A reasonable debate can be had regarding the extent to which the U.S. economy may slow in the near-term but Canada’s sensitivity to interest rates suggests that a Canadian recession is a matter of when, not if.

So says Dann Cushing, in a memo to his clients entitled The Die Is Cast, in which he goes on to say in comments edited and severely abridged (by 57% to only 835 words) for posting on munKNEE.com:

All signs point to the fact that we are late in an economic cycle – high inflation, rising interest rates, slowing GDP growth, deteriorating credit conditions, etc. – and, reflecting this, many economic indicators with 100% hit-rates for predicting recessions are flashing red. The most notable of these is the inverted yield curve for government bonds in Canada and the U.S. and, every time the yield curve has turned negative since WWII, a recession has followed, albeit sometimes with a lag. Is this time really going to be different? Interestingly, the financial rule of thumb for interest rate changes that it takes 18 months for them to actually impact the economy. The first rate hikes by the Fed and Bank of Canada occurred 17 months ago.

While there may be some uncertainty regarding a coming recession in the U.S., the die has been cast in Canada. A recession seems imminent because its economy is so much more sensitive to interest rates than the United States and yet, despite that fact, the Bank of Canada is increasing rates almost in lock-step with the Fed.

- Part of Canada’s sensitivity to rates is due to structural differences in its residential mortgage market vs. the U.S. market:

- In the US, the most common type of mortgage is a fixed-rate 30-year term, on top of which homeowners can generally refinance early without a penalty.

- By contrast, about 25% of Canadian mortgages are variable and the maximum term for fixed-rate mortgages is almost always 5 years which means that roughly 20% of mortgages in Canada are getting renewed every year at prevailing market rates and, as such, by 2026, virtually every residential mortgage in the country will have been reset. For context, over the same period less than 10% of Americans homeowners will face higher mortgage payments.

- Doing the math, the average mortgage payment increase upon renewal in Canada is now in the range of 25% – 30% and that increase is very similar to the rise in rent now experienced when an apartment, house or condo rolls over to a new tenant. About 35% of Canadians have mortgages and another 35% are renters, so about 70% of Canadian are going to have a quarter of their disposable income redirected to paying more for shelter in the near-term, leaving them no choice but to reduce other spending. Practically speaking, however, the percentage will be somewhat less since renters will increasingly choose not to move but, regardless, for an economy in which consumer spending comprises approximately 70% of GDP, the increased cost of shelter is going to pack a punch.

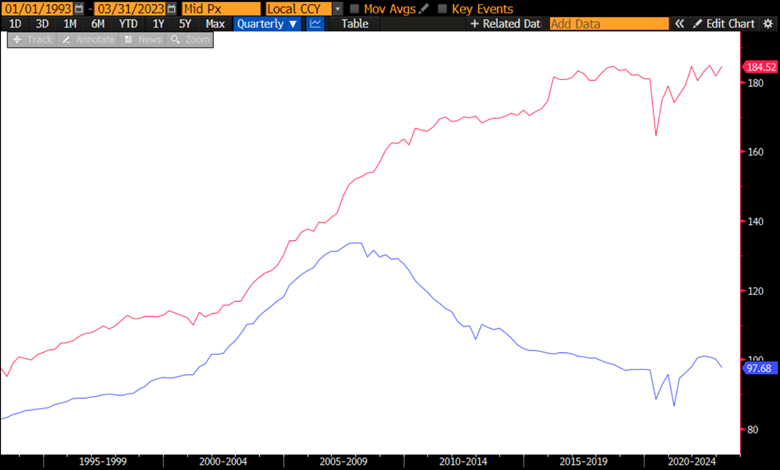

- The other reason that Canada is much more sensitive to interest rates than the U.S. is because of how indebted its consumers are.

Source: Bloomberg, StatsCan

So again, while there is some disagreement as to the extent to which the U.S. economy may slow in the near-term, Canada’s far higher sensitivity to interest rates suggests that a Canadian recession is a matter of when, not if.

Now, all of the above is economic talk. It isn’t surprising that equity markets, and tech stocks in particular, have managed to rally since the spring despite the economic uncertainties mentioned above…[but] what is surprising, however, is how little attention is being given to the corresponding drop in earnings power – down 6% year-over-year into negative territory – that is coming from that same weakening economy. The forward P/E ratio has risen to a lofty 19x and, in conjunction with this, lending standards by banks have tightened to levels typically only seen in a recession and, at the same time, demand for new loans has also dropped to recessionary levels.

Even for the large companies that are still reporting higher earnings, the growth this year has almost exclusively come from higher prices with actual unit volumes generally being negative. If the Fed keeps rates high until inflation falls back to 2%, and the primary source of earnings is higher prices then the equity market’s forward P/E ratio could actually go even higher, at more like 20x – 21x so, with valuations high and earnings poised to be under at least some pressure in the near-term, equity markets seem somewhat stuck for the time being. That’s not to say that certain stocks and sectors won’t perform well – it just that the odds now seem in favor of leadership coming from more defensive companies with generally more modest valuations, rather than from high-flyers continuing to drive the market.

Bottom Line

It doesn’t seem like there’s much room for error built into the financial markets just now, so while we’re generally glass half-full people, now seems like an appropriate time for some caution.

About Dann: He is a Portfolio Manager with Cushing Private Wealth Partners of RBC Dominion Securities Inc.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money