BIG INFLATION is THE BIG MONEY trend today and smart investors will use it to generate literal fortunes – and if you’re not already taking steps to prepare for this, it’s time to get a move on.

The original article by Graham Summers is presented here by munKNEE.com – “ The internet’s most unique site for financial articles! (Here’s why)” – in an edited ([ ]) and revised (…) format to provide a fast & easy read. Visit our Facebook page for all the latest – and best – financial articles!

The original article by Graham Summers is presented here by munKNEE.com – “ The internet’s most unique site for financial articles! (Here’s why)” – in an edited ([ ]) and revised (…) format to provide a fast & easy read. Visit our Facebook page for all the latest – and best – financial articles!

2017 was the year that the financial system moved from fearing deflation to expecting inflation as you can see in the chart below. From 2013 until mid-2016, the financial system’s expectations of future inflation were in a downtrend but in mid-2016 this changed as expectations began to rise. The downtrend broke in early 2017 and since then has continued to rally bouncing off support along the way.

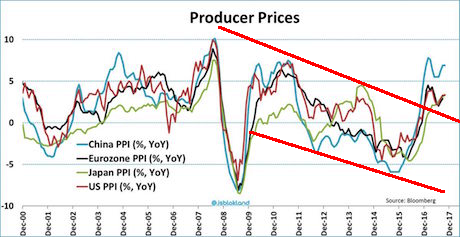

This trend has since strengthened with Producer Prices spiking in every major economy in the world.

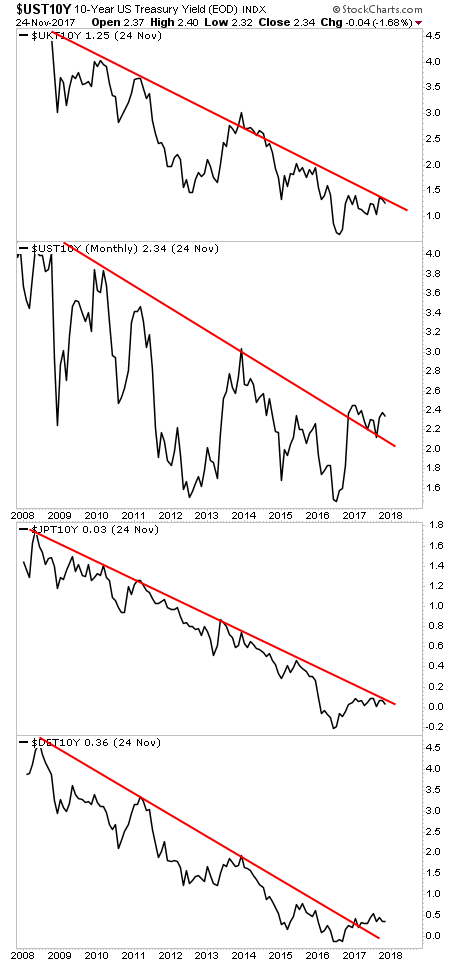

As you can see, Producer Prices are spiking in China, the EU, Japan and the U.S. – four countries accounting for over two thirds of global GDP – and the bond market has finally taken note, with bond yields rising above their downtrends in Japan, the U.K., the U.S. and Germany.

Put simply, BIG INFLATION is THE BIG MONEY trend today and smart investors will use it to generate literal fortunes.

Conclusion

Imagine if you’d prepared your portfolio for a collapse in Tech Stocks in 2000 or a collapse in banks in 2008? Imagine just how much money you could have made with the right investments. THAT is the kind of potential we have today and if you’re not already taking steps to prepare for this, it’s time to get a move on.

If you want more articles like the one above sign up in the top right hand corner of this page and receive our FREE bi-weekly newsletter (see sample here).

Related Articles from the munKNEE Vault:

1. Get Prepared: The World Is Careening Towards An Inflationary Shock

The world is careening towards an inflationary shock. As was the case with the beginning of the Housing Crash, few are noticing what’s happening and even fewer realize the true scale of what’s about to take place.

2. Prepare Your Portfolio From Coming Interest Rate Rises & Global Debt Bubble Collapse – Here’s How

Savers and investors alike need to begin to prepare their portfolios for interest rate rises against a backdrop of crisis-triggering debt levels and unproductive economies. Here’s how.

3. Inflation Shouldn’t Be Feared – Here’s Why

A growing chorus of forecasters see inflation pressures emerging. Even if that’s true, it should be welcomed – not feared. Here’s why.

4. Inflation: What Is It? What Isn’t? Who’s Responsible For It?

Inflation is the debasement of money by the government. PERIOD. It is NOT a general increase in the level of prices for goods and services. These statements are critical to an understanding and correct interpretation of events which are happening today – or expected to happen – that are casually attributable to inflation. Let’s go one step further as to what inflation is, what it isn’t and who’s responsible for it.

5. Inflation Coming Like An On-Rushing Train – Here’s What Investors Should Do Now

The green shoots of inflationary pressures are sprouting in our daily lives and, as such, NOW is the time investors should be actively seeking out sectors that can realize rising revenues and profits because of the wave of price increases in goods and services that will be passed on to businesses and consumers.

6. How to Protect Your Portfolio From Inflation

Inflation lurks in the shadows. It destroys value by gradually eroding real returns over time. It is financial death by a thousand cuts. Investors too often look at “the numbers” in their portfolio without asking what those numbers can actually buy over time. It’s a classic mistake that John Maynard Keynes termed “money illusion.”

7. Now is the Time to Prepare for Coming Inflation

Don’t be afraid of inflation. It is already here and there is nothing we can do about it. The effects will soon be obvious to all. Just make sure you are among those who are protected and prepared to profit.

8. Which Measure of Inflation Is Closest to the Truth?

There is a strong belief that independent measures of inflation are false and not trustworthy. I address this issue and show how the rate of inflation is measured today, the historical background of it, and compare different methods to find out which one is closer to the truth.

9. Inflation: What Exactly Is It? What Causes It? How is It Measured?

Exactly what is inflation, and how do we measure it? It is very important to investors, savers, and people in general, that we understand.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money