…Precious metals are looking like a great alternative…[these days given all the] uncertainty – trade war, high corporate debt, high federal debt, possible negative interest rates, etc. – [that exist in the economic environment out there]…This article analyzes…which metals to choose. The typical choices are gold, silver, and platinum…

This post is taken from the original article by Kiefer Tuck and has been edited ([ ]) and abridged (…) for the sake of clarity and brevity.

Correlation Coefficients for Gold, Silver & Platinum

[As can be seen from the correlation coefficients below for] gold, silver, and platinum are all very similar investments:

- Gold to Silver (1961-2019) – 0.92

- Gold to Platinum (1986-2019) – 0.83

- Silver to Platinum (1986-2019) – 0.89

(If you aren’t familiar with correlation coefficients, 1 is the highest it can go. If the correlation coefficient is 1, it means that each metal perfectly matches relative price movements.)…

PM Ratios to Each Other

The most common ratio is gold to silver. It shows how much silver it would take to buy gold:

- if the ratio is higher than the average, it may mean silver is undervalued;

- if it’s low, it may mean gold is undervalued.

…These ratios aren’t exact evidence [because] it could mean that one metal could out-price another in the long term…Let’s examine them several different ways:

| All Year Average | 2010-2019 Average | Present Ratio (8/28/2019) | |

| Gold to Platinum | 0.85099795 | 1.13468611 | 1.59610984 |

| Platinum to Silver | 84.9634326 | 60.422009 | 47.3941368 |

| Gold to Silver | 56.4015013 | 67.2797875 | 75.732899 |

Gold is currently (and historically) overvalued compared to both platinum and silver according to the price ratios…Another insight is that the gold to platinum ratio is…[almost] double the average.

Demand For These 3 Metals

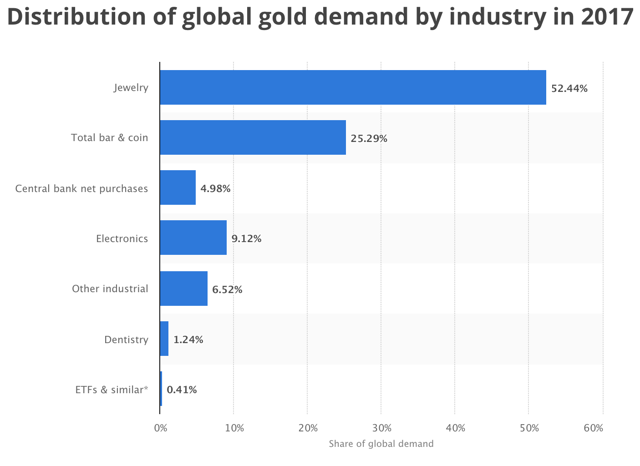

Gold is mainly used for investing, currency, and jewelry.

Source: Statista M. Garside

Source: Statista M. Garside

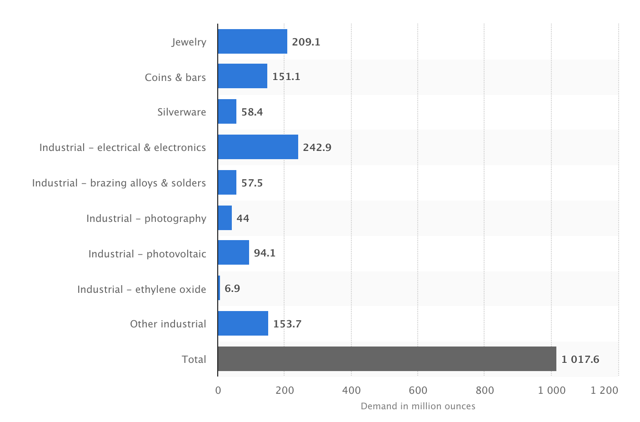

Silver is similar to gold, but with more uses in technology. The following graph is for 2017. Source: Statista M. Garside

Source: Statista M. Garside

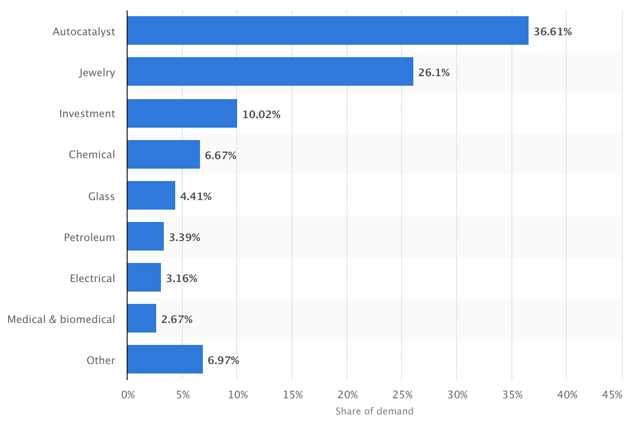

Platinum is different. It has an extremely high melting point, is highly resistant to corrosion, and is highly conductive…[and, as such,] has a variety of different uses. The following graph is for 2019.

Source: Statista M. Garside

Source: Statista M. Garside

Platinum is more susceptible to industry changes,[ however, and, given the fact that] platinum is used heavily in the auto industry but electric cars don’t require platinum…[this could become an headwind in the years to come]. [In addition,] platinum is…rarer than gold producing only about 10% of the annual production of gold…

Portfolio Allocation

[In light of the above]…I have the following allocation in the precious metals section of my portfolio:

- gold – 50%

- silver – 40%

- platinum – 10%

These are all long-term investments and I feel they will be a good balance in my portfolio in the new era of near 0% interest rates.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money