S&P 500 of 1,891 Coming in 2012?

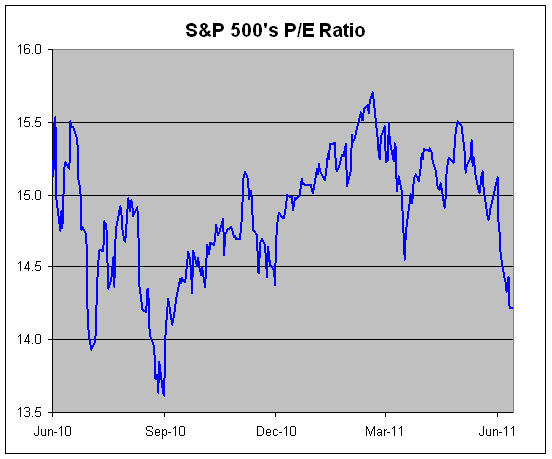

[One look at the P/E ratio of the S&P 500 these days clearly suggests that] the market is overly worried about the future. Put it this way: [were one to] apply the S&P 500 average earnings multiple of 16.94 from 2004 through 2007 to Wall Street’s earnings forecast for 2012 would give us an S&P 500 of 1,891! Words: 400

So says Eddy Elfenbein (www.crossingwallstreet.com/) in an excerpt from an article* which Lorimer Wilson, editor of www.munKNEE.com (It’s all about Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Elfenbein goes on to say:

Sign up for your FREE weekly “Top 100 Stock Index, Asset Ratio & Economic Indicators in Review” report

Who in the world is currently reading this article along with you? Click here to find out

Conclusion

The market’s rally hasn’t been due to higher multiples, but mostly by earnings. In fact, at 14.22 times earnings, the market’s earnings multiple is still fairly modest. Put it this way, the S&P 500 averaged an earnings multiple of 16.94 from 2004 through 2007. Applying that multiple to Wall Street’s earnings forecast for 2012, gives us an S&P 500 of 1,891. There’s a lot of ifs involved in reaching that number, but I wouldn’t say that they’re unreasonable.

The market continues to be overly worried about the future.

*http://www.crossingwallstreet.com/archives/2011/06/the-markets-pe-is-at-a-nine-month-low.html

Related Articles:

- Will the S&P 500 Rally of Fall Off a Cliff? https://munknee.com/2011/06/will-the-sp-500-rally-of-fall-off-a-cliff/

- Surprise! Limited Downside Risk Exists In S&P 500 https://munknee.com/2011/06/surprise-limited-downside-risk-exists-in-sp-500/

- A Violent Correction Is Coming For the S&P 500! Here’s Why https://munknee.com/2011/06/a-violent-correction-is-coming-for-the-sp-500-heres-why/

- Stock Market is Due for a 15-20% Correction – Here’s Why https://munknee.com/2011/06/stock-market-is-due-for-a-15-20-correction-heres-why/

- Today’s Market Breadth is Bad Breath for Tomorrow’s Market – Here’s Why https://munknee.com/2011/05/todays-market-breadth-is-bad-breath-for-tomorrows-market-heres-why/

- Why a Major Stock Market Correction is Imminent https://munknee.com/2011/05/why-and-how-best-to-play-a-major-stock-market-correction-is-imminent/

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above.

- Sign up to receive every article posted via Twitter, Facebook, RSS Feed or our FREE Weekly Newsletter.

Stock Market

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money