…This article…compares the returns of gold stocks and gold bullion in bull markets…[and] explains how gold stocks outperform thanks to profit expansion, and shows why there might be more upside for gold miners to come.

While gold miners offer more potential upside, however, they also have higher volatility and greater downside during dips, making market timing and strong hands all the more important.

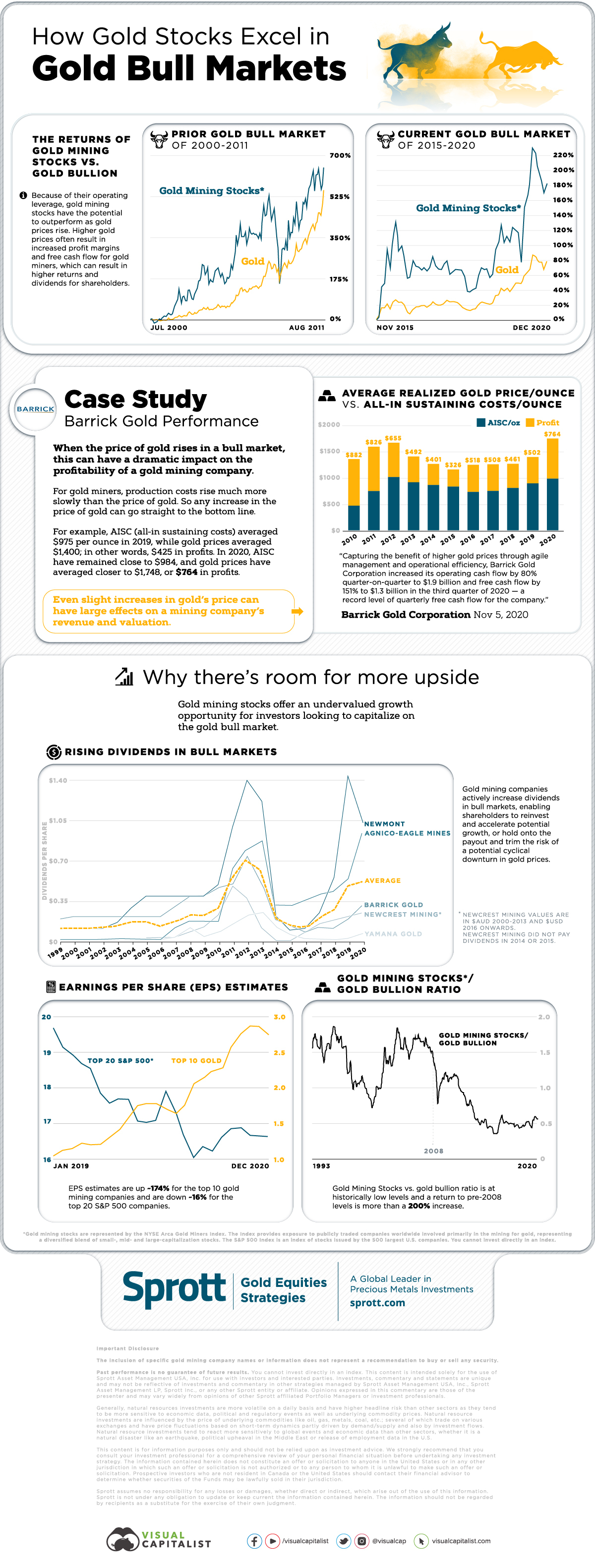

While gold miners offer more potential upside, however, they also have higher volatility and greater downside during dips, making market timing and strong hands all the more important.During the 2000-2011 gold bull market, the price of physical gold rose 550% [but], over the same period of time, gold mining equities (represented by the NYSE Arca Gold Miners Index) returned more than 690%. In the current gold bull market which started in 2015, gold mining stocks are up more than 182%, more than doubling gold bullion’s 78% returns. This outperformance in bull markets is largely due to how gold mining companies use their operating leverage to maximize profits, resulting in their share prices appreciating.

…While the costs to mine gold also rise in bull markets, they rise less and at a slower rate. The result of this is profit expansion: when operationally efficient gold mining companies are able to capture larger profits, resulting in increased operating and free cash flow.

During the current gold bull run which started in 2015, [for example,] Barrick Gold’s average realized price per troy ounce of gold increased by 50%, while their all-in sustaining costs per troy ounce only went up by 18%. This has resulted in the company increasing their profit per troy ounce of gold sold by a staggering 134% over the past six years…

The gold mining stocks-to-gold bullion ratio is at historically low levels after having dropped more than 60% following the 2008 financial crisis. While gold bullion is increasingly seen as a safe haven asset for investors, gold miners are still overlooked despite their strong technicals.

![]() Gold mining stocks are much more volatile compared to gold bullion, and have a variety of additional risks dependent on their company structure, jurisdiction of operations, and operational efficiency, but for investors who are looking for exceptional returns in gold bull markets, they can be an alluring option.

Gold mining stocks are much more volatile compared to gold bullion, and have a variety of additional risks dependent on their company structure, jurisdiction of operations, and operational efficiency, but for investors who are looking for exceptional returns in gold bull markets, they can be an alluring option.

Editor’s Note: The original article by has been edited ([ ]) and abridged (…) above for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

A Few Last Words:

- Click the “Like” button at the top of the page if you found this article a worthwhile read as this will help us build a bigger audience.

- Comment below if you want to share your opinion or perspective with other readers and possibly exchange views with them.

- Register to receive our free Market Intelligence Report newsletter (sample here) in the top right hand corner of this page.

- Join us on Facebook to be automatically advised of the latest articles posted and to comment on any of them.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money