Gold ETFs are a bit more complicated than you might think at first glance but, hopefully, [the]… key facts [in this article will] allow you to get a better handle on the market, and find more information on the best gold ETF option for your needs in today’s investing world.

hopefully, [the]… key facts [in this article will] allow you to get a better handle on the market, and find more information on the best gold ETF option for your needs in today’s investing world.

An article written by Eric Dutram (Zacks.com) which has been slightly edited ([ ]) and abridged (…) to provide a faster and easier read.

Most investors who think of gold ETFs go right to the big dog in the space, the SPDR Gold Trust ETF (NYSEARCA:GLD). This ETF has over $35 billion in assets and a great daily trading volume, making it an easy pick for most. However, there is another great option for investors out there that can get the job done, the iShares Gold Trust ETF (NYSEARCA:IAU). This product still has a robust volume and an impressive $8 billion in assets, but it is often overlooked despite its cheaper expense ratio, coming in at 25 basis points compared to GLD’s 40bps fee.

…In addition to the expense differential, there is another key factor to note. GLD trades as 1/10 of an ounce of gold while IAU uses a 1/100 scheme. This may not sound like a big deal but it actually makes GLD have tighter spreads between its bid and ask which can be important for traders so traders and very large investors should probably stick with GLD as their preferred vehicle, but long-term investors and those buying in smaller quantities would probably be better served by buying IAU instead. The expense ratio difference will really add up over time, and especially if you aren’t doing a whole lot of trading.

Futures vs. physical

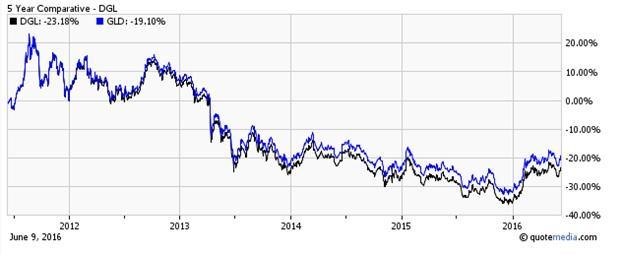

Most commodity ETFs simply offer investors exposure to futures contracts tracking the commodity but, because precious metals have a relatively high ‘value-to-size’ ratio and are easy to store, investors have the option of either buying physically-backed ETFs like GLD or IAU, or purchasing futures-based funds like the PowerShares DB Gold ETF (NYSEARCA:DGL) and the UBS ETRACS CMCI Gold Total Return ETN (NYSEARCA:UBG).

Futures-backed funds can be more expensive and they also may suffer from futures curve issues (such as contango), though this can also become an asset (backwardation) in certain market environments too.

- Over the past year though, DGL has underperformed GLD and to me it probably isn’t worth it given the physical exposure options and the lower holding costs.

- Better to get the real thing in this case, and especially since most commodities don’t offer up the option at all.

The only saving grace is the issue of taxes. DGL may have a lower short-term capital gains tax rate than gold ETFs that hold the commodity thanks to their structure as a ‘commodities pool’. However, this may result in a K-1 at tax time, so there are some potential headaches with that approach too. For me, it seems like physically-backed is so rare in the commodity world and it gets rid of so many problems, that you might as well go for it in the gold world.

Gold Mining ETF Holdings Secrets

There are also a few ways to invest in gold miners if you do not want the gold bullion products directly. Among the most popular are the VanEck Vectors Gold Miners ETF (NYSEARCA:GDX) and the VanEck Vectors Junior Gold Miners ETF (NYSEARCA:GDXJ), which are both from Van Eck. GDX zeroes in on the gold mining industry and holds companies across a range of market cap levels while GDXJ focuses on small cap securities.

While GDXJ is definitely more volatile, most investors may not know that there are actually some similarities between the two funds.

- The top holding in GDXJ finds its way into GDX, while all of GDXJ’s top five holdings are in GDX, granted at a much lower allocation level, so if you are thinking of buying GDX and GDXJ for ‘complete’ gold mining exposure, think again, as you are bound to get some overlap.

