As the dollar strengthens, gold weakens. As the dollar falls, gold rises. In fact, in the past, if the dollar fell over any given year, there was a 77% chance that gold would increase in that same year. In other words, “Call the dollar, and you’ve got gold pinned” – and it is my firm belief that the dollar is toast.

dollar fell over any given year, there was a 77% chance that gold would increase in that same year. In other words, “Call the dollar, and you’ve got gold pinned” – and it is my firm belief that the dollar is toast.

The factors driving the gold price are numerous. However, with gold experiencing one of the largest upwards price movements ever recorded in a quarter, we should probably take a deeper look and see what’s afoot.

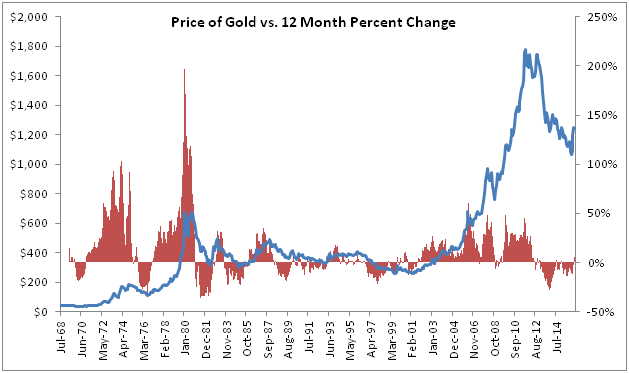

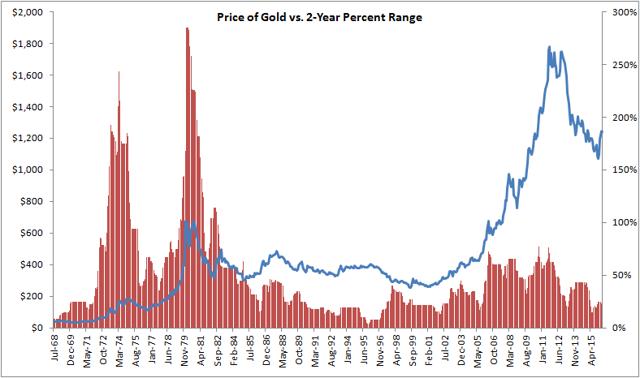

For those who are just noticing it, gold has turned positive after a string of several years of price declines. This is the first time we have seen a reversal of fortune to this extent in nearly 20 years. The last time we saw a reversal in the value of gold of this magnitude, gold went on to increase for over a decade.

There are quite a few factors which directly impact gold.

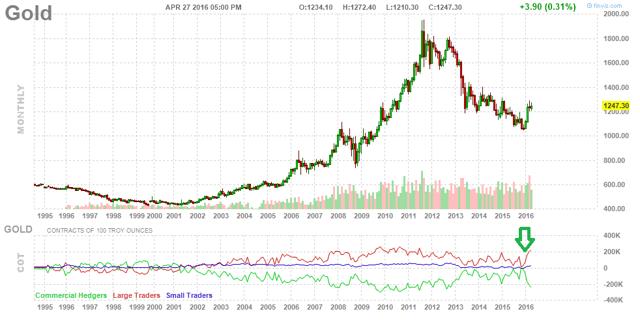

- Large funds and commercial hedgers participating in the futures market is one factor.

- A central bank purchasing the precious metal is another.

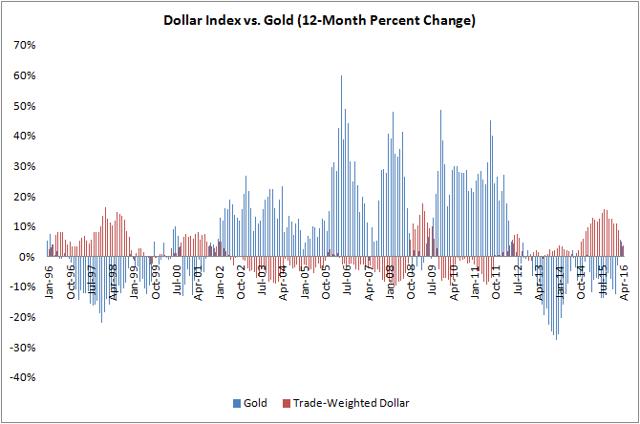

- However, a factor very frequently overlooked is the strength of the dollar. At the most basic level, gold is primarily purchased and priced in dollars. If the dollar weakens, it takes more dollars to purchase the same quantity of gold. The relationship truly is that simple.

Let’s see if it holds up in actual market data.

The relationship is actually startling in clarity. As the dollar strengthens, gold weakens. As the dollar falls, gold rises. In fact, in the past, if the dollar fell over any given year, there was a 77% chance that gold would increase in that same year. In other words, “Call the dollar, and you’ve got gold pinned”.

…It is my firm belief, [however,] that the dollar is toast. In other words, you should seriously consider purchasing everything which increases in value when the dollar falls. You see, we’ve experienced a regime shift in economic factors which drive dollar strength. In the past, quantitative easing was the name of the day. Now, the Federal Reserve is increasing interest rates, which historically has led to collapses in the dollar every single time. On the basis of the dollar alone, investors should consider purchasing gold. If the dollar falls to the same magnitude which it has in previous interest rate cycles, we could see gold rally by 50%.

There are several more gold-specific factors which suggest very strongly that gold is in for a rally.

1. Speculators have added the most futures contracts in the shortest period of time ever recorded. In other words, profession traders (hedge funds, proprietary trading companies, mutual funds, etc.) believe gold is going to increase. These people are only paid if they are correct. When they act, you would be very wise to at the least pay attention. In trader lingo, “We’re all bulled up on gold.”

2. Another factor which strongly indicates gold is in for a lift is volatility. You see, when gold bottoms or starts to increase, it tends to do so quietly. I believe the reason for these quiet beginnings is that many purchasers of gold (Russia, China, etc.) prefer secrecy and do not wish to move the market while buying. These countries will purchase billions of dollars worth of the commodity and the market hardly moves or just slightly drift upwards. The slight upwards drift is of course due to the skill of their traders who are able to secretly and consistently pull supply from the market. As supply is constrained, the market begins to wake up to the lack of available gold and price begins to rise cataclysmically.

Look at the level of volatility we are seeing in the market. Notice how price tends to peak in high periods of volatility but bottom in low volatility? This is the relationship I’m referring to. We are at a bottom in volatility. Central banks and hedge funds are buying with abandon.

Conclusion

Why aren’t you exposed to the commodity? It really is time to buy gold.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money