The U.S. dollar is in a free fall!…The fundamentals have been screaming a “Sell!” for the past several quarters…

“Sell!” for the past several quarters…

An excerpt from an article by QuandaryFX edited ([ ]) and abridged (…) by the editorial team at munKNEE.com – Your Key to Making Money! – to provide a fast and easy read.

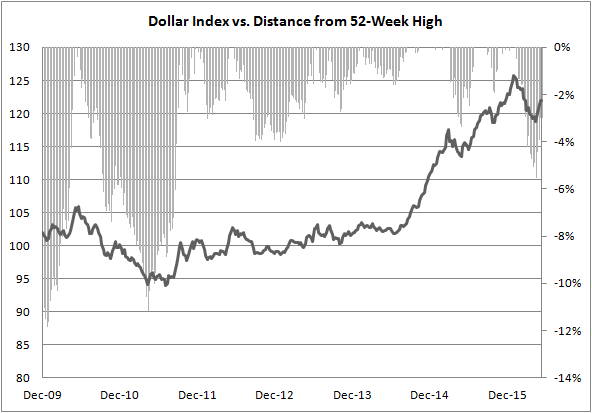

From its peak in 2015, the dollar has fallen by about 5%. This doesn’t sound like a lot at first glance, but when you put it into perspective, the numbers speak a little clearer. This is the largest decline from a 52-week peak since the tail end of the financial crisis.

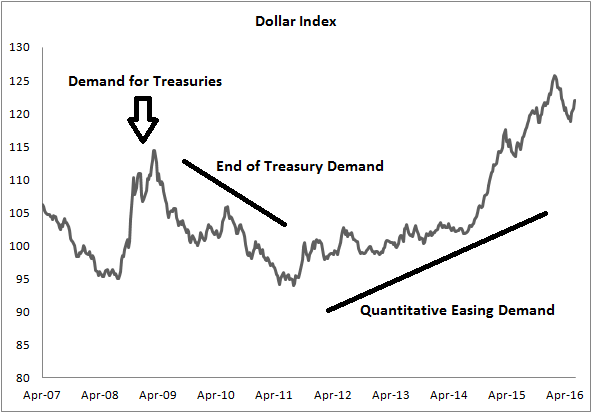

During the financial crisis, there was a surge of demand for the dollar as global investors piled into one of the safest assets – United States Treasuries.

- An often overlooked fact of Treasuries is this – they’re priced in dollars.

- When investors need Treasuries, dollars must be held to purchase them.

- As the financial crisis thickened, global investors parked capital in Treasuries, causing the dollar to skyrocket.

After the dollar peaked in 2009, there was a sell-off in the currency as the global situation slowly began to resolve. However, it wasn’t long until the Fed unveiled a continuous stream of quantitative easing programs.

- These programs can essentially be boiled down to the formula of printing cash to buy an interest rate security to decrease yields in order to encourage borrowing.

- Through the life cycle of these programs, the United States economy recovered.

- As it recovered, global investors once again acquired dollars to participate in the rebounding economy.

- This propelled the currency to new and accelerating heights as program after program entered the scene.

When quantitative easing finally ended and the Federal Reserve began to discuss discount rate increases, the dollar began to slide.

- Essentially, investors realized that the wind beneath the wings of the U.S. economy would slow, so capital would need to be shifted to earn a higher return elsewhere.

- The Federal Reserve increased interest rates for the first time last December, further signaling that the cheap money rally is over.

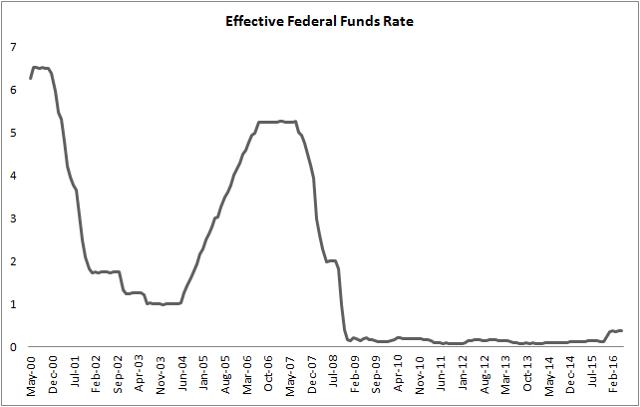

…That brings us to today. As we have previously discussed, there really is no way around it. When the Federal Reserve increases rates, the dollar falls – dramatically. You see, the funds which have been invested in the United States economy realize the truth of business cycles – they end. We have been in a rebound for nearly 8 years.

- As rates increase, businesses will be forced to pursue fewer projects and investments due to the simple math of the difference between return on investment and borrowing cost.

- With more businesses pursuing fewer projects, the output of the economy will decrease.

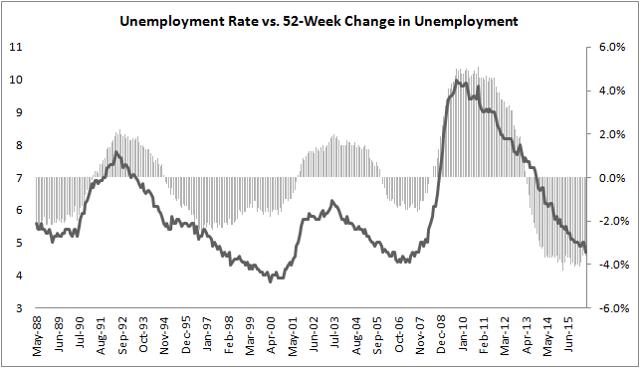

- As the economic output falters, we will see increasing unemployment. Oh wait, that’s started to happen! The recent unemployment report is just a messenger for what’s on the way.

Just like most everything in the economy, unemployment moves in cycles – and we’re at the apex of the employment cycle. Do you see what happened historically when unemployment reached the ballpark of where we’re at today? It turned right around and went back up. In other words, we’re at the top of a business cycle, and economic activity is probably going to fall.

As I’ve argued several times, the dollar is simply toast….The signals continue to shout a clear “Sell!”…

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

In reference to your “As I’ve argued several times, the dollar is simply toast….The signals continue to shout a clear “Sell!”. Where do you go, where did you buy? Did you buy Europe? Africa? The Mid East.? China? South America? Mexico? Canada? the U.K? Australia? New Zealand? Japan?

Not to put too fine a point on this, BUT, there is a reason for US$ strength. It is better then any of the alternatives given above and a lot more. As an analyst you need to revisit you ‘thinking’ or ‘political ‘prejudices and not assume there is no intelligent life ‘elsewhere’.