We are now on the eve of an economic crisis of unfathomable proportions due to an insoluble debt problem. Holding precious metals will be invaluable insurance to survive this crisis financially.

insoluble debt problem. Holding precious metals will be invaluable insurance to survive this crisis financially.

The original article has been edited here for length (…) and clarity ([ ]). For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE tri-weekly Market Intelligence Report newsletter (see sample here)

The U.S. and global economies are soon going to be crushed by the massive global debt situation…Since 1/3 of Americans have less than $5,000 in savings, they have nothing to fall back on when they lose their jobs and hit hard times. At that point, the government will default and there will be no social security net. They will of course print unlimited amounts of money, which will be totally worthless and thus have no effect except for causing hyperinflation.

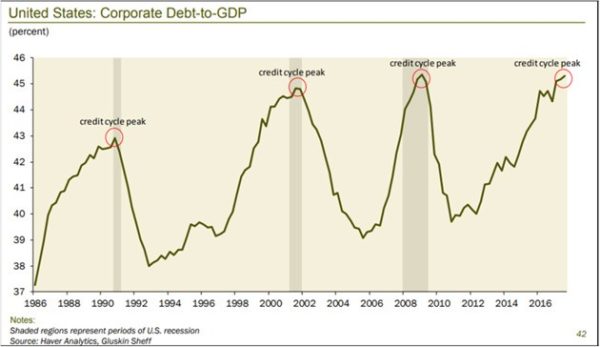

…Corporate debt is now [also] at an extreme and in a similar position as before the 1990, 2000, 2008 economic crises and stock market collapses. As the graph below shows, corporate debt to GDP is currently giving a warning that the next economic and market decline is imminent. The fact that US national debt has doubled since 2009 is certainly not going to make the situation easier.

…In spite of a century with remarkable growth, credit expansion and money printing, the world has a major economic and poverty problem. This will sadly not end well when the current global debt and asset bubbles burst. We will see a global contagion of defaults and economic misery. Central banks will embark on unlimited money printing in a futile attempt to save the world but this time it will fail. Printed money has zero value and will therefore have no effect. You cannot solve a debt problem by issuing more debt.

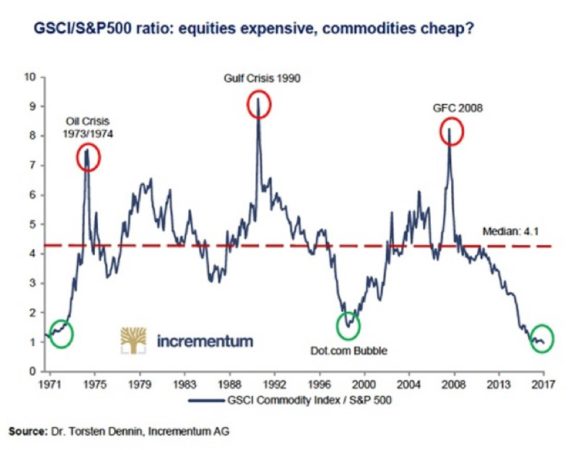

…Let us look at a chart that predicts the future very clearly. Commodities are at a 60 year low relative to equities. This doesn’t just mean that stocks will collapse. More importantly many commodities will surge from here. Part of the reason for this is the coming inflation, leading to hyperinflation and a weak dollar. Commodities will be a major beneficiary of the coming repricing of assets. As bubble assets like stocks, bonds and property collapse, commodities will surge. This will lead to the biggest wealth transfer in history.

Many commodities will make new highs with oil for example very likely to go above $150 per barrel but the main beneficiaries of the coming commodity boom will be the precious metals. Although I wouldn’t call gold and silver commodities, they are classified as such.

Precious metal investors have had to be patient for quite a few years since the 2011 top. For the people who hold physical gold and silver for wealth preservation purposes, the price is less relevant but, as the commodity chart above warns us, the metals are now on the verge of a major breakout that will not only take gold above the $1,920 high and silver above $50 but to levels that will reflect the real inflation adjusted values of the metals which is certainly at least $10,000 for gold and $650 for silver.

With real hyperinflation we will have to add a few zeroes but we must remember that physical gold and silver are not held as investments but as the only money which has survived in history.

We are now on the eve of an economic crisis of unfathomable proportions due to an insoluble debt problem. Holding precious metals will be invaluable insurance to survive this crisis financially.

Related Article From the munKNEE Vault:

1. Debasement of Western Currencies Leading to Hyperinflation – Got Gold?

It is critical to heed the strong warning signs of deep trouble coming in Europe, Japan and the USA. A 75-79% fall in the currencies of these countries is telling us that they will all go to their intrinsic value of ZERO in the next few years. This will lead eventually to the same hyperinflation as in Argentina and Venezuela…

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money