Where do we go from here? I can promise you, it’s only going to get worse! Like our economy, there is clear seasonality when it comes to stocks. Trends flesh out overtime. It’s not random. From that data, I want to give you a picture of what the next few months might look like.

The above comments, and those below, have been edited by Lorimer Wilson, editor of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here – register here) for the sake of clarity ([ ]) and brevity (…) to provide a fast and easy read. The contents of this post have been excerpted from an article* by Harry Dent (economyandmarkets.com) originally entitled It’s Finally Happening: The Crash Season Is Upon Us and which can be read in its unabridged format HERE. (This paragraph must be included in any article re-posting to avoid copyright infringement.)

It’s finally happening. The crash season is upon us. We’ve seen the early signs this week with leading stocks getting the carpet swept out right from underneath them.

- China’s stocks are right where they were when its bubble burst 35% into July. UK stocks are in a correction.

- The DAX is in a correction.

- The S&P 500 hasn’t busted quite as much – yet – but it’s dipped below that important level of 2,000 at the bottom of the S&P 500 Channel going back to late 2011.

The market has topped and the great crash is in motion. It must be grating on the psyche of any investor who’s dared to stay in stocks this long.

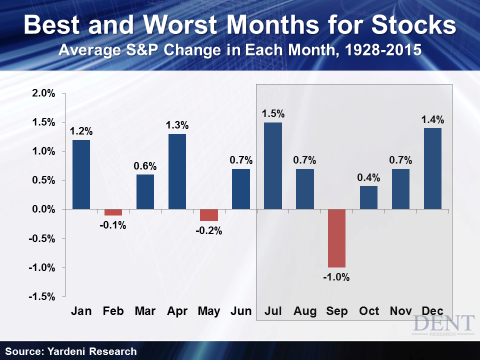

It’s a well-known fact that September tends to be the worst month of the year. This goes all the way back to 1928. It’s the worst month by far. Take a look:

The strongest months are July at a 1.5% average gain, with December, April, and January following in that order. The worst performing months are September, May, and February.

One simple reason stocks get slaughtered in September is taxes. Money managers look at their portfolios and scrap the losers to write those losses off to offset the taxes they’d pay on other gains. This monthly breakdown, however, masks the fact that such annual downturns often start in mid-to-late August and bottom in early-to-mid October. September carries most of the weight, but those months look better than they actually are...

The crash period between mid-August to mid-October tends to be very extreme. 1987 was a classic example of this.

- The market topped on August 25,

- had a minor correction into September 8,

- a minor bounce into October 2,

- then crashed 34% in less than three weeks.

- It bottomed October 20.

- These moves can happen in a flash. The biggest part of that crash happened in just one week: down 31% from October 13 to 20. Black Monday, October 19, saw 20% in one day! Overall, the Dow crashed 41%.

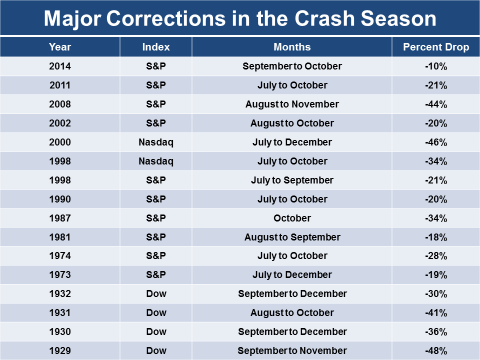

Take a look at the table below. It shows when major corrections have occurred during the crash season. Note the largest string of crashes in the last economic winter season between 1929 and 1932.

The sharper crashes typically fall between July and October. Sometimes a larger crash will extend into the end of the year. 1929’s chaotic meltdown extended into November. 1930’s didn’t stop until December. Bigger bubbles need longer to let the air out!

This crash looks imminent. Now more than ever, I believe we saw a top on May 20. Since then, we’ve seen a “rounding top” much like we saw into August of 2008 before that crash got nasty. How fitting. The only reason this bubble exists is because we fought off that last one with free money. I guess Mother Nature has a sense of humor.

*http://economyandmarkets.com/economy/its-finally-happening-the-crash-season-is-upon-us/

Related Articles from the munKNEE Vault:

1. Trying to Time the Market Is a Fool’s Errand – Here’s Proof

Pullbacks happen, and usually the market recovers, so trying to time the market is probably a fool’s errand – and a money loser.

2. Hang In There! Panic Selling Is A Failing Strategy – Here’s Proof

Successful investors outperform by being patient and riding out the volatility. Losers panic and sell at what might appear to be the beginning of downturns. Losers make the mistake of thinking they can predict what will happen next and unsuccessfully time the market. Here’s proof that Panic Selling Is A Failing Strategy.

3. Predicting What the Stock Market Will Do Is Impossible – Here’s More Proof

Predicting what the stock market will do in the next 12 months is tantamount to predicting coin flips. Here’s more proof that past stock market performance tells you nothing about future results — literally nothing.

4. September To Bring Stock Market Crash & Beginning Of Economic Depression

We are now on HIGH ALERT!!!!! Grand Supercycle degree wave (IV)’s decline could start soon. We need to pay close attention and be prepared for a September 2015 event that triggers a stock market crash and economic depression.

5. Go With the Flow: Buy & Sell Using a “Momentum” Approach – Here’s Why & How

Whether it is called “systematic trend-following”, “momentum trading” or “turtle trading”, it all comes down to entering trades on the basis of markets breaking out from previously established ranges and following some basic rules thereafter. It requires no special understanding of any given market – just a healthy respect for the price action – and can make you a lot of money in the process. Here are the details.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money