There is a strong probability that the correction in the price of gold [down to $1,523] has been completed. The up move just starting should be…the longest and strongest portion of the bull market…at least a 200% gain… [to] a price over $4,500. The largest corrections on the way to this target, of which there should be two, should be in the 12% to 14% range. [Let me explain how I came to the above conclusions.] Words: 760

$1,523] has been completed. The up move just starting should be…the longest and strongest portion of the bull market…at least a 200% gain… [to] a price over $4,500. The largest corrections on the way to this target, of which there should be two, should be in the 12% to 14% range. [Let me explain how I came to the above conclusions.] Words: 760

So says Alf Field in edited excerpts from his original article*.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) has edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) the article below for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Field goes on to say, in part:

There is a strong probability that the correction in the price of gold has been completed. In EW terms, [read Gold Bounce Confirms Bull Market Intact on Its Way to $3,000 – $10,000 for another analysis] the correction consists of three waves, an A wave down, a B wave rally and a final C wave decline. There is usually a relationship between the A and C waves. Often they are equal or have a Fibonacci connection. The chart below is of the gold price using PM fixings:

In this case, the A and C waves are equal in percentage terms at 14.5% and 14.7%. The overall decline from $1895 to $1531 is -$364 or -19.2%. In my speech to the Sydney Gold Symposium last November, [which was edited into 2 articles, namely: Alf Field: Gold Going to $4,500/ozt. in Next Wave Towards Parabolic Peak and Alf Field is Back! The “Moses” Generation and the Future of Gold] showed that the largest corrections in the previous Intermediate wave from $700 to $1895 were about 12% in PM fixings. The forecast was that the current correction from $1895 would be one degree of magnitude larger than 12%. A decline of 19.2% qualifies as one degree larger than 12%.

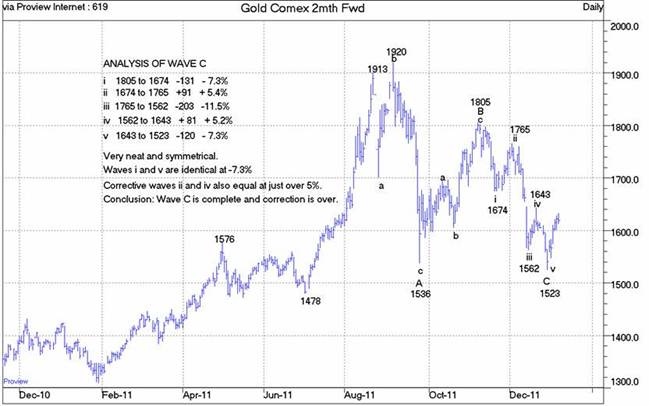

An interesting observation is that if 12% is multiplied by the Fibonacci relationship of 1.618, the result is 19.4%, very close to the actual 19.2% decline for the correction. [Read Contracting Fibonacci Spiral Puts Gold Near $4,000 by 2013 and $7-10,000 by 2020] The chart below is of the gold price in Comex 2mth forward prices:

The Alf Field: Gold Going to $4,500/ozt. in Next Wave Towards Parabolic Peak portion of the Gold Symposium speech suggested that the correction would be between 21% and 26% in spot gold prices. The actual decline was from $1920 to $1523, a loss of -$397, or -20.7%. This is just below the target range but qualifies as one degree larger than the 14% corrections in the previous up move from $680 to $1913 [per troy ounce. Read What Do Gold Measurements “Troy” Ounce and “Karat” Really Mean? for a full understanding of the difference between an ounce and a troy ounce.]

The C wave of the correction in the chart above reveals some symmetrical subdivisions which confirm that the C wave was completed at $1523 on 29 December 2012. With all the minor waves in place and with the correction being of the correct size, that should be the end of both the correction and Intermediate Wave II.

The probability of this analysis being correct is high, perhaps 75%. Smaller probabilities allow for: (i) this to be an A wave of a larger magnitude correction; (ii) the current correction becoming more complex, perhaps reaching the lower price targets (e.g. -26%); and (iii) the possibility of deflation, defaults and depression emerging, also testing lower price targets.

The up move just starting in gold should be Intermediate Wave III of Major Wave THREE, the longest and strongest portion of the bull market. The gain in Intermediate Wave I from $680 to $1913 was 181%. The gain in Intermediate Wave III should be larger, at least a 200% gain. A gain of this magnitude starting from $1523 targets a price over $4,500. The largest corrections on the way to this target, of which there should be two, should be in the 12% to 14% range.

To achieve the EW target of $4,500/ozt. on the next upward move [in gold] will require something to trigger substantial new buying of gold. What could that event be? By definition, it will be a surprise to all market participants, a “black swan” event. That doesn’t prevent us from making a guess [and] one likely area from which problems could emerge…[would be] derivatives. [I explain why that might well be the case in my article Alf Field: Will Derivative Losses Be Black Swan Event Propelling Gold to $4,500?.]

*http://www.24hgold.com/english/news-gold-silver-gold-correction-is-over.aspx?article=3766990104G10020&redirect=false&contributor=Alf+Field&mk=1

If you enjoyed reading the above article then:Sign-up for Automatic Receipt of Articles in your Inbox or via

FACEBOOK | and/or

TWITTER so as not to miss any of the best financial articles on the internet edited for clarity and brevity to ensure you a fast an easy read.

