…Supporters [of helicopter money] argue that it is a necessary option to revive economic growth and generate inflation, while opponents consider it a fancy name for printing money and monetizing fiscal deficits. Who is right, and what does it imply for the gold market?

economic growth and generate inflation, while opponents consider it a fancy name for printing money and monetizing fiscal deficits. Who is right, and what does it imply for the gold market?

The comments above and below are excerpts from an article by Arkadiusz Sieroń (SunshineProfits.com)which may have been enhanced – edited ([ ]) and abridged (…) – by munKNEE.com (Your Key to Making Money!)

to provide you with a faster & easier read. Register to receive our bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner.)

…The term “helicopter money” goes back to Milton Friedman, who wrote in 1969: “Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community.” The idea, although in a different context, was revived in 2002 by Ben Bernanke.

What is important is that helicopter money may be understood two ways.

- Some people interpret the metaphor of helicopter drops quite literally as transferring money from the central bank directly to the citizens, bypassing the financial sector or government…

- This version…[should] generate the highest inflation rate…[but] the problem with the current monetary transmission mechanism is that, [while] the central bank affects the amount of banks’ reserves, it does not control directly credit expansion which depends on the banks’ willingness to lend and borrowers’ eagerness to borrow.

- This is why quantitative easing, contrary to many fears, did not lead to higher prices of consumer goods (although it supported asset prices), because the increase in commercial banks’ reserves did not quickly translate into a dynamic growth in lending addressed to the general public.

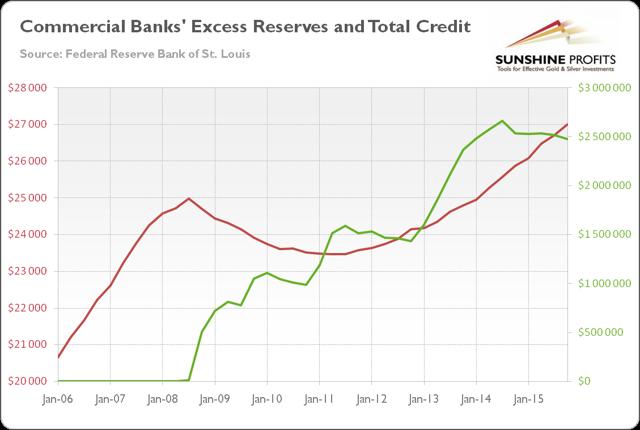

- Indeed, as one can see in the chart below, after the financial crisis burst forth, the total credit to the private non-financial sector started to rise no earlier than in 2011, despite the spike in banks’ reserves in 2008-2009.

Chart 1: Excess reserves of depositary institutions (green line, right axis, millions of $) and total credit to private non-financial sector (red line, left axis, billions of $) from 2006 and 2015.

Now, the idea of people’s helicopter money is to give money directly to consumers. Therefore, helicopter drops could lead to serious inflationary consequences, as newly created funds would end up in the households, which would probably spend them largely on consumer goods.

2. …Most economists, however, see helicopter money as financing the expansionary fiscal policy [because] the risk of inflation getting out of control and legal doubts as to whether the central banks are entitled to transferring money to citizens should be the responsibility of fiscal policy undertaken by the elected government.

- In this version, helicopter money would be an increase in public spending, or a tax cut financed by a permanent increase in the money supply.

- What, in practice, would such helicopter drops look like? Well,

- the central bank could directly credit the government current account or purchase non-interest bearing, non-redeemable government assets (like perpetual bonds, but at zero interest rates).

- Consequently, the budget deficit would be funded by the increase in the monetary base. Governments could then transfer the proceeds directly to citizens, finance tax cuts or increase its spending on goods or services, e.g., for infrastructure projects.

- …In a sense it would boil down to helicopter money for the people, but with the government as an intermediary. All in all, the household incomes would increase, leading to the rise in consumer prices (assuming that people would not save this money or repay their debts).

Would “Helicopter Money” Be Positive or Negative For the Gold Market?

- Although the yellow metal is not always a perfect inflation hedge, the introduction of helicopter drops should raise the fears of inflation overshooting and spur safe haven bids for gold, at least initially. We observed such a pattern both after the Fed’s adoption of quantitative easing and later, after the Bank of Japan’s introduction of the NIRP.

- It is clear as day that investors do not like new monetary tools they are not familiar with. Radical shifts in monetary policies diminish the faith that central banks have everything under control – if that were true, the changes would not be necessary.

Investors should remember, however, that a lot would depend on the details of helicopter drops, such as:

- the specific amount of transfer,

- the duration of the program,

- and the adopted constraints.

For example, if helicopter money somehow managed to revive economic growth without generating high inflation (perhaps due to a limited amount of monetary drops), however, the confidence in central banks would increase and the price of gold would go south.

- “Like” this article on Facebook

- Have your say on Twitter

- Register to receive our bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

- Share your thoughts with us in the comments section below. We’d like to hear from you!

Related Articles from the munKNEE.com Vault:

1. What Tools Does The Fed Have Left ? How Could They Affect The Price of Gold?

Some analysts argue that the Fed would be out of ammunition to deal with any future economic crisis but that is not the case. This article analyzes what monetary weapons the Fed could use and what each would mean for the price of gold as a result.

2. We Desperately Need Higher Inflation – Here’s Why and 3 Ways It Could Easily Be Accomplished

This article analyzes 3 new ways to get inflation on a national and global scale that have not been tried yet but you can see them coming a mile away if you understand elite jargon and the elite message system.

3. The Motives & Incentives Driving the Current Passion For Inflation

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money