- Additionally, it is worth noting that silver companies actually make up a decent portion of both ETFs. In fact, for GDXJ, two of the top five holdings have ‘silver’ in their name (First Majestic Silver Corp. (NYSE:AG) and Pan American Silver Corp. (NASDAQ:PAAS)), while GDX has Silver Wheaton (NYSE:SLW) in its top ten holdings too so both might not be as pure as you are thinking either, something to note if you are getting into the precious metal ETF space.

Another Way to Invest in Gold with ETFs

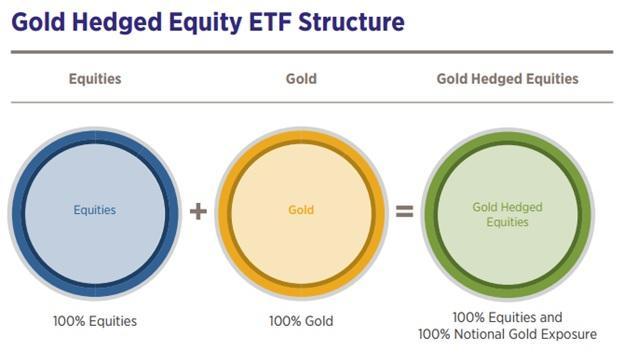

Two often overlooked ways to invest in gold include products that utilize hedging techniques. In essence, they invest in broad markets, but use gold as a sort of hedge in order to mitigate risks.

A great example of this approach is the REX Gold Hedged S&P 500 ETF (NYSEARCA:GHS) from REX.

- This ETF invests in both the S&P 500 and it takes a long position in gold futures contracts, making the ETF designed to outperform broad indexes when gold is soaring.

- This technique can also act as a bit of a hedge, since gold and broad markets generally have low correlation levels as well.

Gold Exploration ETF: The Final Frontier?

For investors who don’t like the idea of leverage but still want to roll the dice, then the gold exploration ETF market may be for you.

- This segment of the ETF world is arguably the most volatile thanks to the companies that it holds.

- These companies don’t produce gold, but are on the lookout for gold fields and deposits around the globe, which can be recovered at a profitable rate.

- They are sort of like what the E&P market is for oil, making them highly leveraged to the price of the underlying commodity.

- As you might expect, these are top performers in bull markets, but can be sluggish if we enter a bear market scenario once again.

- However, they are perfect for risk takers who do not want to delve into the leverage market (more on that below).

Leveraged Gold Mining ETFs Are an Insane Long Term Investment

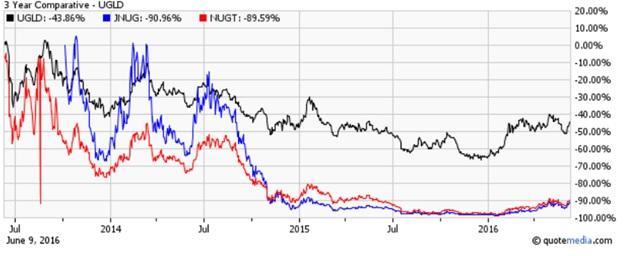

Investor interest in the triple leverage market has been rekindled thanks to some absurd performances for funds in this space.

- Year-to-date the triple leverage gold ETN, the VelocityShares 3x Long Gold ETN (NASDAQ:UGLD) is up over 60%, while mining triple leverage funds have been even crazier, with

- the Direxion Daily Gold Miners Index Bull 3x Shares ETF (NYSEARCA:NUGT) adding over 300% in the time frame and

- JNUG, tracking junior gold miners, soaring by over 425% so far this year.

However, even with these great performances, all have been horrendous when taken from a long-term look.

- All three are lower by at least 40% over the past three years,

- with the mining funds posting losses nearing 90%

so, while it might be tempting to buy-and-hold these given how they have done in 2016, the longer-term chart suggests extreme volatility and big losses, proving once again that leveraged funds should be short-term trading tools and nothing more.

