“…Understanding not only the difference between a “bull” and “bear” market, but when a change is occurring, is critical to capital preservation and appreciation so, what really defines a “bull” versus a “bear” market?”

By Lorimer Wilson, editor of munKNEE.com – Your KEY To Making Money!

[This article of edited excerpts* (859 words) from the original article (1603 words) by Lance Roberts provides you with a 46% FASTER – and EASIER – read. Please note: This complete paragraph, and a link back to the original article, must be included in any article re-posting to avoid copyright infringement.]

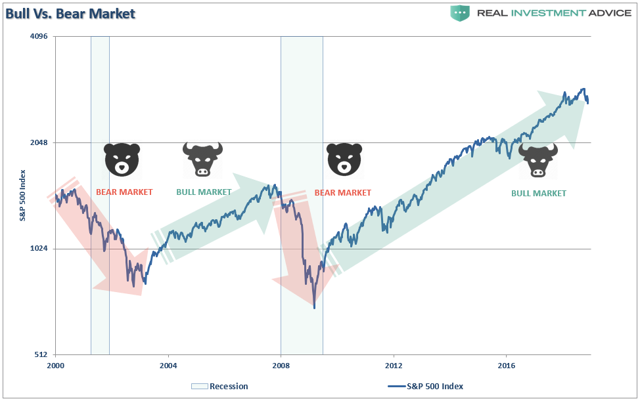

“Let’s start by looking at the S&P 500.

Bull and bear markets are obvious with the benefit of hindsight…[but,] while it is obvious that missing a bear market is incredibly important to long-term investing success, it is impossible to know when the markets have changed – or is it?The next couple of charts will simply build off of the weekly chart above.

Identifying The Trend

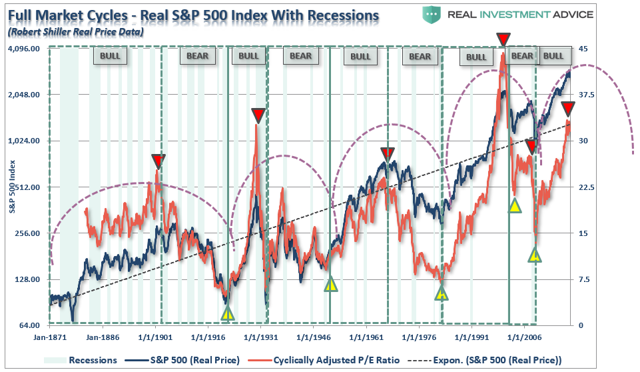

…In the short term, which is from a few weeks to a couple of years, the market is simply a “voting machine” as investors scramble to chase what is “popular” as prices rise; or “panic sell” everything when prices fall. But these are just the wiggles along the longer-term path.

In the long term, the markets “weigh” the substance of the underlying cash flows and value. During bull market trends, investors become overly optimistic about the future bid up prices beyond the reasonable aspects of the underlying value. The opposite is also true, as “nothing has value” during bear markets. This is why markets “trend” over time as excesses in valuations, in both directions, are reverted to, and beyond, the long-term means.

While the long-term picture is quite clear, valuations still don’t do much in terms of telling us “when” the change is occurring.

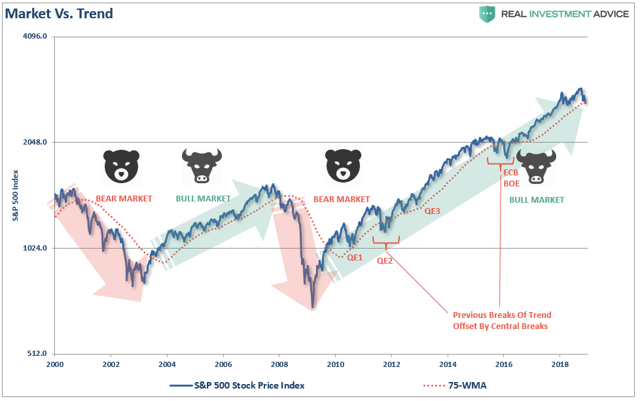

During a bull market, prices trade above the long-term moving average. However, when the trend changes to a bear market prices trade below that moving average. This is shown in the chart below which compares the market to the 75-week moving average. During “bullish trends”, the market tends to trade above the long-term moving average and below it during “bearish trends.”

