Timing the market seems simple enough…but there is clear evidence that market timing is difficult…By contrast, staying invested through highs and lows has generated competitive returns, especially over longer periods.

This post is an abridged version of the original article originally posted on Advisor Channel.

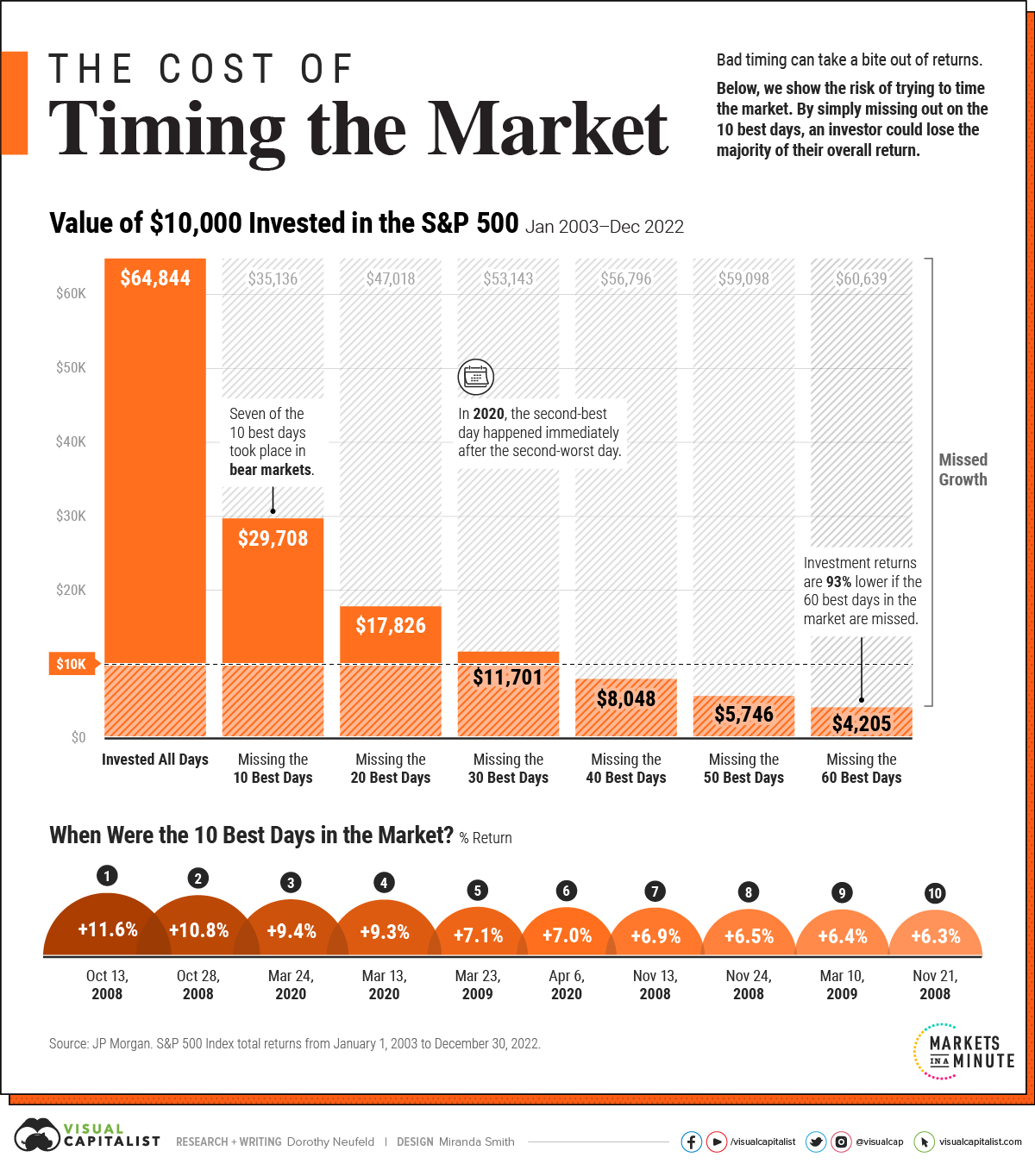

The graphic below shows how trying to time the market can take a bite out of your portfolio value, using 20 years of data from JP Morgan.

The Pitfalls of Timing the Market

…[Failing to time] the market by even a few days can significantly affect an investor’s returns. The following scenarios compare the total returns of a $10,000 investment in the S&P 500 between January 1, 2003 and December 30, 2022. Specifically, it highlights the impact of missing the best days in the market compared to sticking to a long-term investment plan.

| Portfolio Value | Annual Return (2003-2022) | |

|---|---|---|

| Invested All Days | $64,844 | +9.8% |

| Missed 10 Best Days | $29,708 | +5.6% |

| Missed 20 Best Days | $17,826 | +2.9% |

| Missed 30 Best Days | $11,701 | +0.8% |

| Missed 40 Best Days | $8,048 | -1.1% |

| Missed 50 Best Days | $5,746 | -2.7% |

| Missed 60 Best Days | $4,205 | -4.2% |

As we can see in the above table, the original investment grew over sixfold if an investor was fully invested for all days.

- If an investor were to simply miss the 10 best days in the market, they would have shed over 50% of their end portfolio value. The investor would finish with a portfolio of only $29,708, compared to $64,844 if they had just stayed put.

- Making matters worse, by missing 60 of the best days, they would have lost a striking 93% in value compared to what the portfolio would be worth if they had simply stayed invested.

- Overall, an investor would have seen almost 10% in average annual returns using a buy-and-hold strategy. Average annual returns entered negative territory once they missed the 40 best days over the time frame.

…Not only does timing the market take considerable skill, it involves temperament, and a consistent track record. If there were bulletproof signals for timing the market, they would be used by everyone.

Related Articles from the munKNEE Vault

- Is Market Timing a Myth?

- Invest assets in the market as soon as you are able. Yes, there will be ups and downs, but as long as the world economy continues to improve living standards, investors will be rewarded with compounding growth on their investments.

-

Market Timing Works Using These Trend Indicators

-

The trend is your friend and this article reviews the 7 most popular trend indicators to help you make an extensive and in-depth assessment of whether you should be buying or selling.

-

-

Ride the Market Waves With These 6 Momentum Indicators

-

It is hard to know what to buy or sell let alone just when to prudently do so. Thank goodness there are indicators available that provide information of stock and index movement of a more immediate nature to help you make such important decisions. This article describes the 6 most popular Momentum Indicators. If ever there was a “cut and save” investment advisory this is it!

-

-

Make Money! Time the Market Using Market Strength Indicators – Here’s How

-

There are many indicators available that provide information on stock and index movement to help you time the market and make money. Market strength and volatility are two such categories of indicators and a description of six of them are described in this “cut and save” article. Read on!

-

-

Timing Is Everything When Assessing the Future Price of Gold

-

A basic understanding of gold price phases throughout the year [provides the answer to the question:] “What’s next for the price of gold?” Let me explain.

-

-

Market -Timing Pays BIG Dividends for Income Investors – Here’s Why

-

Many income investors have been taught to believe that “market-timing” is anathema to their investment objectives and/or that it can’t be done successfully… I will argue that this piece of conventional wisdom is false – dangerously false. In a three-part series of essays, I will argue that market-timing needs to be incorporated as a fundamental component of income investing. I will demonstrate why market-timing is important, when it should be applied and how it should be implemented.

-

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money