News out of Venezuela continues to be quite grim, pointing to further economic deterioration… Here is the the latest:

latest:

So says SoberLook.com in edited excerpts from the original article* entitled Venezuela’s “radicalization of the economy” has brought the country to the brink and a follow-up article** entitled Latest developments in Venezuela – a crisis in the making.

[The following is presented by Lorimer Wilson, editor of www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Below is an amalgamation of the edited excerpts.

1. Foreign reserves are down 28% since the end of 2012 (currently at $21.4 billion). Part of the decline was caused by lower gold prices, which impacted the value of Venezuela’s bullion holdings. The country has $18 billion in short-term debt – with some $7bn coming due shortly.

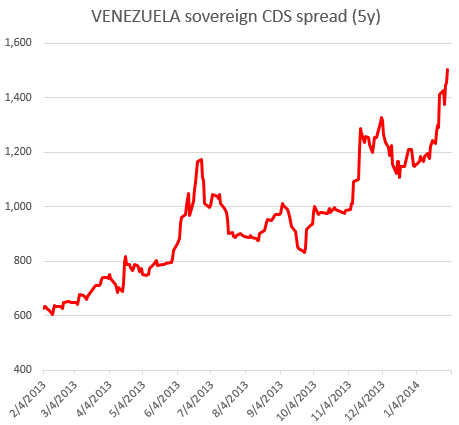

2. Not surprisingly the rating agencies have downgraded the nation’s debt with negative outlook… S&P called what is taking place in Venezuela “growing radicalization of the economy”.

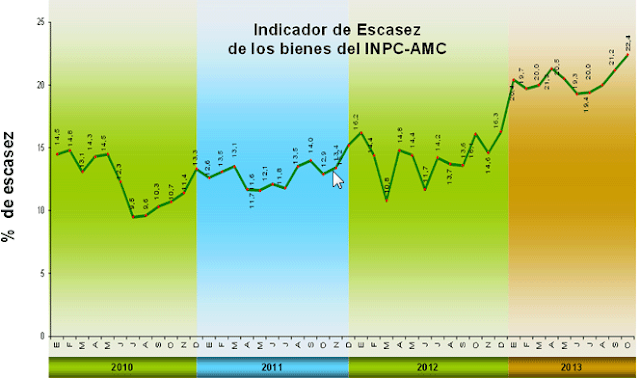

3. The recent effort to borrow dollars from private investors has not been received well. The central bank was only able to raise US$24.3mm out of $100mm of securities auctioned.

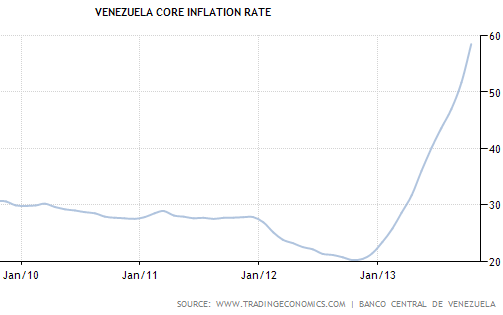

4. Venezuela’s inflation rate spiked to 56.2% (not a typo) during 2013.

5. With the Venezuelan bolivar buying power collapsing, demand for dollars has accelerated. Black market dollars are now trading at some 1,000% above the official exchange rate (i.e. above 60 vs. the official rate of 6.3 to the U.S. dollar).

6. The government’s answer to this out of control inflation has been to take over businesses, jail the executives/owners, and force discounting. Over 1000 businesses were ordered to cut prices. The government calls this their fight against “speculators”.

7. 2013 was marked by empty store shelves (in part as a result of #6 above, as price controls often create scarcity). For those who remember the long lines and scarcity of products in Eastern Europe a few decades back, the situation in Venezuela is significantly worse. While the media has focused on the lack of toilet paper, the more critical issue is food. Items such as corn oil have become difficult to find. The central bank’s so-called scarcity index reached new highs in 2013 – see chart below.

|

| Source: Central Bank of Venezuela |

President Nicolas Maduro’s repose? He is simply blaming it all on what he calls “parasitic bourgeoisie” as he attempts to consolidate power.

As a followup to the above on Venezuela, here are the latest developments from edited excerpts from the article** entitled Latest developments in Venezuela – a crisis in the making:1. The government has since created two exchange rates in order to stem rampant dollar outflows – essentially devaluing the currency. Only essential goods are permitted to be imported using the original rate. The weaker exchange rate (more expensive dollars – nearly 2x the original rate) is used for everyone else. Black market dollars trade at some 10x the original rate.2. Oil exports have fallen to the lowest level since 1985. A great deal of the oil the country does export is shipped to China to cover the billions of dollars worth of loans.3. Government bonds have sold off sharply in January, with long-term rates now above 15%;

| 15y gov bond yield (source: Investing.com) |

4. According to the central bank, core inflation is running at close to 60%, although given the shortages it’s difficult to measure.

4. Shortages of basic goods persist.

5. Dollar debt to the private sector is now over 60% of FX reserves.

6. Foreign reserves are dwindling….The country’s arrears on non-financial debt are put at over $50 billion including more than $3 billion owed to foreign airlines for tickets sold in bolívares, and around $9 billion in private-sector imports that have not been paid for because of the dollar shortage and “under the current economic model, and with this economic policy,” says Asdrúbal Oliveros of Ecoanalítica, “this (debt) looks unpayable.”

7. The country’s sovereign CDS volume has picked up as traders smell profits, and the spread hit a new high.

[There’s more! Read Venezuela Gives Businesses Until Monday to Comply with “Fair Prices Act” or Face State Takeover Also read Venezuela Enacts “Law of Fair Prices” Banning Profits Over 30%, with 10-Year Imprisonment for Hoarding]

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

Related Articles:

1. Argentina In Advanced Stage of Yet Another Financial Panic/Meltdown

With international reserves in virtual free-fall, the black market peso rate plunging, and no sign for months that President Kirchner has any appreciation at all of the gravity of the situation, the country is in the advanced stages of another financial panic/meltdown. This will end badly, another chapter in the long history of Argentine financial crises extending back almost 100 years. Read More »

Like health, freedom erodes gradually over time… then all at once. We lose a freedom here, there, through a slow, measured deterioration of civil and economic liberty: body scanners at the airport; declarations of foreign accounts; mandatory health insurance and then, suddenly, there’s a bifurcation point when the deterioration goes nonlinear. It’s like the old saying about going broke– it happens gradually, then all at once. We lose our freedoms in the same way. [That is already happening in Argentina where the government is] screwing everyone, big time: banks, businesses, workers, retirees, professionals, entrepreneurs, even government employees and the U.S. is starting to go down this road as well. [Let me explain.] Words: 625 Read More »

3. How NOT to Run a Country: What’s REALLY Happening – and About to Happen – in Argentina

One can barely keep up with what is going on here in Argentina, since each day brings more ‘new’ government dictates, rules and initiatives which all seem to share the same features – dumb and dumber – and virtually all with guaranteed unintended negative consequences. Let me give you my on-the-ground insights of the lay of the land – of what is REALLY happening in Argentina – and about to happen! Words: 853 Read More >>

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I believe that other Countries are now squeezing Venezuela in order to acquire their Gold holdings at reduced values since Venezuela is now faced with having to repay their debt in paper money of some other Countries choosing. I would be very surprised to learn that China and others have not offered to trade their US$ holdings forVenezuelan Gold and/or their other mineral wealth!