the reality of what has surrounded us in recent years, and may continue to do so for many years to come…

The economy is assumed to prosper over time.

- Stocks may go up and down in the short term, but a diversified portfolio of stocks is assumed to reliably generate substantial wealth given sufficient time and patience.

- Bonds will yield less than stocks but are assumed to reliably produce a more stable cash flow that will be sufficient to comfortably support us in retirement.

Take the proceeding,

- mix well,

- invest every month in our retirement account,

- use low-cost index funds,

- change the ratio between stocks and bonds over time

and we are supposed to be able plan our financial future decades down the road, with quite a bit of confidence.

Beneath all the jargon and numbers, however, is an assumption that we know the future, at least within certain broad outlines and, if we don’t actually know that future, then all we have is pure guesswork and assumptions.

As a starting point if the economy isn’t prosperous – then we don’t know anything about future investment returns for stocks or bonds – and if there is no knowledge, there is no certainty. There is no certainty that following any particular formulas for investment choices now will guarantee any particular compounding of wealth in the future, or guarantee financial security in retirement.

The problem with the Mainstream approach is that it is a leap of faith about knowing the future, and there is neither backup nor security if the consensus is wrong (again) about the future. Yet, as one part of the false dichotomy, we are told that this is what smart people do, this is what educated people do, and there is effectively no alternative but to trust the experts and take our chances.

On the flip side, there are those in the Gloom & Doom camp who for a number of years now have been continuing to call for the inevitable collapse of the monetary system of the United States as well as much of the global financial system.

Month after month, year after year, the call is made that there is no direction but straight up for precious metals investments, with the profits resulting from the purportedly inevitable meltdown of the financial system. While it’s a call with some logic underlying it, as the danger of financial collapse at some future point is indeed a very real threat, it is nonetheless a call that so far has also turned out to be wrong, month after month, year after year.

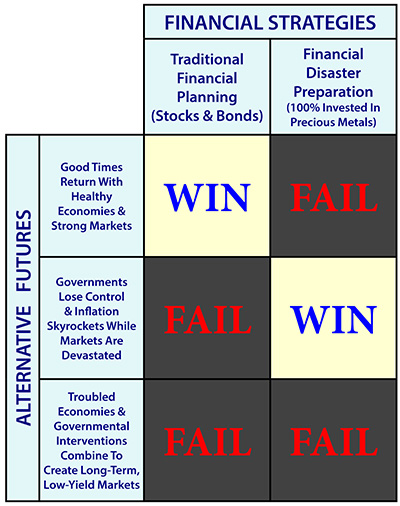

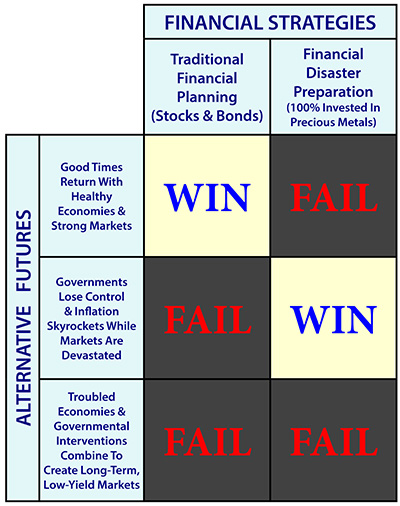

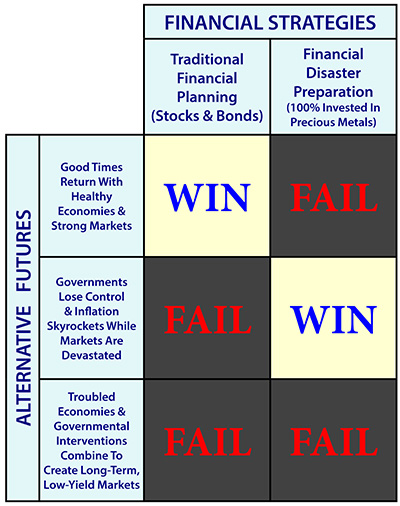

As illustrated in the chart below, when we put these starkly contrasting “certainty-based” strategies side by side, we see that both the Mainstream stock/bond strategies and the “Doom & Gloom” 100% precious metals strategies are effectively “Win-Lose” strategies.

- Mainstream stock/bond-based strategies Win if we experience (1) “normal” market conditions and economic growth over the coming decades…

- This is particularly the case because both stock and bond markets are at stratospheric levels by long-term historical standards, with extraordinary interventions by the Federal Reserve and other central banks having helped to create this situation.

The markets are effectively priced for perfection, which means we need a near certainty about perfection to justify the price levels yet, all it takes is a return to the normal business cycle (economic history indicates we are overdue for a recession), or a return to something even close to normal interest rates, and the situation is ripe for a sharp decline in stock and bond prices. What would be far more damaging would be if the future does bring another and possibly worse financial crisis. With either possibility meaning that we Lose in a potentially major way.

On the other side of the coin, a Gloom & Doom purely precious metals-based strategy can Win in a spectacular fashion (at least in pre-tax terms) if the future does work out to be severe financial crisis accompanied by a possible currency collapse yet a 100% precious metals weighting will likely Lose if the future instead works out to be a return to “normalcy”, keeping in mind that gold lost 80% of its purchasing power over a 20 year period when the dysfunctional stagflation of the 1970s was followed by the healthy economy and markets of most of the 1980s and 1990s. (Precious metals can be superb as one component of an overall strategy. It is when one believes they have certain knowledge of the future and put 100% of their investments into precious metals, where things can become problematic.)