Related Articles:

1. Alf Field: Gold Going to $4,500/ozt. in Next Wave Towards Parabolic Peak

Once this present correction in gold has been completed it should [undergo] the largest and strongest wave in the entire gold bull market…to around $4,500 with only two 13% corrections along the way. [Let me explain how I came to that conclusion.] Words: 1900

2. Alf Field is Back! The “Moses” Generation and the Future of Gold

I have come out of retirement for this one off, once only, speech to warn that the good ship “Life As We Know It” is sinking. You have the choice of getting into a life boat now or going down with the ship. The life boats consist of precious metals and other assets that will survive the coming currency destruction. [Let me explain.] Words: 1400

3. Alf Field: Will Derivative Losses Be Black Swan Event Propelling Gold to $4,500?

To achieve the EW target of $4,500/ozt. on the next upward move [in gold that I laid out in my article Alf Field: Correction in Gold is OVER and on Way to $4,500+!] will require something to trigger substantial new buying of gold. What could that event be? By definition, it will be a surprise to all market participants, a “black swan” event. That doesn’t prevent us from making a guess [and] one likely area from which problems could emerge…[would be] derivatives. [Let me explain why that might well be the case.] Words: 591

4. Gold Bounce Confirms Bull Market Intact on Its Way to $3,000 – $10,000

With what is happening in the price of gold these past few weeks/months it is imperative to take a look at the big picture and in doing so it shows that we are still very much in a long-term bull market. Let’s take a look at some charts that clearly outline where we are currently and where we could well be going. Words: 925

5. New Analysis Suggests a Parabolic Rise in Price of Gold to $4,380/ozt.

According to my 2000 calculations, if interest rates and inflation stay constant over the next 2 years, we could expect to see (with 95.2% certainty) a parabolic peak price for gold of $4,380 per troy ounce by then! Let me explain what assumptions I made and the methods I undertook to arrive at that number and you can decide just how realistic it is. Words: 740

6. Deja Vu? Is Gold Just in a Correcting Phase on Its Way to Parabolic Peak of $4,294?

The current volatility in the precious metals market doesn’t necessarily indicate a change in secular direction. [In fact,] if today’s gold price was to rise by the same degree over the next 14 months [as it did from the beginning of 1979 into 1980, it would hit $4294/ozt. by Jan 2013! Let me explain.] Words: 420

7. Goldrunner Called $1,920 Gold High Exactly; Now Expects $3,000 – $3,500 by Mid-Year

Short-term volatile moves in Gold, as we have seen over the past few months, do not affect our projections for the future price of Gold based on our fractal (pattern) “model” off the late 70′s Gold Bull. Just as we correctly projected the $1,920 high in our April article entitled Goldrunner: Gold on track to Reach $1860 to $,920 by Mid-year (gold reached $1,917.20 in late August and $1,923.70 in early September, 2011), our current analysis indicates that Gold will enter a range between $3,000 and $3,500 by mid-year 2012. Words: 975

8. What Do Gold Measurements “Troy” Ounce and “Karat” Really Mean?

You have no doubt read countless articles on the price of gold costing x dollars per “troy ounce” or perhaps just x dollars per “ounce” but the difference between the two measurements is significant. For that matter, what’s the difference between a 24 karat gold ring and an 18 karat gold ring? Let me explain. Words: 863

9. Gold is NOT a Perfect Inflation Hedge! Here’s Why

Almost any traditional inflation hedge [such as gold, silver as well as real estate, stocks or whatever,] has difficulty in reaching the break-even point on an after-inflation and after-tax basis when we take into account the pervasive problem of hidden “inflation taxes”…If our future is one of high inflation, then whether and how you deal with inflation taxes may be one of the biggest determinants of your personal standard of living for decades to come… Why? Because government fiscal policy destroys the value of our dollars and government tax policy does not recognize what government fiscal policy does, and this blindness to inflation means that attempts to keep up with inflation generate very real and whopping tax payments, on what is from an economic perspective, imaginary income. [Let me illustrate that fact with three examples and suggest some remedial measures.] Words: 3085

10. Contracting Fibonacci Spiral Puts Gold Near $4,000 by 2013 and $7-10,000 by 2020

Gold is operating on a smaller Contracting Fibonacci Spiral Cycle that is in synch with the larger Contracting Fibonacci Spiral the markets are in. Adding together the sum of parts… the price of gold will move up in price in 2013, 2016, 2018, 2019 and 2020, with each subsequent leg moving less in percentage terms than the prior move. Gold advanced 4 foldish from 1999 until 2008 ($252/ounce to $1046/ounce) suggesting that gold should top out below $4000/troy ounce by the end of January, 2013…[on its way] to $7,000 and $10,000 per troy ounce by 2020. [Let me explain.] Words: 834

Other Articles by Alf Field:

1. Where Is This Unprecedented Global Financial Crisis Headed? A Retrospective from Alf Field

Everyone must be wondering where this “unprecedented global financial crisis”, (the World Bank’s words), is heading. What follows, for what they are worth, are my cogitations on this crisis. Words: 1641

2. Alf Field’s 7 “D’s” of the Developing Disaster Revisited

When the supply of something is increased sharply relative to demand, the value of that commodity will decline. If the supply continues to increase rapidly and indefinitely, then that item will become worth less and less, with the potential to finally become nearly worthless. This is the Developing Disaster facing the US Dollar and the world. This is the factor that could become the single most important criterion in investment allocation decisions and possibly even for individual financial survival…[Let me explain this further by reviewing the 7 major problems facing the U.S. (and thus the world) and how they all will lead to problem #7 – devolution.] Words: 1520

3. America’s Current Account Deficit Causing World’s Financial Crisis! Here’s Why

The onset of the world’s worst financial crisis in many decades is one of the most important factors (if not the most important factor) currently influencing investment decisions. The crisis has created chaos and confusion. Not many people understand how the world has arrived at this unfortunate situation. This report endeavours to identify the underlying causes of the crisis and explains why the USA current account deficit has been the main destabilising force in world finance. Words: 3806

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money