In this article, I…rank an elite group of stocks that have increased their dividend payouts for at least 50 consecutive years (called Dividend Kings)…based on David Van Knapp’s quality scoring system and my modifications…

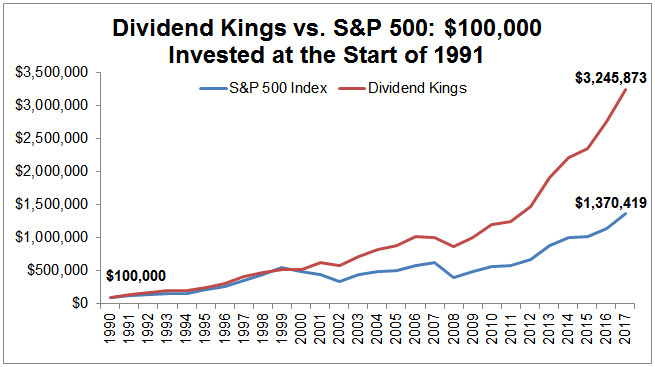

Dividend Kings have performed quite well when compared to the S&P 500. While tracking the performance of the Dividend Kings suffers from survivorship bias, nevertheless, it is informative to consider historical performance:

Source: Simply Safe Dividends

- An investment of $100,000 in the S&P 500 index in 1991 would have grown to nearly $1.4 million at the end of 2017, at a compound annual growth rate of 10.2%.

- In comparison, the same investment in the current Dividend Kings would have grown to about $3.2 million, for annual returns of 13.8%.

- Furthermore, over the 27-year period, a portfolio of the Dividend Kings exhibited annual volatility of 12.5%, which is much lower than the volatility of the S&P 500 index of 17.3% of the same period.

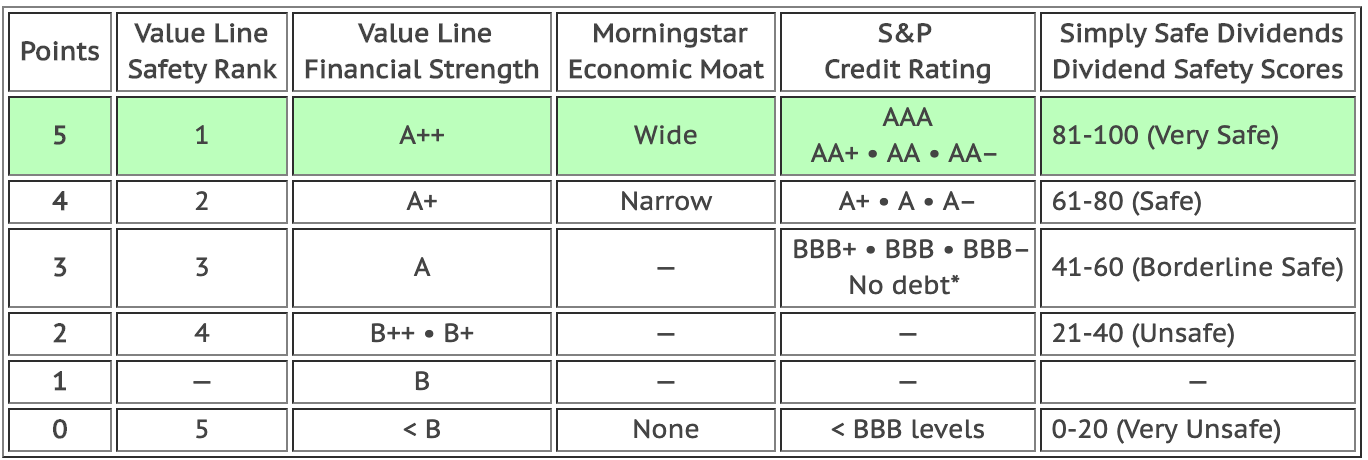

Before presenting my ranking of Dividend Kings, here is a brief summary of David Van Knapp’s quality scoring system and my modifications:

- The system references 5 quality indicators, assigning 0-5 points to each quality indicator for a maximum score of 25 points, as follows:

- Value Line‘s Safety Rank measures the total risk of a stock relative to approximately 1,700 other stocks covered by Value Line. The safest stocks get a rank of 1 and the riskiest stocks get a rank of 5.

- Value Line also provides a Financial Strength rating, based on factors such as balance sheet strength, corporate performance, market capitalization, and stability of returns. The scale runs from A++ to C in nine steps.

- Morningstar‘s Economic Moat reflects the strength and sustainability of a company’s competitive advantage. Morningstar differentiates between wide, narrow, and no moat companies.

- Standards & Poors (S&P) provides credit ratings to help investors determine investment risks. The ratings are either investment grade (AAA through BBB–) or speculative (BB+ through D).

- Simply Safe Dividend’s Dividend Safety Scores, which range from 0 to 100 and are based on more than a dozen fundamental metrics that influence the ability of companies to continue paying dividends:

Here is the scoring system used, a slightly modified version of the one presented by David Van Knapp:

Modified version of David Van Knapp’s quality scoring system.

