There’s change afoot in the gold market…the spot price has rallied by over 15% since the year began… the first upswing in a very long time. It is my belief that we will see this upswing continue strongly over the next year. I do not base this belief on subjective analysis or any intangible intellect which only I possess, but rather on the cold, hard facts of numbers. To help you see things the way I see them, let’s begin our story by looking at…manufacturing.

over 15% since the year began… the first upswing in a very long time. It is my belief that we will see this upswing continue strongly over the next year. I do not base this belief on subjective analysis or any intangible intellect which only I possess, but rather on the cold, hard facts of numbers. To help you see things the way I see them, let’s begin our story by looking at…manufacturing.

By QuandaryFX (as edited ([ ]) and abridged (…) by the editorial team at munKNEE.com (Your Key to Making Money!)

to provide you with a fast & easy read.)

…Very few will make the connection between gold and manufacturing. In fact, it sounds absurd, doesn’t it? One of the largest commodity markets in the world being driven by the ebbs and flows in the United States’ business cycle as measured by the strength of producers. When you dig into the numbers, though, production is a very logical base of analysis for examining gold.

The price of gold is driven by a whole lot of things.

- There’s…demand from the jewelry markets [but,] even though this is the largest single source of demand, this only accounts for 50% of consumption of the material. This, in and of itself, makes gold a very unique commodity – the supply and demand balance is not driven purely by consumption.

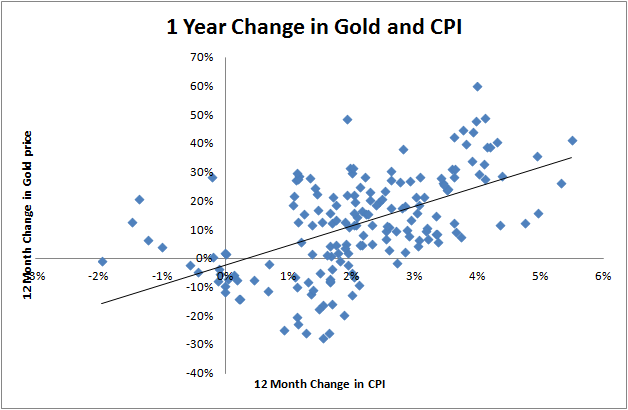

- In fact, gold is widely viewed as a “hedge” against inflation. Under this view, investors will purchase the commodity in the hopes that the price will rise as inflation erodes the purchasing power of a currency, requiring more currency to buy the same quantity of gold. For ardent supporters of this view, I have a nice message for you – you’re actually kind of right.

As you can see in the chart above, there is a direct correlation between changes in inflation as measured by the CPI and changes in gold. In other words, if there’s high inflation over a period of time, gold will more than likely increase over that same period of time. But what drives inflation? If we can predict changes in inflation, does this mean we can predict changes in gold? Yes.

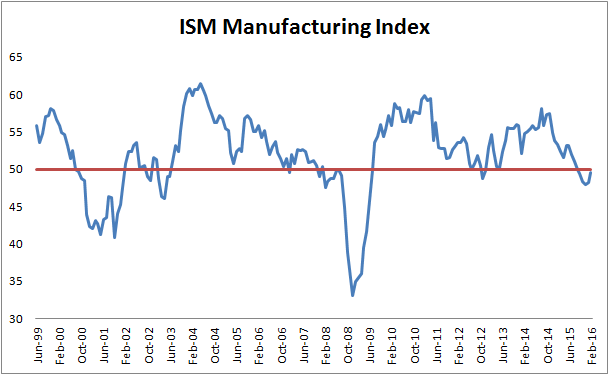

Here’s where manufacturing enters the picture. In case you’re just noticing, there’s been a bit of doom and gloom forecasted recently as we’ve seen the ISM Manufacturing Index dip below 50. Historically 50 has been viewed as a threshold beyond which recessions tend to occur.

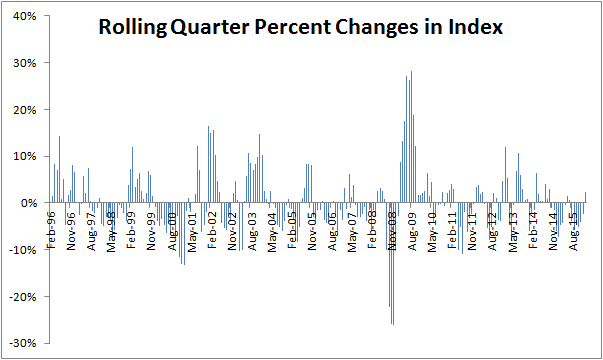

However, I’m the type who really likes to turn data on its head and see what the underlying relationship is. For example, instead of looking at the flat index, I prefer to look at a 3-month trailing percent change in the index. This allows me to normalize the data and get a consistent picture to see if production is weakening or strengthening.

If you’ve looked carefully at the chart above, you’ll notice something that just happened. We turned positive for the first time in several months. In fact, it’s only the third month in the last 2 years that we’ve had positive growth in manufacturing. It might be too early to officially call a “bottom” in manufacturing, but the data sure suggests that the production may start expanding in the very near future.

What’s this have to do with gold?

- Well, when production increases, the economy “speeds up”.

- Producers tend to only manufacture a product when there is actual demand for the finished good.

- Since production is increasing, this means that economic activity is strengthening.

- When economic activity increases, inflation rises as demand for goods and services outpaces supply, driving up the price of goods and – you guessed it

- when inflation rises, so does gold.

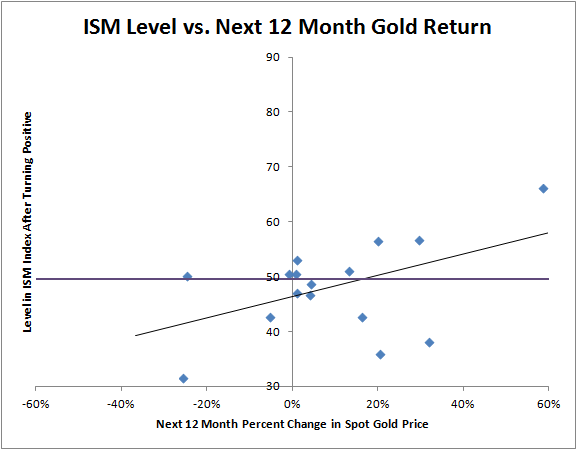

This theory is lovely, but does the data support it? Take a look at the following. Note the purple, horizontal line, showing where we are today.

There is a very strong relationship between changes in manufacturing and gold. In the chart above, I’ve pulled every other incident in which manufacturing turned positive after an equivalent or greater slump and graphed it against what happens to gold over the next year.

The evidence is pretty conclusive and strongly indicates that we are in for a price rally. In fact, since 1975, gold has increased in 75% of all years following resumption of economic activity. It really is time to buy gold.

Source of original version of article

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money