Legendary global investor John Templeton once said that the best time to buy was when there was “maximum pessimism,” and the best time to sell was when there was “maximum optimism”…right now, I see gold as the ultimate contrarian investment.

The yellow metal is largely unloved at the moment. It’s set to notch its worst monthly slump since November 2016, and the 50-day moving average is threatening to fall below the 200-day moving average…

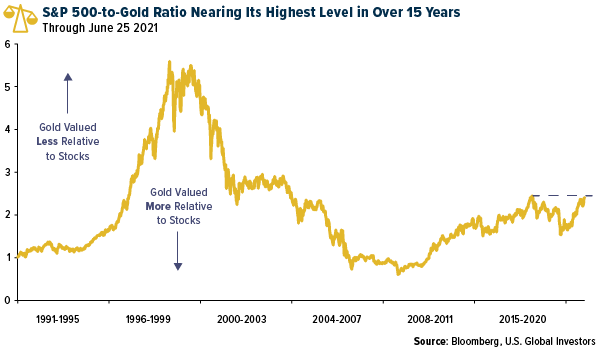

The S&P 500 to Gold Ratio

[In addition,] the S&P 500-to-gold ratio is nearing its highest level in over 15 years. As of this week, it takes close to two and a half ounces of gold to buy one “share” of the S&P 500. That’s up significantly from September 2011 when two thirds of an ounce of gold was enough to get you entry.Record Money-Printing Favors Gold

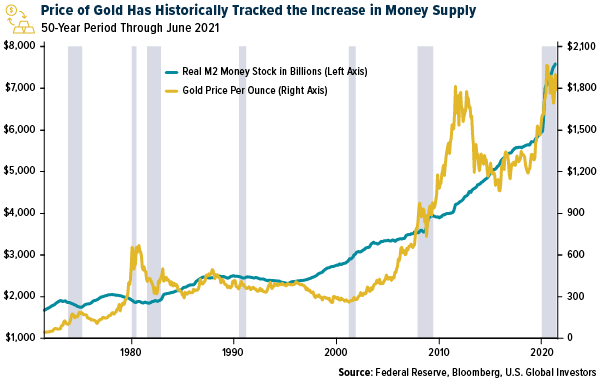

Over the past 18 months, central banks…have [been] printing money at a record pace, which has the direct effect of diluting the purchasing power of the local currency…[Indeed,] nearly a quarter of all U.S. dollars in circulation has been created since January 2020 meaning that, essentially, the greenback has lost a quarter of its value thanks to the actions of Powell & Company.

…There’s decades’ worth of data illustrating the near-perfect positive correlation between the amount of money circulating in the U.S. economy and the price of gold. As the value of the U.S. dollar has decreased due to greater rates of money-printing, gold has surged to new record highs. The implication, of course, is that gold may continue to benefit from the Fed’s easy-money policies.

Inflation to Remain Elevated

…May’s consumer price index (CPI) rose 5% over the same month last year. That’s the highest rate we’ve seen since August 2008. The real inflation, though, could be much higher.

- The price of used cars and trucks are up more than 36% from last year, according to vehicle auction company Manheim, with some pre-owned vehicles selling for more than their original sticker price…

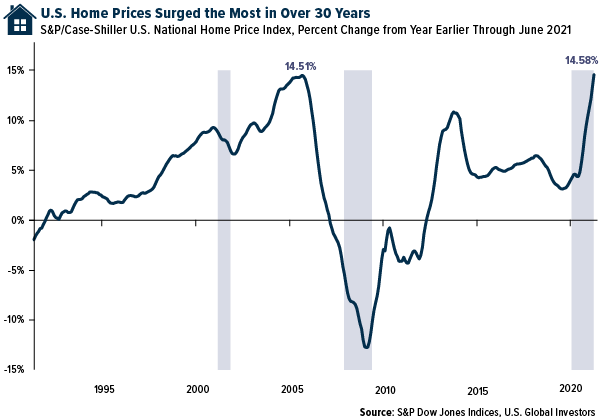

- Home prices…[have] climbed at their fastest rate on record in April, increasing 14.5% year-over-year, surpassing the previous record rate set in September 2005.

Despite the Fed’s insistence that this current spate of inflation is “transitory,” analysts at Bank of America believe prices could remain elevated for two to four years…

Everyone’s heard at one point or another that gold is an excellent inflation hedge. That hasn’t been true in every cycle, and it’s not true now: The CPI is up 5% while gold is effectively flat compared to a year ago but that may be because we’re at “maximum pessimism,” as Templeton called it.

With bond yields trading below zero on a real basis right now, investors may have little alternative than to consider gold and gold mining stocks in an effort to combat inflation’s impact on their portfolios.

If Templeton were alive today, he might say now is the time to buy.

Editor’s Note: The above version of the original article by Frank Holmes, has been edited ([ ]) and abridged (…) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

A Few Last Words:

- Click the “Like” button at the top of the page if you found this article a worthwhile read as this will help us build a bigger audience.

- Comment below if you want to share your opinion or perspective with other readers and possibly exchange views with them.

- Register to receive our free Market Intelligence Report newsletter (sample here) in the top right hand corner of this page.

- Join us on Facebook to be automatically advised of the latest articles posted and to comment on any of them.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money