Monitoring how Beijing is managing China’s slowdown, and whether it will be able to rebalance its growth, are highly important as weakness in China will weigh on U.S. stocks. [Given] the ongoing structural reforms, government policies and global economic conditions, certain sectors within China have surfaced as winners while some are surprisingly becoming losers, which…[provide] long-term investing opportunities. This article identifies the sectors that are winning, losing and remaining neutral.

growth, are highly important as weakness in China will weigh on U.S. stocks. [Given] the ongoing structural reforms, government policies and global economic conditions, certain sectors within China have surfaced as winners while some are surprisingly becoming losers, which…[provide] long-term investing opportunities. This article identifies the sectors that are winning, losing and remaining neutral.

The comments above and below are excerpts from an article by Andrej Pajovic which may have been enhanced – edited ([ ]) and abridged (…) – by munKNEE.com (Your Key to Making Money!)

to provide you with a faster & easier read.

Overview

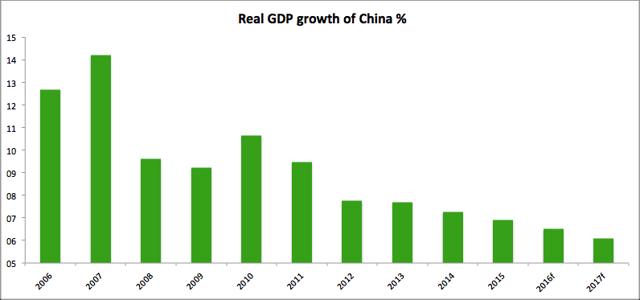

China’s economy grew 6.9% in 2015, which was the slowest expansion rate in the last 25 years. The Chinese economy is expected to continue slowing in the following years and will probably undershoot the government’s average annual target of 6.5%.

Source: World Bank

Source: World Bank

While the authorities are implementing reforms needed to rebalance growth in favor of consumption and services, weak companies have been hit on profits margins. Nevertheless, it is expected that the Chinese government will continue to introduce “favourable” policy initiatives concerning supply side reforms, even though the monetary relaxation is proving to be ineffective and the volatility of the financial markets could undermine confidence levels among investors and consumers.

Due to the ongoing structural reforms, government policies and global economic conditions, certain sectors within China have surfaced as winners while some are surprisingly becoming losers, which…[provide] long-term investing opportunities.

Winners

Among the winners, are the:

- automotive (ATHM),

- information communication technologies (ACTS, CNTF)

- retail (ATV, ATAI) and

- transportation

sectors, which will continue to benefit from the positive demand outlook [which is] supported by a rising middle-income class and stronger government emphasis on consumption.

Companies in the above sectors are also expected to continue investments in fixed assets which will further be boosted by government incentives for targeted industries, such as electric vehicle and aircraft engine manufacturing…

…[Another] bright spot is the pharmaceutical sector…(WX)… While enterprises within this sector are enjoying steady profit margins, they are at the same time less dependent on borrowing for their ongoing operations. Looking ahead, the pharmaceutical sector is likely to enjoy an increase in structural demand, with the continuing expansion of the middle classes and the ageing population.

Losers

On the other side [of the coin,] former champions of the Chinese economy – chemicals (DQ, SHI) and construction – can be classified as sector losers.

These sectors have been suffering from:

- significant overcapacity,

- falling demand and

- lower support from the government.

In addition, companies within those sectors have cut back on investment projects, as reflected by slowing growth in fixed asset investment. Moreover, many of them are assigned with high risk ratings, indicating a higher default probability and insolvencies due to challenging business conditions.

The metals sector is another sector likely to face challenges as its two key segments, steels and non-ferrous metals, have been suffering from muted demand and significant overcapacity.

…China’s official PMI has been around 50 for the most of 2016 showing little improvement. This points to a lackluster demand for steel and non-ferrous metals (aluminum, copper. magnesium, nickel). Besides, authorities in China plan to reduce capacity in the steel sector, which is evident from the steel production data from 2015 that shows a decrease of 2.3% from 2014 levels. These actions can affect a variety of steel companies worldwide (X, ACH, OSN, AKS, STLD, NUE, MT) as China still accounts for 49.5% of global production.

Neutrals

There are also those [sectors] that do not benefit directly [from,] and are not harmed directly by, China’s structural reforms… They…include:

- the textile-clothing sector…

- the paper-wood sector… and

- the agricultural sector.

This combination of weakness in China and other developing economies and the potential that they could send the global economy into a recession are the real problems that will weigh on U.S. stocks.

Follow the munKNEE – Your Key to Making Money! “Like” this article on Facebook; have your say on Twitter; register to receive our bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Thanks for this broad analysis of the Chinese economy.

China’s moves to “buy up” global mining capacity has attracted attention, but less attention has been given to its purchase of US forest/paper/pulp resources. But…with its elderly population growing, China will need a lot of diapers.