So when it comes to the most common approaches to investing, we essentially pick our future and we take our chances. If we are right – then we Win, perhaps spectacularly. If we turn out to be wrong about the decades ahead, then we likely Lose, also perhaps spectacularly.

[The above being said,] there is a third potential future to consider which I believe to be the most compelling – even if it is generally not taken into consideration by either Mainstream or Gloom & Doom investment strategies…[It] is the continuation of the path we’ve been on these last seven years.

With the abovementioned future, the economy doesn’t collapse – but neither does it return to the healthy growth of past decades.

- the economy experiences low growth or no growth,

- the names and specifics may change, but massive periodic interventions in the markets occur as needed, with the Federal Reserve creating trillions of dollars out of the nothingness to keep interest rates forced down and asset values at least somewhat propped up,

- the laws continue to change as needed to force stability,

- tax rates continue to rise as needed to help pay for expensive government promises,

- bond yields never return to historical averages – because a government $19 trillion in debt can’t afford for that to happen,

- stock values don’t collapse, but neither do they deliver the compounded wealth that is built into traditional financial planning assumptions and,

- given that stock returns are ultimately dependent on the real economy over long periods of time, if sufficient real wealth is not being created by the economy, then the real wealth just isn’t there to deliver to tens of millions of retirees – whether they individually own their investments or are depending on pension fund investments.

When we consider the possibility of this third category of future, then both Mainstream stock & bond-based strategies – as well as Gloom & Doom purely precious metals-based strategies – become Lose-Lose-Win propositions.

Mainstream strategies likely steadily Lose over time if we see a continuation of low or no economic growth, high unemployment, steady but moderate monetary inflation covering over asset deflation, low interest rates, rising tax rates and confiscatory inflation taxes – all of which are being held together by governmental interventions which dominate the markets and economy.

Gloom & Doom purely precious metals-based strategies may also continue to incur steady ongoing losses in after-inflation and after-tax terms in the event of a continuation of the past few years, with many problems in the system, but without an actual collapse of some kind.

The belief, then, that the only two possible paths for the future are “Mainstream” or “Gloom and Doom“– that is, either a growing economy or outright collapse – is a false dichotomy – because what economic history shows us is something else altogether, which is that when it comes to governments in financial distress, they can avoid default and collapse by changing the rules to put the clamps down on markets and investors, enforcing an artificial stability that can last for decades.

The third path – and new status quo – is of a blended economy that shifts a little more each year from being dominated by the markets to being dominated by the governmental interventions, even while laws, regulations and tax shelters repeatedly change on a wholesale basis to allow the government to pay for the extraordinarily expensive promises that are used to win elections. This third path is not theoretical, but is all around us, and has been growing in strength ever since 2008.

For most investors, however, it can be very difficult to make the mental transition and break out of the false dichotomy. We’ve all been taught to invest for the most fundamental assumptions of all, which are those of a free market economy and a free market that determines investment prices. The free markets are what creates the wealth, and the market forces are what collapse irresponsible governments and their currencies, but in an economy that is increasingly dominated by public spending, and in which there is substantial likelihood that the rules will be repeatedly rewritten to increase the control over market forces in order to force stability – even as the rules are also rewritten to increase the take that is needed from the private sector to pay for the rapidly rising costs of the promises that have been made to the electorate – what can we do?

The Doomers are absolutely justified, in my opinion, in their concern about another round of financial crisis occurring, whether in the near term or further in the future. It is thus entirely prudent to be well prepared for this [but they]…fall into the false dichotomy trap if they invest on the assumption that some form of financial collapse is inevitable, because there is in fact nothing inevitable about it. After all, if it were inevitable – it would have already happened.

Let me suggest that [Doom & Gloom] collapse didn’t happen, even though the [Mainstream] old status quo stopped working long ago, because it has been the new status quo of a radically different monetary system and ever increasing government control of markets that has been with us the whole time since 2008.

Now, this new status quo doesn’t change any of the core realities – far from it.

- Government interventions can’t create real wealth, nor can printing dollars or manipulating statistics and markets. Real wealth isn’t the size of the government check or the nominal level of a stock market index, but rather it is the real goods and services of the economy that determine the standard of living for a nation.

- Given that a politically-controlled economy with suppressed markets and an ever growing public sector has a lower growth rate in the real wealth of real goods and services – if there is any growth at all – it is therefore a sick and dysfunctional economy when compared to a healthy free market economy in which decision makers have accurate information to work with.

- It also has the potential to become a quite stable dystopia, even in an environment where collapse might seem inevitable when viewed from the perspective of how the U.S. economy worked in the last century. That’s what governments tend to do when they accrue ever more power – they deploy that power first and foremost to make sure they continue to rule.

Before any problem can be solved, the necessary first step is to recognize the existence of the problem, which is, in this case, to recognize that our current status quo is quite different from the latter half of the 20th Century. That doesn’t mean the economy or markets must be like they used to be during those particular decades in a few Western societies – or else collapse is inevitable [as] there are myriad possible futures that don’t involve either a return to the economies and markets of the past nor a collapse of those markets. Recognizing that plain and simple truth is what is missing from far too much of the investment discussion and, unfortunately, missing that simple truth could be deadly dangerous for investors, because falling for the false dichotomy leaves them choosing between two unsatisfactory types of strategies, each of which leads to Lose-Lose-Win risk exposures in a potentially long-term, low-growth and low-yield future.

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money