Some Broad Precious Metal Funds Are Basically Gold ETFs

There are a couple of ETFs out there – the PowerShares DB Precious Metals ETF (NYSEARCA:DBP) and the ETFS Physical Precious Metal Basket Trust ETF (NYSEARCA:GLTR) in particular – which bill themselves as broad precious metal ETFs, but is that really the case? Not really if you look to their underlying holdings, as these both put the majority of their holdings in gold.

- GLTR puts nearly 60% of its assets in gold, leaving under 30% for silver, and roughly 11% for the duo of platinum and palladium combined.

- Meanwhile, DBP is even worse, as this ETF puts over three-fourths of its assets in gold and has the rest in silver.

…Just because something says it is a ‘precious metals ETF’, it doesn’t mean that it isn’t a gold ETF with a slight bit of diversification on top of it.

GLD Holds More Gold than The ECB

The level of investor interest in physically-backed gold ETFs is staggering. GLD owns enough gold to put it into the top ten holders of gold in the world, ahead of countries like the UK or India, and even the European Central Bank too and ,if you add other gold ETFs to the mix, gold holdings easily surpass one thousand tonnes on the ETF front, making exchange-traded funds a force in the gold world.

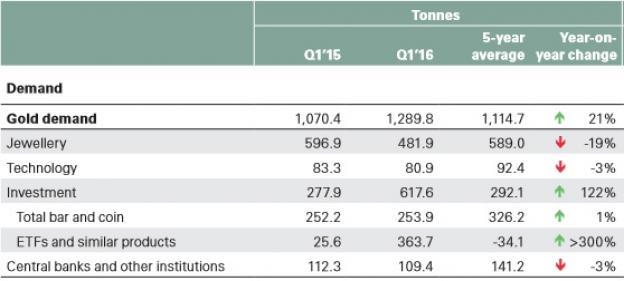

Gold ETFs Probably Help Boost Prices

Given this massive supply of gold held by ETFs, it probably shouldn’t be too much of a surprise to note that gold ETFs probably help boost prices in the underlying metal. That is because, at least in Q1, according to the World Gold Council, the main change in gold demand was from gold ETFs.

As you can see in the chart above, ETF demand year over year was over 300% higher and was the primary difference when compared to 2015 numbers. Jewelry and technology were both lower showing that the bulk of the increase in gold demand was from investing, and specifically from ETFs so, for at least part of this year’s gains, gold investors can thank ETFs!

Don’t Buy Gold ETFs for the Apocalypse

Some investors complain that gold ETFs aren’t useful because you can’t take physical delivery in the main funds like GLD or IAU (unless you are a massive investor). They say that one of the main reasons for owning gold is protection against an economic calamity and the ability to use gold as a bartering mechanism.

Investors should just think of gold ETFs as trading tools that can offer up exposure to the bullion market in a very liquid way. Without gold ETFs, the buying and selling of gold by the average person would be a laborious task and would involve high premiums and markups too but with gold ETFs, you can easily trade gold back and forth in seconds with minimal costs, so just think of these as easy ways to trade gold, and not part of a doomsday protection plan.

The one exception to this rule is the VanEck Merk Gold Trust ETF (NYSEARCA:OUNZ), a fund from Merk. This ETF invests in gold bullion but it allows for convertibility and deliverability, giving investors the option to request the physical delivery of their gold. The issuer also states that this is a tax-free event since you are merely taking possession of the gold you already owned in ETF form.

True ‘gold bugs’ might prefer OUNZ, though it is worth noting you will still need to pay delivery costs in order to get the gold in your possession. Still, it might be a better option for some that want that ability to take hold of their gold at some point or those who are buying gold as part of a severe economic downturn defense plan.

Bottom Line

Gold ETFs are a bit more complicated than you might think at first glance. But hopefully, this list of key facts allowed you to get a better handle on the market, and find more information on the best gold ETF option for your needs in today’s investing world.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money