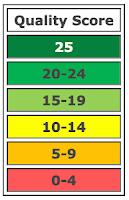

My modifications include assigning 3 points to companies that don’t have an S&P Credit Rating but carry no debt. Also, I award points for Dividend Safety Scores matching the colored ranges below (which may have been David’s intent but was not so presented in this article)…

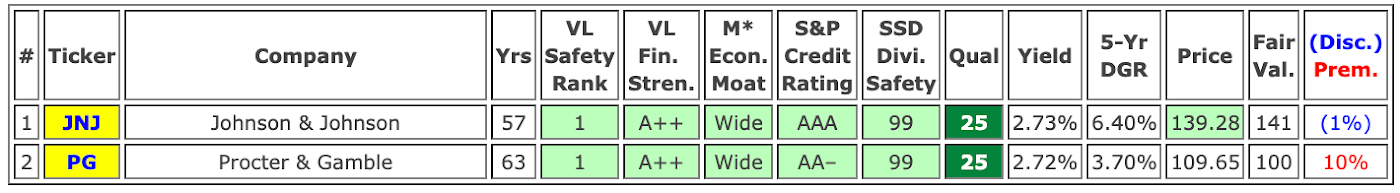

…The top-ranked Dividend Kings are JNJ and PG, both earning perfect scores of 25:

…The stocks in the second group missed a perfect score on up to two of the quality indicators:

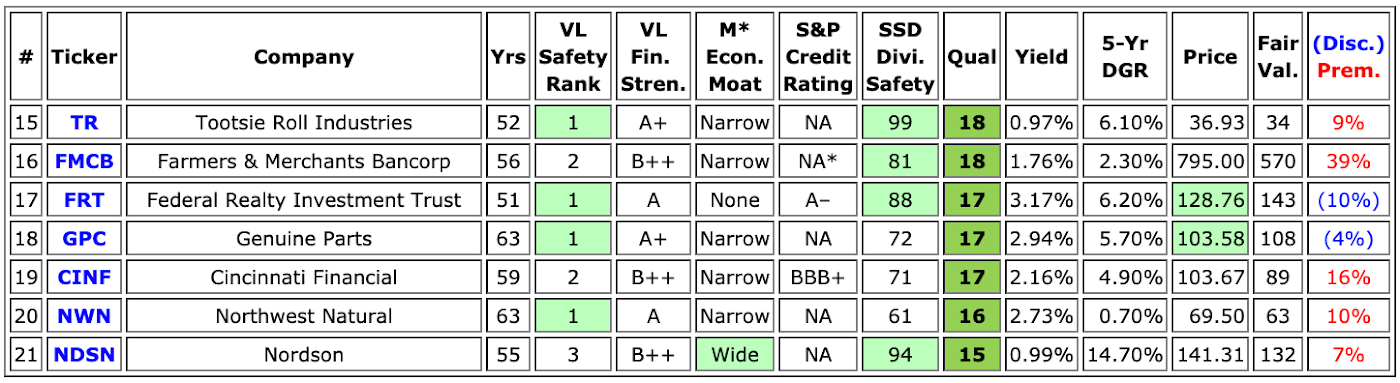

…The next group of stocks fell short on up to five quality indicators:

…This group of stocks fell short on up to three quality indicators:

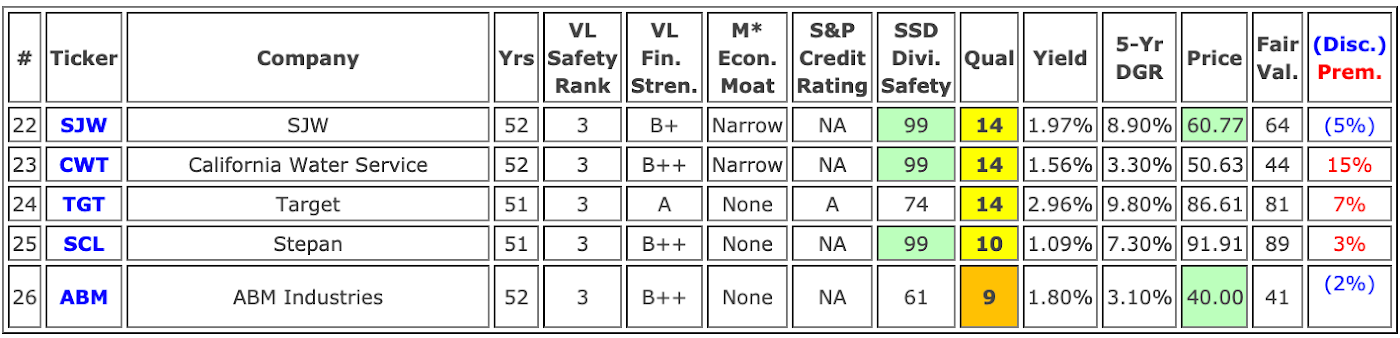

…The next group of stocks missed on up to four quality indicators:

Conclusion

I love the simplicity of David Van Knapp’s quality scoring system and I believe it does a remarkable job of identifying high-quality stocks. The quality scoring system is quite stringent and stocks scoring 20-25 points would be considered high-quality stocks by many investors…

Hopefully, this article will give dividend growth investors a good starting point for stock selection and further research…

(The above is a companion article to one in which I ranked the Dividend Aristocrats, which are S&P 500 stocks that have increased their dividend payouts for at least 25 consecutive years.)

Editor’s Note: The above excerpts from the original article have been edited ([ ]) and abridged (…) for the sake of clarity and brevity. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

Want more such articles? “Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here, sign up in top right hand corner of page).

Get engaged: Have your say regarding the above article in the Comment section at the bottom of the page.

Contributors Wanted: Original articles & links to other informative articles that deserve a wider read. Provide in Comment section at the bottom of the page.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money