Edited by: munKNEE.com – Your Key to Making Money!

The price of silver has been corroding for much of the past year but a variety of signals in recent months suggest that it may not be long before silver begins to shine once again. [This article identifies 5 such signals and/or reasons why that may well be the case.] Words: 643; Charts: 2

signals in recent months suggest that it may not be long before silver begins to shine once again. [This article identifies 5 such signals and/or reasons why that may well be the case.] Words: 643; Charts: 2

So writes Eric Parnell (http://gerringwm.wordpress.com/) in edited excerpts from his original article* posted on Seeking Alpha entitled Silver: Polishing Off The Tarnish. (Original Post)

This article is presented compliments of www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Parnell goes on to say, in part:

Silver has been a most rewarding investment over the past decade with an annualized rate of return of roughly +17% over this time period. Not coincidentally, the bull market in silver began not long after U.S. fiscal and monetary policy makers shifted to a weak dollar policy in early 2002, and dramatically picked up steam once policy makers began flooding the financial system with liquidity following the outbreak of the financial crisis in 2008.

Looking forward, the fundamental case for owning silver is as strong as ever. Silver continues to serve as an alternative currency in that it provides a hard asset store of value for those investors seeking protection against the inflationary effects of currency debasement as well as the threat of crisis. [Also,] given the fact that the U.S. Federal Reserve stands ready to explode their balance sheet by more than $1 trillion in the coming year alone in an environment where the economic and geopolitical environment remains highly unstable, the appeal of owning silver should be as strong as ever.

[That being said, however,]…, silver’s performance since spring 2011 has been lackluster at best and disappointing at worst. Overall, silver has lost -34% of its value since peaking at the very end of April 2011. While this recent performance has been trying for those that remain positive on owning the white metal in the current environment, the good news is that this recent pullback represents a healthy consolidation in an ongoing uptrend.A variety of forces continue to build that should help propel the next move higher in silver, namely:

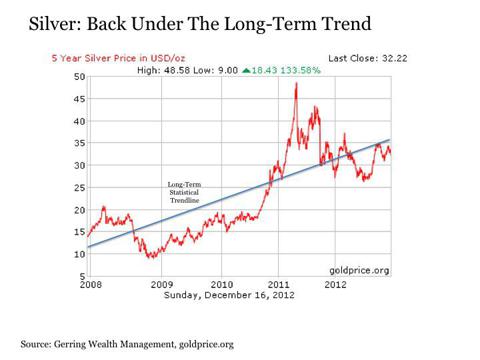

1. The silver price is now starting from a sounder base. When silver spiked toward $50 per ounce back in April 2011, it soared well beyond its long-term trendline dating back to the beginning of its current bull market. Following its recent price consolidation it is trading at levels that are now below this same trendline.

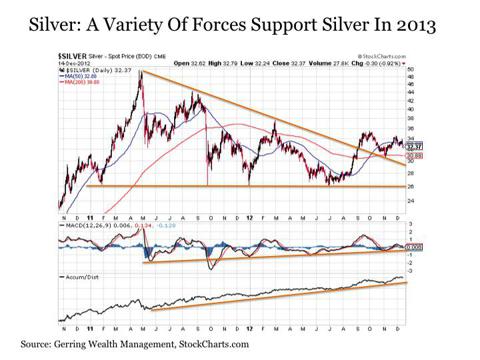

2. Silver is setting up increasingly well from a technical perspective as we enter the new year. Starting in early September 2012, not long after breaking out above its 200-day moving average and just ahead of the Fed’s launch of QE3, silver broke decisively above the downward sloping trendline that began at its peak in April 2011. Since that time, silver has successfully held support both at the same downward sloping trendline as well as the 200-day moving average.

3. The momentum behind the silver price has been gradually building, as we have seen higher lows in momentum readings since May 2011, with the sole exception being the sharp Operation Twist induced sell-off in September 2011.

4. The steady increase in the cumulative flow of money into silver over the past two years, suggesting that upward pressure on the silver price continues to build despite the recent consolidation phase.

[As a result of the above 4]…reasons, I am bullish on silver for the coming year [and reason #5 is that,]…with over $1 trillion set to come off of the Fed printing presses next year, silver has shown itself to be a favorite final destination for these liquidity flows and is set up well for it again in the future….

Sign up HERE to receive munKNEE.com’s unique newsletter, Your Daily Intelligence Report

- FREE

- The “best of the best” financial, economic and investment articles to be found on the internet

- An “edited excerpts” format to provide brevity & clarity to ensure a fast & easy read

- Don’t waste time searching for articles worth reading. We do it for you!

- Sign up HERE and begin receiving your newsletter starting tomorrow

- You can also “follow the munKNEE” on twitter & Facebook

*http://seekingalpha.com/article/1069651-silver-polishing-off-the-tarnish (This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.)

Related Articles:

1. David Morgan: Gold to Go Up 10-20% in 2013; Silver By a Good 30%

According to David Morgan 2013 will be a bullish year in which a new leg up will start with gold going up 10% to 20% and silver a good 30%. That leg up is starting right now, although we probably will not see a substantial acceleration in the leg up like we saw in the first part of 2011 but, obviously, as soon as $50 is crossed an acceleration can be expected. [Morgan explains his position in article excerpts below.] Words: 912

Savers will not stand idly by and watch their savings get wiped out by taxes and inflation….[which] is good news for investors who buy and hold commodity assets today – and it’s also a stark reminder to not be fooled by the short-term head fakes that might make it look like the commodity bull is over. Stay the course – the biggest profits are yet to come. [Here’s why.] Words: 405

4. Which Gold and Silver Assets (and How Much) Should You Own?

5. It is Imperative to Invest in Physical Gold and/or Silver NOW – Here’s Why

6. U.S. Dollar Index to Plunge; Gold & Silver to Soar! Here’s Why

7. Why You Should Now Invest in Silver vs. Gold

8. Gold:Silver Ratio Suggests MUCH Higher Price of Silver in Next Few Years

9. Goldrunner: Silver to Rocket to $60 – $68 and Then Much Higher

10. Alf Field Sees Silver Reaching $158.34 Based on His $4,500 Gold Projection!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

High Oh Silver, And Away…

– The Lone Ranger