In the last decade, there have been two occasions where the long-term moving average was violated but did not lead to a longer-term change in the trend.

- The first was in 2011, as the U.S. was dealing with a potential debt-ceiling and threat of a downgrade of the U.S. debt rating. Then Fed Chairman Ben Bernanke came to the rescue with the second round of quantitative easing (QE) which flooded the financial markets with liquidity.

- The second came in late-2015 and early-2016 as the market dealt with a Federal Reserve which had started lifting interest rates combined with the threat of the economic fallout from Britain leaving the European Union (Brexit). Given the U.S. Federal Reserve had already committed to hiking interest rates, and a process to begin unwinding their $4-Trillion balance sheet, the ECB stepped in with their own version of QE to pick up the slack.

Had it not been for these artificial influences, it is highly likely the markets would have experienced deeper corrections than what occurred.

Today, Central Banks globally are ending their monetary injection programs, rates are rising, and the surge in global economic growth is fading. With stock valuations at historically extreme levels, the value being ascribed to future earnings growth is being revised lower as interest rates rise.

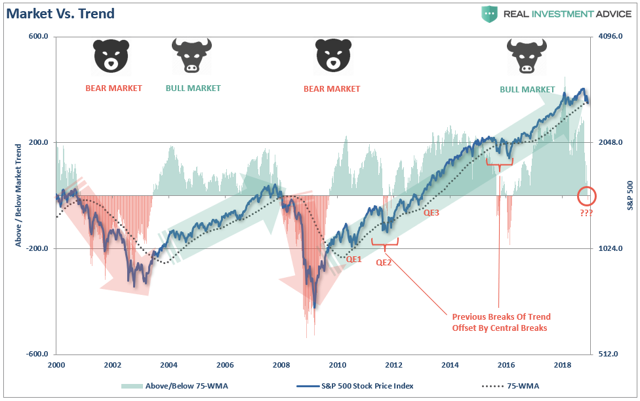

The chart below shows the deviation in the price of the market above and below the 75-week moving average. Note that whenever prices begin to approach 200-points above the long-term moving average, there have been corrections. The difference between a “bull market” and a “bear market” is when the deviations begin to occur BELOW the long-term moving average on a consistent basis. For only the third time in the last decade, the market has now slipped below that longer-term trend. The difference this time, however, is [that] there are no Central Banks talking about coming to the markets rescue – at least not yet.

Understanding that a change is occurring, and reacting to it, is what is important. The reason so many investors “get trapped” in bear markets is that by the time they realize what is happening, it has been far too late to do anything about it. Sure, this time could be different. However, as Ben Graham stated back in 1959:

- “The more it changes, the more it’s the same thing.’ I have always thought this motto applied to the stock market better than anywhere else. Now the really important part of the proverb is the phrase, ‘the more it changes.’

- The economic world has changed radically and will change even more. Most people think now that the essential nature of the stock market has been undergoing a corresponding change, but if my cliché is sound, then the stock market will continue to be essentially what it always was in the past, a place where a big bull market is inevitably followed by a big bear market.

- In other words, a place where today’s free lunches are paid for doubly tomorrow. In the light of recent experience, I think the present level of the stock market is an extremely dangerous one.”

…Conclusion

…It is still too early to know for sure whether this is just a “correction” or a “change in the trend” of the market…[so] pay attention to the market…[as its] action this year is very reminiscent of previous market topping processes.”

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here).

Scroll to very bottom of page & add your comments on this article. We want to share what you have to say!

If you enjoyed reading the above article please hit the “Like” button, and if you’d like to be notified of future articles, hit that “Follow” link.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money