The only reason that I can come up with that would have the Fed raise rates is…[that] it wants to crash the markets. Why? Because Main Street is really not doing well as the Price to Sales ratio chart below clearly shows. Thus the Fed, and the markets, are stuck and those who are fully invested now will probably get creamed if…[a] negative catalyst like Donald Trump becoming President was to happen, as he would surly cause instability and rock the government institutions.

is…[that] it wants to crash the markets. Why? Because Main Street is really not doing well as the Price to Sales ratio chart below clearly shows. Thus the Fed, and the markets, are stuck and those who are fully invested now will probably get creamed if…[a] negative catalyst like Donald Trump becoming President was to happen, as he would surly cause instability and rock the government institutions.

The following are excerpts from the original article by Peter George Psaras (askfriedrich.com) which has been edited ([ ]) and abridged (…) to provide a fast and easy read.

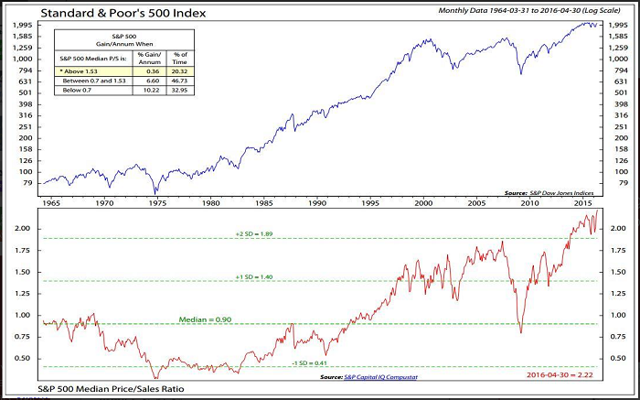

…What the chart below is telling us is that the Price to Sales ratio of the S&P 500 Index is at 2.22 and that is the highest in the 52 years represented in the chart above. To give you a little historical perspective, during the Dot Com boom and bust in 2001 the price to sales of the S&P 500 Index was 1.65 and the S&P 500 Index fell -45% and in 2007 the Price to Sales of the S&P 500 Index was 1.85 and the S&P 500 Index fell -59% so we are now at 2.22 so it basically comes down to mathematics:

- 1.65 = -45% loss

- 1.85 = -59% loss

- 2.22 = is 20% higher than 1.85 so what is coming is even more scary.

This is also proof that Janet Yellen and the Fed gang are not being truthful with us as they say the economy is doing great. Thus Wall Street is being told to be bullish by the Fed even though revenue growth is non-existent. President Obama will be the first president in history who did not achieve at least one year of 3% GDP growth during his 8 years, that’s the first time.

The reason the markets have recovered at all since the last crash is because the governments of the world have kept interest rates at zero for those 8 years and unfortunately have now gone negative in many countries….

Janet Yellen and gang are talking about raising rates but they are not being truthful for if the Fed did raise rate this weak economy could not sustain it and we would immediately dip into a serious recession, which would cause investors to flock to the 10 year even faster and force the U.S. to negative rates even faster. The only reason that I can come up with that would have the Fed raise rates is simply because it wants to crash the markets, because Main Street is really not doing well as the Price to Sales ratio clearly shows. Thus the Fed and the markets are stuck and those who are fully invested now will probably get creamed if just one negative catalyst like Donald Trump becoming President were to happen, as he would surly cause instability and rock the government institutions.

…What is an investor to do? Well, in my case, I am sitting patiently in a ton of cash and am waiting for the inevitable to happen. I have no choice in the matter as the math is very solid and true and the reality on Main Street is as clear as the nose on your face…

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money